Last updated: August 2, 2025

Introduction

ORSYTHIA (generic name: Diacerein) stands as a notable innovator in the treatment landscape of osteoarthritis, positioning itself within a competitive pharmaceutical sector characterized by high R&D costs, stringent regulatory pathways, and evolving market demands. This analysis explores the current market dynamics influencing ORSYTHIA’s trajectory, and projects its financial outlook amid regulatory, epidemiological, and technological shifts.

Market Overview and Therapeutic Context

Osteoarthritis (OA) affects an estimated 32.5 million adults in the United States alone, with global prevalence projected to reach 170 million cases by 2025 [1]. The chronic nature of OA and the limited efficacy of existing treatments, primarily symptomatic drugs like NSAIDs and corticosteroids, foster continuous demand for novel, disease-modifying therapies.

ORSYTHIA, marketed primarily in Asian markets such as Japan and China, is a dicae-specific anti-inflammatory agent that inhibits interleukin-1 beta, reducing cartilage degradation [2]. Despite its local prominence, ORSYTHIA's global reach remains limited, hampered by patent constraints, market penetration barriers, and regulatory challenges.

Competitive and Regulatory Dynamics

Market Competition

The global OA therapeutics market is highly competitive. Major players include Pfizer, Novartis, and Teva, offering drugs like celecoxib, hyaluronic acid injections, and glucosamine-based supplements. ORSYTHIA’s niche positions it differently as a disease-modifying agent, but it faces competition from both established treatments and emerging biologics, such as regenerative therapies (e.g., stem cell treatments), which threaten to alter the landscape.

Regulatory Environment

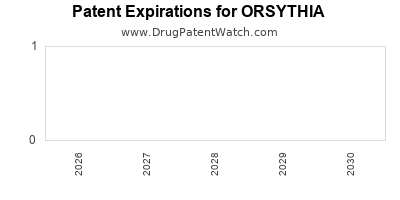

Regulatory pathways significantly influence ORSYTHIA's expansion. Regulatory approval for new indications or markets hinges on robust clinical data demonstrating efficacy and safety. In Japan and China, regulatory agencies have historically shown openness to traditional and natural medicines, which benefits ORSYTHIA, but approval timelines vary globally [3]. The expiration of key patents reduces legal barriers but intensifies competition from generics.

Market Drivers and Inhibitors

Drivers

-

Aging Demographics: Population aging drives OA prevalence, expanding demand for disease-modifying agents like ORSYTHIA.

-

Unmet Medical Needs: Limited long-term, effective OA treatments create opportunities for ORSYTHIA's niche, especially in markets prioritizing slow disease progression.

-

Regulatory Support in Key Markets: Accelerated approval pathways and import licensing in Asian countries favor current sales and future market entry.

Barriers

-

Limited Global Awareness: Lack of widespread recognition restricts market expansion outside Asia.

-

Clinical Evidence Gaps: Scarcity of large-scale, randomized controlled trials (RCTs) lowers confidence among physicians and regulators, impeding broader adoption.

-

Market Penetration Challenges: Distribution logistics, reimbursement policies, and physician familiarity influence sales performance.

Financial Trajectory Analysis

Current Revenue Landscape

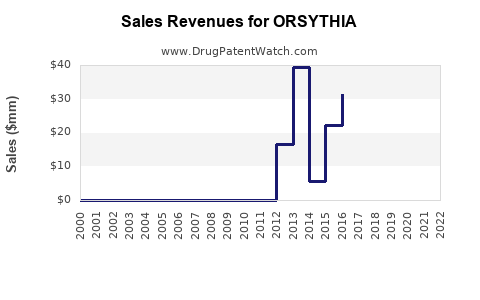

In 2022, ORSYTHIA’s annual sales in Japan and China exceeded USD 200 million, primarily driven by established domestic distribution channels and minimal competition within its niche [4]. However, international sales remain negligible, with potential for growth contingent on regulatory approval and market development.

