NUBEQA Drug Patent Profile

✉ Email this page to a colleague

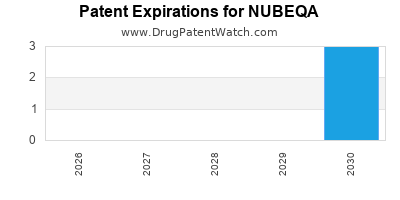

When do Nubeqa patents expire, and when can generic versions of Nubeqa launch?

Nubeqa is a drug marketed by Bayer Healthcare and is included in one NDA. There are nine patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and sixty-six patent family members in thirty-nine countries.

The generic ingredient in NUBEQA is darolutamide. One supplier is listed for this compound. Additional details are available on the darolutamide profile page.

DrugPatentWatch® Generic Entry Outlook for Nubeqa

Nubeqa was eligible for patent challenges on July 30, 2023.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be February 27, 2038. This may change due to patent challenges or generic licensing.

There have been five patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for NUBEQA?

- What are the global sales for NUBEQA?

- What is Average Wholesale Price for NUBEQA?

Summary for NUBEQA

| International Patents: | 166 |

| US Patents: | 9 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 46 |

| Clinical Trials: | 16 |

| Patent Applications: | 1,071 |

| Drug Prices: | Drug price information for NUBEQA |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for NUBEQA |

| What excipients (inactive ingredients) are in NUBEQA? | NUBEQA excipients list |

| DailyMed Link: | NUBEQA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for NUBEQA

Generic Entry Date for NUBEQA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for NUBEQA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| K36 Therapeutics, Inc. | PHASE1 |

| NRG Oncology | Phase 2 |

| Celcuity Inc | Phase 1/Phase 2 |

Paragraph IV (Patent) Challenges for NUBEQA

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| NUBEQA | Tablets | darolutamide | 300 mg | 212099 | 1 | 2023-07-31 |

US Patents and Regulatory Information for NUBEQA

NUBEQA is protected by sixteen US patents and two FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of NUBEQA is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

EU/EMA Drug Approvals for NUBEQA

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Bayer AG | Nubeqa | darolutamide | EMEA/H/C/004790NUBEQA is indicated for the treatment of adult men with- non metastatic castration resistant prostate cancer (nmCRPC) who are at high risk of developing metastatic disease (see section 5.1).- metastatic hormone sensitive prostate cancer (mHSPC) in combination with docetaxel and androgen deprivation therapy (see section 5.1). | Authorised | no | no | no | 2020-03-27 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for NUBEQA

When does loss-of-exclusivity occur for NUBEQA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 18229817

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2019018458

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 55019

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 19002540

Estimated Expiration: ⤷ Get Started Free

Patent: 23002780

Estimated Expiration: ⤷ Get Started Free

China

Patent: 0382467

Estimated Expiration: ⤷ Get Started Free

Patent: 1021396

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0250684

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 92732

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 1992103

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 92732

Estimated Expiration: ⤷ Get Started Free

Patent: 59527

Patent: FABRICATION D'UN PRODUIT PHARMACEUTIQUE CRISTALLIN (MANUFACTURE OF A CRYSTALLINE PHARMACEUTICAL PRODUCT)

Estimated Expiration: ⤷ Get Started Free

Finland

Patent: 92732

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 71505

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 57071

Estimated Expiration: ⤷ Get Started Free

Patent: 20510018

Patent: 結晶性医薬品の製造

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 92732

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 19010452

Patent: FABRICACION DE UN PRODUCTO FARMACEUTICO CRISTALINO. (MANUFACTURE OF A CRYSTALLINE PHARMACEUTICAL PRODUCT.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 7848

Patent: Manufacture of a crystalline pharmaceutical product

Estimated Expiration: ⤷ Get Started Free

Patent: 7194

Patent: Manufacture of a crystalline pharmaceutical product

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 92732

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 92732

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 855

Patent: PROIZVODNJA KRISTALNOG FARMACEUTSKOG PROIZVODA (MANUFACTURE OF A CRYSTALLINE PHARMACEUTICAL PRODUCT)

