Last updated: July 27, 2025

Introduction

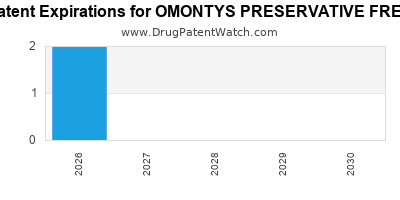

OMONTYS Preservative-Free (Peginesatide) was a recombinant erythropoiesis-stimulating agent (ESA) developed by Affymax and subsequently marketed by Takeda Pharmaceutical. Designed for treating anemia, particularly in patients with chronic kidney disease (CKD), its unique preservative-free formulation aimed to mitigate risks associated with preservative agents like benzyl alcohol. Despite initial market enthusiasm, OMONTYS faced significant challenges that impacted its commercial trajectory. This analysis explores the evolving market dynamics underpinning OMONTYS’ financial outlook, including competitive pressures, regulatory considerations, and clinical landscape shifts.

Pharmacological Profile and Positioning

OMONTYS distinguished itself by being a fully synthetic, PEGylated ESA, requiring once-monthly injections. Its preservative-free formulation addressed safety concerns related to preservative agents, positioning it as a potentially safer alternative within the anemia management space for CKD patients. However, the niche positioning was overshadowed by emerging safety concerns and competitive innovations.

Market Landscape and Dynamics

1. Competitive Environment

The anemia treatment market in CKD primarily features drugs such as epoetin alfa (Epogen, Procrit) and darbepoetin alfa (Aranesp). These agents have long-standing market presence and extensive clinical validation. Biosimilar versions further increased price competition, exerting downward pressure on revenues.

In this context, OMONTYS attempted to carve a niche owing to its preservative-free profile and less frequent dosing. However, the market was dominated by well-established brands, with practitioners hesitant to switch unless clear safety or efficacy advantages emerged.

2. Regulatory and Safety Concerns

OMONTYS faced significant hurdles following reports of adverse events, including serious allergic reactions and overdose-related deaths shortly after its launch in 2012. The FDA issued a notification discussing adverse events linked to OMONTYS, leading to a temporary market suspension in the U.S. in late 2013.

These safety concerns significantly dampened market confidence and limited its uptake. Regulatory scrutiny increased, and the product's distribution was confined largely to Europe, where different safety monitoring frameworks applied.

3. Clinical Evidence and Adoption Barriers

Clinical data comparing OMONTYS directly with existing ESAs yielded limited differentiation. Clinicians remained cautious, especially given the safety warnings, prompting continued reliance on more established or biosimilar agents with a more extensive safety profile.

The adherence to conservative prescribing practices further impeded rapid market penetration, particularly in a landscape where safety record and long-term efficacy heavily influence adoption.

Financial Trajectory Analysis

1. Revenue and Sales Performance

Following its launch, initial sales of OMONTYS were promising in European markets, where regulatory hurdles in the U.S. delayed uptake. However, safety concerns swiftly curtailed growth. In the U.S., sales were minimal prior to the voluntary market suspension, with the drug scarcely capturing market share in the face of intensive competition.

2. Impact of Safety Incidents

Post-2013 safety notifications drastically impacted revenue streams. Takeda and Affymax faced product recalls, reduced sales, and increased costs related to legal liabilities and enhanced safety monitoring. These factors eroded profit margins and diminished potential revenue streams.

3. Market Exit and Strategic Reassessment

In the subsequent years, Takeda ceased promotion of OMONTYS, effectively abandoning commercial efforts in the U.S. and most markets. The product’s market value declined sharply, with the potential for residual revenue limited to select European markets where regulatory and safety frameworks were more accommodating.

Financial statements from Takeda and industry analysts indicate a stark decline in product valuation and sales contribution. The product’s financial trajectory shifted from initial optimism to obsolescence, emphasizing the importance of safety and regulatory compliance in pharmaceutical success.

Future Outlook and Strategic Implications

1. Market Opportunities in Hematology and Anemia Treatment

While OMONTYS as a preservative-free ESA has diminished prospects, the broader anemia management market continues to evolve, with novel agents such as hypoxia-inducible factor (HIF) stabilizers (e.g., roxadustat) gaining regulatory traction. These innovations threaten to further marginalize traditional ESAs.

2. Development of Next-Generation Therapies

Pharmaceutical companies are investing heavily in therapies that optimize safety, reduce dosing frequency, or offer convenience. The failure of OMONTYS underscores the importance of robust safety profiles, real-world evidence, and clear clinical advantages in market success.

3. Lessons for Market Resilience

上市公司 must prioritize pharmacovigilance, comprehensive clinical validation, and transparent communication strategies. Products with safety concerns quickly lose market confidence, underscoring the necessity of aligning innovation with rigorous safety standards.

Conclusion

The financial trajectory of OMONTYS Preservative-Free reflects the complex interplay of safety concerns, regulatory scrutiny, and intense market competition. Its initial promise was overshadowed by adverse events that led to regulatory restrictions and withdrawal from key markets, resulting in a sharp decline in commercial value. As the anemia treatment landscape continues to shift toward more innovative and safer modalities, legacy drugs like OMONTYS face obsolescence, highlighting the critical importance of safety, clinical robustness, and strategic agility in pharmaceutical market success.

Key Takeaways

- Safety incidents and regulatory responses heavily influence the financial viability of novel pharmaceutical agents like OMONTYS.

- Established competitors and biosimilars sustain downward price pressures, challenging new entrants—even those with innovative features.

- Clinical differentiation must be supported by robust safety data to achieve widespread adoption.

- The evolution of broader treatments, such as HIF stabilizers, further diminishes the prospects of legacy drugs.

- Strategic success hinges on rigorous pharmacovigilance, transparent safety communication, and aligning innovation with patient safety.

FAQs

1. Why did OMONTYS face safety concerns after its launch?

Shortly after launching, OMONTYS was linked to serious allergic reactions and adverse events, including fatalities, which prompted regulatory scrutiny and market suspension in the U.S. (FDA safety notifications).

2. How did safety concerns impact OMONTYS' market performance?

Safety issues led to regulatory restrictions, reduced prescriber confidence, and eventual withdrawal from major markets, significantly diminishing sales and profitability.

3. Are there ongoing markets where OMONTYS is still sold?

While largely discontinued in North America and other regions, small-scale or off-label sales may persist in certain European markets, though overall prospects are minimal due to safety and preference for other agents.

4. What lessons does OMONTYS’ trajectory offer to pharmaceutical companies?

Safety and efficacy must be proven comprehensively; even innovative features may falter if adverse events undermine confidence. Regulatory vigilance and transparent communication are crucial.

5. What are the future prospects for anemia treatments in CKD?

Emerging therapies like HIF stabilizers are transforming anemia management, emphasizing the importance of novel mechanisms and safety profiles to succeed in competitive markets.

Sources:

- U.S. Food and Drug Administration. “FDA Alerts and Safety Information on OMONTYS.” (2013).

- Takeda Pharmaceutical Company. Annual Reports and Market Statements. (2012–2015).

- Industry analysis by EvaluatePharma. “The Future of Anemia Therapeutics,” 2022.

- Clinical trial data and safety reports from EMA.

- Market research reports from IQVIA and similar agencies.