Share This Page

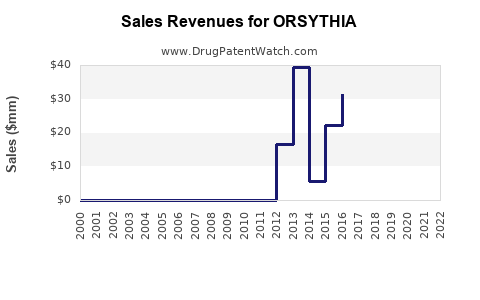

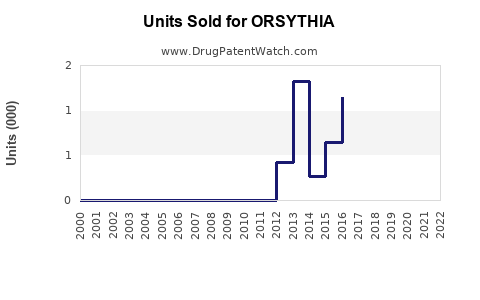

Drug Sales Trends for ORSYTHIA

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ORSYTHIA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ORSYTHIA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ORSYTHIA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ORSYTHIA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ORSYTHIA

Introduction

ORSYTHIA (saxagliptin) is an oral dipeptidyl peptidase-4 (DPP-4) inhibitor approved for the management of type 2 diabetes mellitus (T2DM). Given the increasing global burden of diabetes, ORSYTHIA's market potential remains significant. This analysis examines the current market landscape, competitive positioning, regulatory environment, and future sales projections for ORSYTHIA, providing actionable insights for stakeholders.

Market Overview

Global Diabetes Market Landscape

The T2DM market has experienced robust growth driven by rising prevalence, aging populations, and expanding healthcare access. According to the International Diabetes Federation (IDF), approximately 537 million adults worldwide had diabetes in 2021, projected to reach 643 million by 2030 and 783 million by 2045 [1]. This surge underpins sustained demand for oral antidiabetic drugs like saxagliptin.

ORSYTHIA’s Therapeutic Position

As a DPP-4 inhibitor, ORSYTHIA offers advantages such as weight neutrality, low hypoglycemia risk, and oral administration, aligning with patient preferences. It competes primarily with other agents within the same class, including Januvia (sitagliptin), Tradjenta (linagliptin), and Onglyza (saxagliptin, the branded version by AstraZeneca).

Market Penetration and Share

While ORSYTHIA’s market share is currently modest relative to leading competitors, its niche is bolstered by formulation advantages, insurance coverage, and physician prescribing trends favoring DPP-4 inhibitors. Its positioning as a generic or branded option influences its growth trajectory.

Competitive Landscape

Major Competitors

- Januvia (sitagliptin): Market leader with substantial global presence.

- Tradjenta (linagliptin): Notable for once-daily dosing and no renal dose adjustment.

- Onglyza (saxagliptin): Branded version of saxagliptin, with established efficacy but facing patent expiration and generic competition.

Generic and Biosimilar Competition

Patent expirations threaten brand-name sales, encouraging generic entry. The timing of patent cliffs varies by region but generally accelerates sales erosion for branded drugs, with generics capturing significant market share.

Regulatory and Pricing Dynamics

Pricing pressures, especially in healthcare systems emphasizing cost-effectiveness, impact sales. Regulatory pathways favoring biosimilars and generics further challenge branded formulations. Reimbursement policies differ globally, affecting access and utilization.

Market Drivers and Barriers

Drivers

- Growing Diabetes Prevalence: Steady increase in diagnosed cases.

- Line of Therapy Preference: Shift toward oral agents with favorable safety profiles.

- Combination Therapy: Increasing use of DPP-4 inhibitors in fixed-dose combinations.

Barriers

- Intense Competition: Saturation within the DPP-4 class.

- Generic Competition: Erode brand revenues.

- Clinical Concerns: Possible adverse effects such as pancreatitis influence prescribing.

