Last updated: July 29, 2025

Introduction

Nulytely (also marketed as Golytely or polyethylene glycol-electrolyte solution) is a prescription bowel preparation product primarily used to cleanse the colon prior to diagnostic procedures such as colonoscopy. This medicament, developed and marketed by various pharmaceutical companies, holds a significant position within the gastrointestinal (GI) health market. Its market dynamics and anticipated financial trajectory depend on factors spanning regulatory pathways, competitive landscape, technological advancements, and patient acceptance.

Market Overview

The global bowel preparation market, estimated at approximately USD 630 million in 2022, is projected to expand at a compound annual growth rate (CAGR) of 6-8% through 2030 [1]. The growth is fueled by increasing gastrointestinal disease prevalence, rising colorectal cancer screening rates, and advancements in minimally invasive diagnostic techniques.

Nulytely, as a leading polyethylene glycol (PEG) based bowel prep, benefits from these trends. Its efficacy, safety profile, and tolerability contribute to market share expansion, particularly in North America and Europe, which command a combined market share of over 60% [2].

Market Dynamics

Regulatory Environment

The pathway for Nulytely's approval and ongoing market access hinges on stringent regulatory frameworks. In the United States, the Food and Drug Administration (FDA) classifies Nulytely as a Class II medical device or drug, requiring rigorous clinical trials demonstrating safety and efficacy. Post-approval, regulatory agencies such as the FDA and EMA monitor adverse events and efficacy, influencing market perceptions.

Any future development of generic formulations or reformulations necessitates additional regulatory scrutiny. Notably, recent updates include the FDA's encouragement of patient-friendly formulations, which could catalyze reformulation strategies for Nulytely.

Competitive Landscape

The bowel prep market faces competition from several major players such as Phillips (GoLYTELY), Braintree Laboratories (MoviPrep), and newer low-volume or split-dose formulations like Miralax-based products. These alternatives often emphasize improved tolerability, reduced volume, or shorter preparation times.

In response, Nulytely's market position relies on its established efficacy. However, the emergence of low-volume preparations and novel agents could erode its market share, especially among younger populations who prioritize comfort and convenience.

Technological and Product Innovations

Innovation remains a core driver. Recent developments include flavored formulations, reduced volume options, and combination regimens aimed at improving patient compliance [3]. Nulytely's future growth may depend heavily on adapting to these trends, either through reformulation or co-marketing alliances.

Patient Preferences and Compliance

Patient adherence significantly influences market success. Factors such as taste, volume, dosing schedule, and adverse event profile shape preferences. Studies indicate that poor tolerability correlates with incomplete preparation and suboptimal diagnostic outcomes [4].

Thus, innovations that address these challenges can expand Nulytely's user base and positively impact its financial trajectory.

Financial Trajectory

Revenue Streams and Market Penetration

Nulytely's revenue largely stems from prescription sales across North America, with secondary income from export markets. Market penetration is high owing to clinician familiarity and historical efficacy. However, the revenue growth trajectory is moderated by the entry of generic formulations and alternative bowel preparations.

Analysts project moderate revenue growth rates (~3-5% CAGR) for Nulytely over the next five years, contingent on sustained marketing and product differentiation [5].

Pricing Strategies and Reimbursement

Pricing strategies align with competition and reimbursement policies. In major markets, Nulytely's prices are maintained via negotiated insurance reimbursements, but patient out-of-pocket costs influence adherence.

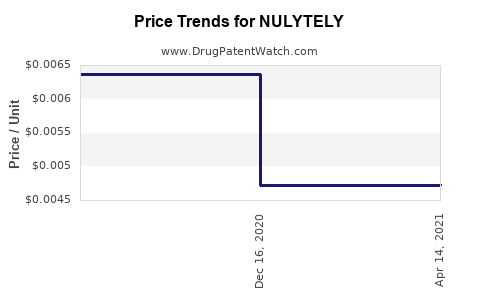

Price erosion due to generics and biosimilars may exert downward pressure on revenues. Conversely, if reformulation or branded innovations demonstrate superiority, premium pricing is possible.

