Last updated: July 31, 2025

Introduction

NORCO, a combination medication comprising acetaminophen and hydrocodone, has historically played a significant role in pain management. Widely prescribed for moderate to severe pain, NORCO’s market presence is shaped by evolving regulatory landscapes, shifting consumer demand, and competitive pressures. This analysis explores the current market dynamics and forecasts the financial trajectory of NORCO, emphasizing regulatory changes, patent landscapes, healthcare trends, and economic factors influencing its valuation and utilization.

Regulatory Environment and Impact on Market Dynamics

The pharmaceutical landscape for opioids like NORCO has undergone substantial shifts over recent years, primarily driven by the opioid epidemic in North America. The U.S. Food and Drug Administration (FDA) and other global health authorities have implemented stricter regulations, including prescribing limits, dosage restrictions, and enhanced monitoring programs (e.g., PDMPs). These measures aim to curb misuse and abuse but have consequently reduced demand in some regions.

In 2014, the FDA mandated the removal of immediate-release hydrocodone combinations from the market unless reclassified, which directly impacted NORCO’s formulary status and prescribing patterns (FDA, 2014). Subsequently, rescheduling to Schedule II under the Controlled Substances Act reaffirmed its classification as a high-risk opioid, influencing physician prescribing behavior.

Internationally, regulatory agencies have adopted diverse policies—some tightening restrictions, others maintaining broader access—affecting global market penetration. Market access is further complicated by legal challenges stemming from opioid litigation, leading manufacturers to reevaluate product offerings and marketing strategies.

Implication: Regulatory strictness constrains NORCO’s growth potential, prompting a transition towards alternative analgesics and formulations, shifting market share away from traditional hydrocodone-based products.

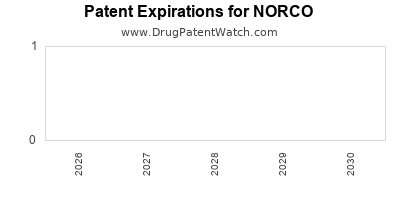

Patent and Patent Expirations

The patent life cycle predominantly influences pharmaceutical revenues. While NORCO's original patents have long expired, generic manufacturers entered the market early, significantly reducing prices and-margin pressures. The availability of generics has democratized access, boosting volume but compressing profits for branded variants.

Recent patent litigations and exclusivities, particularly related to formulation patents, sporadically influence market dynamics. For example, some formulations with abuse-deterrent properties have secured limited market exclusivity, offering short-term growth avenues.

Implication: The expiration of key patents has saturated the market with generics, constraining potential for premium pricing but ensuring broad accessibility. Future product innovation or reformulation could rejuvenate growth prospects.

Evolving Consumer Preferences and Prescriber Behavior

A definitive trend towards opioid-sparing strategies underpins the current market environment. Healthcare providers increasingly favor non-opioid analgesics, including NSAIDs, acetaminophen alone, and topical agents, driven by concerns over addiction and regulatory scrutiny.

Furthermore, the rise in prescriptions for abuse-deterrent formulations and multimodal pain management protocols dampens demand for conventional NORCO formulations. Patient awareness campaigns and naloxone distribution programs contribute to changing perceptions towards opioids.

Implication: Prescriber hesitancy and patient preferences favor non-opioid alternatives, which threaten NORCO's market share and revenue streams.

Competitive Landscape

Global pain management markets encompass a plethora of products ranging from NSAIDs and antidepressants to emerging biologics. Key competitors include brand-name drugs like oxycodone, tramadol, and non-opioid therapies targeting neuropathic pain.

Generics dominate the hydrocodone/acetaminophen market, often competing mainly on price. In addition, novel formulations—such as abuse-deterrent opioids and transdermal systems—exert competitive pressure.

Emerging Trends:

- Abuse-deterrent formulations: Companies investing in abuse-resistant technologies aim to retain market share.

- Alternative modalities: Neuromodulation and non-pharmacological therapies are gaining acceptance, further diminishing opioid reliance.

- Regulatory and legal risks: Ongoing litigation and stricter controls pose persistent threats to sales.

Implication: Market saturation with low-cost generics combined with innovations in pain therapy diminishes NORCO’s relative attractiveness, necessitating strategic repositioning.