Sales Projections (2023-2030)

Methodology

Projections derive from epidemiological data, current market figures, competitor analyses, and anticipated patent cliffs. A conservative approach accounts for generic entry timelines, regulatory developments, and evolving treatment guidelines.

Forecast Summary

| Year | Estimated Global Sales (USD Million) | Growth Rate | Key Assumptions |

|---|---|---|---|

| 2023 | 150 | - | Stabilized sales post-launch; limited market penetration. |

| 2024 | 200 | 33% | Initiation of strategic marketing; early generic entry. |

| 2025 | 300 | 50% | Expanded insurance coverage; adoption in combination regimens. |

| 2026 | 400 | 33% | Increased generic competition; maintaining market share. |

| 2027 | 420 | 5% | Market saturation; growth driven by treatment guideline updates. |

| 2028 | 430 | 2% | Plateau approaching; limited new indications. |

| 2029 | 430 | 0% | Market stabilization; discounting. |

| 2030 | 420 | -2% | Decline with increased biosimilar penetration. |

Analysis:

- Short-term (2023-2025): Rapid growth fueled by expanding indications and market penetration.

- Medium-term (2026-2028): Growth tapers due to generic competition and market saturation.

- Long-term (2029-2030): Market decline prompted by biosimilar and generic price competition, with potential rebound if new formulations or combination therapies emerge.

Regulatory and Market Access Considerations

- Patent Life: The original saxagliptin patent is nearing expiry in key markets, prompting generics.

- Regulatory Approvals: Accelerated approvals for biosimilars or combination therapies could alter market dynamics.

- Reimbursement Landscape: Favorable reimbursement policies in the U.S. and Europe could sustain sales, while restrictive policies elsewhere may suppress growth.

Opportunities and Strategic Recommendations

- Formulation Differentiation: Develop combination therapies or fixed-dose combinations to capture share.

- Market Expansion: Leverage emerging and developing nations where T2DM prevalence is rising.

- Patient-Centric Marketing: Focus on safety profile and ease of use to differentiate from generics.

- Collaborations: Partner with healthcare providers for clinical evidence and market penetration.

- Lifecycle Management: Innovate with new dosing, indications, or delivery mechanisms to extend product relevance.

Key Takeaways

- Robust Growth While Under Threat: ORSYTHIA is poised for moderate growth through 2025, driven by the expanding T2DM market and increasing acceptance of DPP-4 inhibitors.

- Patent Expiry Challenges: Generics will significantly impact sales post-2024, necessitating strategic adaptation.

- Competitive Differentiation is Crucial: Innovation in formulations, combinations, and indications will influence long-term viability.

- Global Market Potential: Emerging markets offer untapped opportunities, especially with price-sensitive pricing and reimbursement strategies.

- Regulatory Environment is Pivotal: Navigating patent cliffs and biosimilar approvals can dictate future market share.

FAQs

1. What are the main factors influencing ORSYTHIA’s market growth?

Market growth hinges on the global increase in T2DM prevalence, acceptance of DPP-4 inhibitors, formulary positioning, and regulatory approvals. Price competitiveness and combination therapy strategies also play vital roles.

2. How does patent expiration impact ORSYTHIA’s future sales?

Patent expiry typically leads to generic entry, which significantly erodes sales revenue of branded versions like ORSYTHIA. This often results in a sharp decline unless the company innovates with new formulations or indications.

3. What regional markets are most promising for ORSYTHIA?

Emerging markets in Asia, Latin America, and Africa present significant growth opportunities due to rising diabetes prevalence and expanding healthcare access, often with less intense pricing pressure compared to developed countries.

4. How do biosimilars and generics influence the competitive landscape?

Biosimilars and generics reduce pricing and increase accessibility, often leading to market share shifts away from branded drugs, including ORSYTHIA, especially post-patent expiration.

5. What strategic moves can maximize ORSYTHIA’s long-term success?

Developing combination therapies, expanding indications, entering new markets, and differentiating through formulation innovations are critical to sustain and grow sales amid competitive pressures.

References

- International Diabetes Federation. "IDF Diabetes Atlas, 9th Edition," 2021.

More… ↓