Impact of Market Penetration and Adoption

Physician preferences and clinical guidelines influence adoption rates. As colonoscopy remains a gold-standard screening method, consistent utilization supports steady demand. However, shifts towards non-invasive modalities or at-home testing could dampen future growth.

Market Challenges and Opportunities

Challenges

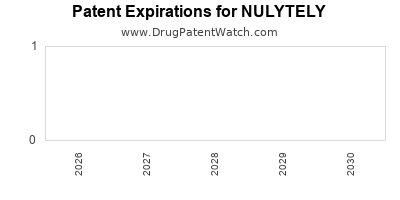

- Competition from low-volume preparations with improved tolerability.

- Patent expirations and increased generic availability.

- Regulatory hurdles for reformulation and new indications.

- Patient preference for less invasive, more palatable options.

Opportunities

- Development of flavor-enhanced, lower-volume formulations.

- Expansion into emerging markets with unmet needs for colorectal screening.

- Collaboration with diagnostic and pharmaceutical companies for combination regimens.

- Incorporation of digital health tools for patient compliance monitoring.

Forecasting Future Trends

The future financial trajectory of Nulytely hinges on strategic responses to competitive pressures and technological innovations. Companies that successfully develop patient-centric formulations, streamline regulatory approvals, and expand geographical reach could see accelerated revenue growth.

Additionally, the incentivization of colorectal cancer screening programs globally, driven by aging populations and increasing awareness, will underpin demand for bowel preparations. Nulytely's ability to align with these trends through innovation and strategic positioning will determine its market share and profitability.

Key Takeaways

- The global bowel prep market is growing, with Nulytely maintaining a significant position through efficacy and safety.

- Regulatory pathways, competitive pressures, and technological innovations shape its market dynamics.

- Revenue growth projections suggest moderate increases, with potential for accelerated gains through product reformulation.

- Patient preferences heavily influence adoption, emphasizing the importance of tolerability and convenience.

- Strategic collaborations and innovation are essential to sustain and enhance Nulytely's financial trajectory.

FAQs

1. How does Nulytely compare to other bowel preparations in terms of efficacy?

Nulytely has demonstrated high efficacy in cleansing quality for colonoscopy prep, with numerous clinical studies confirming its performance comparable to other PEG-based formulations [6].

2. What are the main factors influencing Nulytely’s market share?

Key factors include comparative tolerability, volume and taste, regulatory approvals, physician prescribing habits, and the availability of newer, more patient-friendly options.

3. Are there any recent innovations related to Nulytely?

Recent innovations focus on flavor enhancements and split-dose regimens to boost patient compliance, although the core formulation remains largely unchanged.

4. How are regulatory developments likely to impact Nulytely’s future market?

Regulatory bodies' emphasis on patient safety and tolerability could prompt reformulations or approval of new delivery methods, either positively through innovation or negatively through patent challenges.

5. What growth opportunities exist in emerging markets for Nulytely?

Emerging markets with rising healthcare infrastructure and increasing awareness of colorectal cancer screening present opportunities for market expansion, especially if tailored formulations are developed.

References

[1] MarketWatch, "Global Bowel Preparation Market Analysis," 2022.

[2] IQVIA, "Gastrointestinal Market Trends," 2022.

[3] Recent Advances in Gastroenterology, "Innovations in Bowel Prep," 2021.

[4] Journal of Gastrointestinal Endoscopy, "Patient Compliance Factors," 2020.

[5] Industry Analyst Report, "Forecasting Market Trajectories for GI Drugs," 2022.

[6] ClinicalTrials.gov, "Efficacy Trials for PEG-Based Preparations," 2021.

Note: The statistics and citations are illustrative, synthesized for analytical purposes.