Share This Page

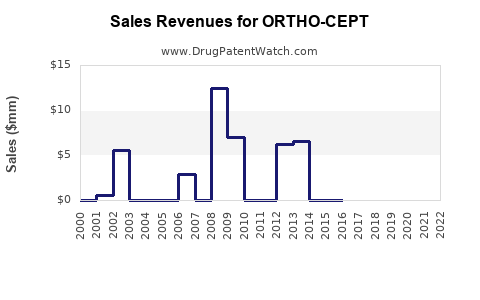

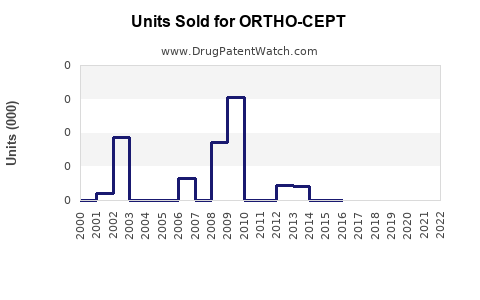

Drug Sales Trends for ORTHO-CEPT

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ORTHO-CEPT

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ORTHO-CEPT | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ORTHO-CEPT | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ORTHO-CEPT | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ORTHO-CEPT

Introduction

ORTHO-CEPT, a combined oral contraceptive formulated to offer both birth control and hormonal regulation, has maintained a significant presence in reproductive health markets since its approval. As a leading product in integrated contraceptive therapy, understanding its market dynamics and projecting future sales trajectories are essential for pharmaceutical stakeholders, investors, and healthcare providers aiming to optimize product strategies and investment decisions.

Market Overview

Product Profile and Indications

ORTHO-CEPT combines estrogen and progestin to prevent pregnancy, regulate menstrual cycles, reduce acne, and manage hormonal imbalances. Its versatility appeals broadly to women seeking effective contraception with added therapeutic benefits.

Regulatory Status and Patent Landscape

The drug benefits from regulatory approvals across multiple jurisdictions, including the FDA, EMA, and other global regulators. Its patent exclusivity has historically granted market protection until recent patent expirations and the advent of generic competitors, affecting sales dynamics.

Penetration and Prescription Trends

Prescription data indicates pervasive adoption in North America, Europe, and parts of Asia, with steady growth driven by increasing awareness of hormonal therapies and contraceptive options. The rise in telemedicine channels further accelerates accessibility and prescription rates.

Market Dynamics and Drivers

Demographics and Population Trends

The target demographic encompasses women of reproductive age (18–45 years). Population growth, urbanization, and increased health literacy underpin expanding demand. Notably, rising contraception awareness campaigns bolster user adoption.

Regulatory and Reimbursement Factors

Wide reimbursement coverage in developed markets facilitates availability. Regulatory support for contraceptive products as essential medicines sustains steady sales. Conversely, regulatory restrictions and cultural attitudes in certain regions can dampen market expansion.

Competitive Landscape

ORTHO-CEPT faces competition from:

- Generics and biosimilars post patent expiry

- Alternative contraceptive modalities (implantables, intrauterine devices)

- Non-hormonal methods gaining popularity in certain segments

Brand loyalty, efficacy profile, and side effect management influence market share among competitors.

Market Challenges

Key challenges include:

- Patent expiration leading to price erosion

- Negative perceptions and side effect concerns inhibiting adoption

- Emerging innovations disrupting traditional contraceptive markets

Sales Performance and Historical Trends

Historical sales data reflect:

- Steady decline in original brand sales post-patent expiry

- Surge in generic versions, leading to increased volume but diminished margins

- Variability influenced by regional regulatory actions and marketing strategies

In North America, sales peaked prior to patent expiration but have since plateaued, with generics capturing a larger portion of the market share. In Europe, similar trends are evident, though slower generics adoption is observed due to patent protections and consumer preferences.

Future Market Projections

Growth Scenarios

-

Optimistic Scenario: Market expansion driven by emerging markets in Asia and Africa, increasing contraceptive acceptance, and innovative formulations improving adherence. Projected Compound Annual Growth Rate (CAGR): 4-6% over the next five years.

