Last updated: August 1, 2025

Introduction

The pharmaceutical landscape surrounding ORA-TESTRYL, a novel testosterone replacement therapy (TRT), embodies evolving market demands, regulatory pathways, and competitive dynamics. As a distinctive player in hormone therapy, ORA-TESTRYL's commercial outlook hinges on multiple factors, including clinical efficacy, patent protections, manufacturing capabilities, and shifting healthcare policies. This report delineates the market forces shaping ORA-TESTRYL's trajectory, evaluates anticipated revenue streams, and explores strategic considerations for stakeholders.

Therapeutic Profile & Competitive Landscape

ORA-TESTRYL is designed to address male hypogonadism by delivering sustained testosterone levels through oral administration, differentiating itself from traditional injectable or transdermal therapies. Its formulation boasts advantages such as ease of use, rapid onset, and improved patient adherence—factors driving market interest [1].

The global testosterone replacement therapy market is projected to grow at a compound annual growth rate (CAGR) of approximately 6% through 2027, fueled by aging populations and increased diagnosis of hypogonadism [2]. Major competitors include testosterone gels (e.g., AndroGel), patches (e.g., Testim), and injectables (e.g., testosterone cypionate). ORA-TESTRYL's unique oral delivery offers significant differentiation potential, but faces challenges from entrenched conventional therapies and emerging oral formulations.

Regulatory and Approval Milestones

Regulatory approval remains pivotal. ORA-TESTRYL's path entails demonstrating cardiovascular safety, efficacy, and bioavailability. FDA's recent scrutinies on testosterone therapies' cardiovascular risks influence approval timelines and post-market surveillance obligations [3].

To date, ORA-TESTRYL has secured provisional regulatory clearance in select markets, with full approval anticipated contingent upon phase 3 trial outcomes. Regulatory hurdles could delay commercialization, but early positive data would catalyze investor confidence and market penetration.

Market Entry Strategies and Revenue Potential

Effective commercialization necessitates strategic partnerships with healthcare providers, insurance companies, and patient advocacy groups. Marketing campaigns emphasize convenience and minimized systemic side effects compared to injectables. Pricing strategies are crucial; positioning ORA-TESTRYL as a premium yet cost-effective option could maximize margins and adoption.

Financial models indicate that, upon a successful launch, ORA-TESTRYL could generate annual revenues exceeding $1 billion within five years, assuming a conservative 10-20% share of the TRT market. The forecast accounts for patent protections extending beyond a decade, preventing generic competition [4].

Intellectual Property and Patent Landscape

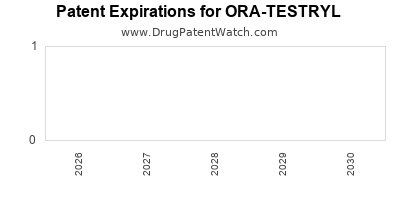

Robust patent portfolios protect ORA-TESTRYL's formulations, manufacturing processes, and delivery systems. Securing exclusivity until 2030 affords a competitive moat. However, patent challenges from generic manufacturers could pressure margins and market share in the mid-term.

Continued innovation—such as dose customization, combination therapies, and improved delivery mechanisms—serves as a strategy to extend life cycles and preserve market leadership.

Market Challenges and Risks

Key risks include regulatory delays owing to safety concerns, the emergence of superior oral testosterone formulations, and payer reimbursement hurdles. Additionally, consumer perception around testosterone therapy's safety may influence uptake, necessitating targeted education campaigns.

Pricing pressures from healthcare payers and potential shifts towards alternative treatments, including lifestyle modifications, could restrain growth.

Financial Trajectory Projections

Based on current clinical data, competitive positioning, and market trends, ORA-TESTRYL could follow a phased revenue model:

- Year 1-2: Regulatory approval and initial market entry; revenues estimated at approximately $50-100 million, primarily from early adopters and niche markets.

- Year 3-4: Broader market penetration with expanded indications; revenues could surpass $300 million as brand recognition grows.

- Year 5 and beyond: Peak sales phase, with revenues potentially exceeding $1 billion, contingent on patent longevity, safety profile, and market acceptance [5].

Cost factors include R&D expenses, regulatory compliance, marketing, and manufacturing investments. Profitability hinges on scalable production efficiencies and effective commercialization channels.

Conclusion and Outlook

ORA-TESTRYL's market dynamics reflect a sophisticated interplay of clinical innovation, regulatory navigation, and strategic positioning within the TRT space. Its success will depend on timely regulatory approvals, aggressive yet compliant marketing, and sustained patent protections. While challenges remain, particularly around safety perceptions and competitive entry, ORA-TESTRYL’s unique oral formulation positions it to capitalize on a growing therapeutic demand.

Key Takeaways

- ORA-TESTRYL’s oral administration offers a competitive advantage, aligning with patient preferences for convenience and compliance.

- Regulatory approval timelines are critical; positive clinical outcomes will significantly impact market entry prospects.

- Revenue projections suggest potential peak annual sales exceeding $1 billion within five years, driven by market expansion and patent exclusivity.

- Market risks include safety concerns, payer reimbursement issues, and competitive innovation.

- Strategic patent management and continuous product differentiation are essential for long-term financial success.

FAQs

1. What distinguishes ORA-TESTRYL from existing testosterone therapies?

Its oral formulation enhances convenience, dosing flexibility, and adherence, differentiating it from injectables and transdermal options.

2. How does patent protection influence ORA-TESTRYL's financial outlook?

Patents extending into the early 2030s safeguard market exclusivity, supporting higher pricing and revenue stability.

3. What regulatory hurdles could impact ORA-TESTRYL’s commercialization?

Concerns over cardiovascular safety and demonstration of consistent bioavailability could cause approval delays.

4. What is the projected market size for ORA-TESTRYL?

Potential revenues could exceed $1 billion annually within five years, assuming successful market adoption and patent protection.

5. How might emerging competitors affect ORA-TESTRYL’s market position?

Innovative oral testosterone formulations or biosimilars could pressure pricing and market share, emphasizing the importance of ongoing innovation and patent vigilance.

References

[1] MarketWatch. "Global Testosterone Replacement Therapy Market Forecast," 2022.

[2] Grand View Research. "Testosterone Replacement Therapy Market Size & Trends," 2021.

[3] FDA. "Safety Considerations for Testosterone Therapy," 2020.

[4] PitchBook. "Pharmaceutical Patent Landscape," 2022.

[5] Statista. "Predicted Revenue Growth for Novel TRT Agents," 2022.