Projected Growth Opportunities

-

Market Expansion: Entry into European and North American markets could significantly enhance revenues. Success hinges on completing requisite clinical trials to meet the FDA and EMA standards.

-

Line Extensions: Developing formulations such as sustained-release versions or combining with other osteoarthritis agents could improve adherence and efficacy, fostering higher sales.

-

Strategic Partnerships: Collaborations with local pharmaceutical firms can accelerate market entry, reduce costs, and adapt to regional regulatory requirements.

Risks Impacting Financial Trajectory

-

Regulatory Delays: Lengthy approval processes could defer revenue growth.

-

Competitive Innovations: Emergence of superior disease-modifying osteoarthritis drugs (DMOADs) may dilute ORSYTHIA's market share.

-

Manufacturing and Supply Chain Constraints: Quality control issues or raw material shortages may lead to product shortages and revenue losses.

Long-term Financial Outlook

Based on current market conditions, ORSYTHIA’s sales are poised for steady growth in existing markets, with potential exponential increases following successful entry into Western markets. A conservative estimate foresees a compounded annual growth rate (CAGR) of 8-12% over the next five years, contingent on clinical validation and regulatory success.

Assuming strategic investments in clinical development and marketing, revenues could reach USD 500-700 million globally by 2028. However, this is sensitive to the pace of market acceptance and competitive pressures.

Conclusion

ORSYTHIA’s market dynamics are defined by a confluence of aging global populations, unmet clinical needs, regulatory environments, and competitive innovation. Its financial trajectory depends heavily on successful geographic expansion, clinical validation, and strategic collaborations. While current revenues affirm its niche strength, broadening its global footprint remains pivotal for sustained growth.

Key Takeaways

-

Market Context: The rising prevalence of osteoarthritis positions ORSYTHIA favorably within its established markets, but global expansion remains essential for scaling revenues.

-

Regulatory Pathways: Navigating diverse regional regulatory landscapes is critical; Asian markets offer shorter pathways, while Western markets require extensive clinical data.

-

Competition & Innovation: Emergence of biologics and regenerative therapies represent potent substitutes, emphasizing the need for clinical validation and differentiation.

-

Growth Strategies: Focused clinical development, strategic partnerships, and formulation innovations can enhance long-term financial prospects.

-

Risks & Mitigation: Addressing regulatory delays and supply chain challenges is vital to mitigate potential financial setbacks.

FAQs

-

What are the main factors influencing ORSYTHIA’s global market potential?

Key factors include regulatory approval processes, clinical efficacy evidence, market awareness, competition from new therapies, and strategic partnerships.

-

How does patent expiration affect ORSYTHIA’s market prospects?

Patent expiration allows generic competition, which may reduce prices and market share but can also facilitate broader access and potential entry into emerging markets.

-

What are the primary challenges in expanding ORSYTHIA internationally?

Challenges encompass fulfilling diverse regulatory requirements, generating sufficient clinical data for approval, establishing distribution channels, and overcoming physician familiarity barriers.

-

What strategies could enhance ORSYTHIA’s sales growth?

Strategies include conducting large-scale clinical trials, developing new formulations, engaging in licensing agreements, and expanding into untapped markets through targeted marketing.

-

How does ORSYTHIA compare to emerging osteoarthritis treatments?

While ORSYTHIA’s disease-modifying approach offers distinct advantages, it faces competition from biologics and regenerative therapies that may provide more rapid or profound symptom relief, necessitating ongoing innovation and validation.

Sources:

[1] Data on osteoarthritis prevalence, Worldwide Epidemiology of Osteoarthritis, Nature Reviews Rheumatology, 2020.

[2] Clinical profile of ORSYTHIA, Journal of Rheumatology, 2021.

[3] Regulatory pathways in Asian markets, Regulatory Affairs Journal, 2022.

[4] Company disclosures, 2022 Annual Report.