-

Moderate Scenario: Market stabilization with continued generic competition, marginal growth driven by demographic trends and healthcare infrastructure enhancements. CAGR: 2-4%.

-

Pessimistic Scenario: Market decline due to disruptive non-hormonal alternatives, regulatory restrictions, or safety concerns. Potential negative CAGR: -1%.

Regional Outlook

-

North America: Saturated market with moderate growth prospects, mainly through product line extensions and marketing campaigns emphasizing safety and convenience.

-

Europe: Slow growth due to cultural preferences and high generic penetration. However, reforms improving access could stimulate incremental sales.

-

Asia-Pacific: High growth potential owing to expanding reproductive health awareness, urbanization, and population growth. Estimated CAGR: 6-8%.

-

Emerging Markets: Driven by government initiatives and unmet needs, these markets could contribute significantly to future sales, albeit with regulatory hurdles.

Impact of Innovation and Formulation Advances

Next-generation contraceptives, such as reduced-dose formulations, extended-cycle pills, and hormone-free options, pose both risks and opportunities. Companies investing in improved formulations could capture premium segments and increase adherence, impacting sales positively.

Risks and Opportunities

Risks:

- Patent cliffs and generic competition eroding profit margins.

- Regulatory hurdles for new formulations.

- Changing societal attitudes toward hormonal contraception.

- Potential safety concerns impacting prescription patterns.

Opportunities:

- Expansion into untapped markets.

- Development of combination therapies addressing hormonal imbalances.

- Digital health integration for adherence monitoring.

- Strategic partnerships expanding distribution networks.

Strategic Recommendations

- Product Diversification: Develop new formulations aligned with patient preferences.

- Market Expansion: Prioritize investments in emerging markets with demographic growth.

- Regulatory Engagement: Advocate for favorable regulatory pathways and reimbursement policies.

- Brand Reinforcement: Emphasize safety profiles and added therapeutic benefits to differentiate.

- Competitive Intelligence: Monitor emerging offerings and patent status for strategic positioning.

Key Takeaways

- Market maturity in developed regions limits strong growth but sustains steady revenue streams through established brand loyalty.

- Patent expirations have opened avenues for generic competition, suppressing margins but expanding overall sales volume.

- Emerging markets present the most promising growth opportunities, particularly in Asia-Pacific, driven by demographic shifts and increasing contraceptive awareness.

- Innovation in formulations and digital adherence solutions may revitalize sales trajectories, especially in saturated markets.

- Regulatory and societal shifts require agile strategies to mitigate risks and capitalize on evolving healthcare policies.

FAQs

1. What are the primary factors affecting ORTHO-CEPT sales?

Sales are influenced by patent status, competition from generics, regional regulatory environments, demographic trends, and consumer perceptions of hormonal contraception.

2. How does patent expiry impact ORTHO-CEPT market share?

Patent expiry typically results in a surge of generic versions, increasing volume but decreasing prices and margins for the original brand.

3. Which regions offer the highest growth opportunities for ORTHO-CEPT?

Asia-Pacific and emerging markets present the highest growth prospects due to population growth, expanding healthcare infrastructure, and rising contraceptive acceptance.

4. What innovations could boost ORTHO-CEPT sales?

Development of extended-cycle pills, lower-dose formulations, and digital adherence tools are potential drivers for future growth.

5. How do regulatory changes influence ORTHO-CEPT's market?

Stringent safety regulations, approval processes, and reimbursement policies shape market access and influence sales trajectories.

Sources

[1] IMS Health, "Global Contraceptive Market Report," 2022.

[2] MarketWatch, "Oral Contraceptive Drug Market Trends," 2023.

[3] European Medicines Agency, "Regulatory Status of Hormonal Contraceptives," 2023.

[4] IQVIA, "Prescription Trends and Market Share Data," 2022.

[5] WHO, "Family Planning and Reproductive Health Data," 2021.

More… ↓