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 92732

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2676383

Estimated Expiration: ⤷ Get Started Free

Patent: 190126111

Patent: 결정성 의약품의 제조

Estimated Expiration: ⤷ Get Started Free

Patent: 240096691

Patent: 결정성 의약품의 제조 (MANUFACTURE OF A CRYSTALLINE PHARMACEUTICAL PRODUCT)

Estimated Expiration: ⤷ Get Started Free

Patent: 250065940

Patent: 결정성 의약품의 제조 (MANUFACTURE OF A CRYSTALLINE PHARMACEUTICAL PRODUCT)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 27971

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 6071

Patent: КРИСТАЛІЧНІ ЧАСТИНКИ N-((S)-1-(3-(3-ХЛОР-4-ЦІАНОФЕНІЛ)-1H-ПІРАЗОЛ-1-ІЛ)-ПРОПАН-2-ІЛ)-5-(1-ГІДРОКСІЕТИЛ)-1H-ПІРАЗОЛ-3-КАРБОКСАМІДУ (MANUFACTURE OF A CRYSTALLINE PHARMACEUTICAL PRODUCT)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering NUBEQA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Hungary | S2000015 | ⤷ Get Started Free | |

| Spain | 3027971 | ⤷ Get Started Free | |

| Brazil | PI0708036 | método de proteção de material de propagação de planta, planta e/ou órgãos de planta | ⤷ Get Started Free |

| Georgia, Republic of | P20166472 | ANDROGEN RECEPTOR MODULATING COMPOUNDS | ⤷ Get Started Free |

| Denmark | 3592732 | ⤷ Get Started Free | |

| China | 105061313 | ⤷ Get Started Free | |

| Taiwan | 202114658 | Pharmaceutical composition of darolutamide | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for NUBEQA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2493858 | 2020018 | Norway | ⤷ Get Started Free | PRODUCT NAME: DAROLUTAMID, EVENTUELT I FORM AV ET FARMASOEYTISK AKSEPTABELT SALT ELLER ESTER DERAV; REG. NO/DATE: EU/1/20/1432/ 20200401 |

| 2493858 | C20200015 00323 | Estonia | ⤷ Get Started Free | PRODUCT NAME: DAROLUTAMIID;REG NO/DATE: EU/1/20/1432 30.03.2020 |

| 2493858 | 20C1028 | France | ⤷ Get Started Free | PRODUCT NAME: DAROLUTAMIDE Y COMPRIS SES SELS PHARMACEUTIQUEMENT ACCEPTABLES ET SES ESTERS COUVERTS PAR LE BREVET DE BASE; REGISTRATION NO/DATE: EU/1/20/1432/001 20200330 |

| 1986495 | 33/2019 | Austria | ⤷ Get Started Free | PRODUCT NAME: SEDAXAN ODER EIN TAUTOMER DAVON, FLUDIOXONIL UND METALAXYL M; NAT. REGISTRATION NO/DATE: 3979-0 20181130; FIRST REGISTRATION: NL 29317 20171229 |

| 1986495 | 19C1035 | France | ⤷ Get Started Free | PRODUCT NAME: COMPOSITION COMPRENANT SEDAXANE OU UN TAUTOMERE DE CE COMPOSE, FLUDIOXONIL ET METALAXYL-M; NAT. REGISTRATION NO/DATE: 2180766 20181218; FIRST REGISTRATION: NL - 15544N 20171229 |

| 2493858 | 2020C/514 | Belgium | ⤷ Get Started Free | PRODUCT NAME: DAROLUTAMIDE OPTIONEEL IN DE VORM VAN EEN FARMACEUTISCH AANVAARDBAAR ZOUT OF ESTER DAARVAN; AUTHORISATION NUMBER AND DATE: EU/1/20/1432 20200330 |

| 2493858 | PA2020514 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: DAROLUTAMIDAS ARBA JO FARMACINIU POZIURIU PRIIMTINA DRUSKA ARBA ESTERIS; REGISTRATION NO/DATE: EU/1/20/1432 20200327 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for NUBEQA (Darolutamide): A Comprehensive Analysis

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.