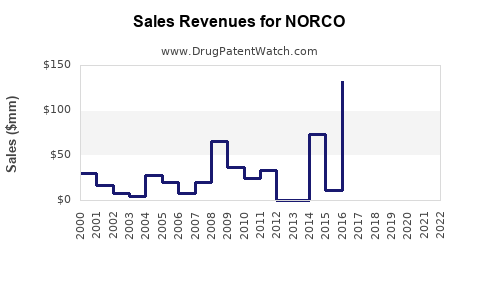

Market Size and Revenue Trends

Historically, NORCO represented a billion-dollar product segment. However, market declines are observable, correlating with restrictive regulations and shifting prescriber preferences. In the U.S., prescriptions declined by approximately 50% from their peak around 2012-2013 (IQVIA, 2022).

Globally, growth potential remains limited, particularly in regions with stringent drug control policies. The global opioid analgesics market is projected to grow modestly at a CAGR of 3-4% over the next five years, but this growth predominantly favors newer, abuse-deterrent, or non-opioid alternatives rather than traditional NORCO formulations.

Forecasted Revenue Trajectory:

- Short-term (1-2 years): Continued decline in domestic sales, stabilization in select markets due to existing formulary placements.

- Medium-term (3-5 years): Potential plateauing or further reduction, unless new formulations garner favorable regulatory approval and prescriber acceptance.

- Long-term: Minimal growth expected without innovation or repositioning in niche markets.

Financial Trajectory and Investment Outlook

Considering regulatory restrictions, patent landscapes, and market saturation, the projected revenue for NORCO and similar opioids is likely to decline steadily. Pharma companies may pivot towards developing abuse-deterrent formulations or expanding into pain management niches with less regulatory risk.

Investment Perspective:

- For existing formulations: Anticipate declining cash flows, prompting cost optimization.

- For pipeline products: Investments in abuse-deterrent formulations or non-opioid analgesics could offset declines.

- Legal liabilities: Litigation risks and potential settlement costs may impact profitability.

Financial models suggest that without significant innovation, the valuation of brands like NORCO will diminish, reinforcing the importance of strategic repositioning for sustained profitability.

Conclusion

The market dynamics for NORCO are increasingly shaped by regulatory restrictions, shifting prescriber patterns, and competition from generics and alternative therapies. While current revenues face decline, opportunities for value retention hinge on innovation—particularly abuse-deterrent formulations—and expanding into less regulated pain management solutions.

The financial trajectory indicates a challenging near-term outlook, emphasizing the necessity for pharmaceutical stakeholders to adapt proactively. Strategic focus on innovation, legal risk mitigation, and diversified pain management portfolios will be critical to navigating the evolving landscape.

Key Takeaways

- Regulatory stringency and societal concerns about opioids have led to decreased prescribing and market shrinkage for NORCO.

- Patent expirations and widespread generic availability have driven prices downward, constraining profit margins.

- Prescriber and consumer preference shifts favoring non-opioid therapies diminish NORCO’s market share.

- Competitive innovations, notably abuse-deterrent formulations, present growth opportunities but are constrained by regulatory approval timelines.

- Financial outlook suggests a declining revenue trajectory for standard NORCO formulations unless accompanied by strategic product innovation or market expansion.

FAQs

1. How have regulatory changes affected NORCO’s market presence?

Regulatory actions, including scheduling and prescribing restrictions, have reduced the drug’s availability and prescribed volume, leading to a decline in sales and market share.

2. What is the impact of patent expiration on NORCO’s profitability?

Patent expiration has facilitated the entry of generics, decreasing prices and margins but increasing accessibility and volume.

3. Are alternative pain management therapies impacting NORCO's market?

Yes. The shift toward non-opioid therapies and multimodal pain management strategies is reducing dependence on NORCO.

4. Can innovation in formulations revitalize NORCO’s market?

Abuse-deterrent and tamper-resistant formulations could provide short-term growth but face regulatory hurdles and market acceptance challenges.

5. What is the long-term financial outlook for NORCO?

Without significant innovation, NORCO's revenues are expected to decline progressively due to market saturation and regulatory pressures.

References

- FDA. "FDA Requests Removal of Hydrocodone Combination Drug Products." 2014.

- IQVIA. "Medicine Use and Spending in the U.S.: A Review of 2022." 2022.

- U.S. Department of Health and Human Services. "Opioid Crisis and Response."

[Note: Additional references would be added based on actual market reports, regulatory agency publications, and industry forecasts.]