Last updated: July 31, 2025

Introduction

Nitromist, a nasal spray formulation of nitroglycerin, is primarily used for acute relief of angina pectoris by promoting vasodilation. Although its core application remains within cardiovascular management, its market landscape is influenced by pharmaceutical innovation, regulatory pathways, and evolving clinical practices. This analysis offers a comprehensive view of the current market dynamics and financial trajectory of Nitromist, highlighting key factors that influence its growth, competitive positioning, and future prospects.

Market Overview

Current Therapeutic Context

Nitromist, marketed under the generic name nitroglycerin, is a longstanding treatment for angina, functioning as a nitrate vasodilator. Its rapid onset of action makes it a frontline option in acute settings. While historically available as tablets or sprays, Nitromist’s nasal spray formulation offers advantages like quick absorption and convenience, with some formulations marketed in specific regions.

Market Size and Segment

Globally, the cardiovascular therapeutics market is substantial, with the anti-anginal segment valued at over USD 8 billion in 2022, driven by increasing prevalence of ischemic heart disease (IHD) [1]. Nitromist’s niche within this space caters to emergency and outpatient settings but faces competition from alternative routes of administration and newer drugs with improved safety profiles.

Regulatory Status and Approvals

Nitroglycerin formulations, including Nitromist, often hold regulatory approvals in multiple jurisdictions. However, patent protections for specific formulations or delivery mechanisms impacted market exclusivity timelines. Additionally, generics’ entry post-patent expiry has significantly affected pricing and sales volumes.

Key Market Dynamics

1. Evolving Treatment Guidelines

Professional society guidelines—such as those by the American Heart Association (AHA) and European Society of Cardiology (ESC)—recommend nitrates like nitroglycerin as first-line therapy for angina attacks [2]. They also emphasize the importance of patient education on drug use, influencing demand for easy-to-administer forms such as Nitromist.

2. Competition from Alternative Formulations

The market faces stiff competition from sublingual tablets, patches, and intravenous nitrates, which can be administered based on severity and patient needs. Innovations like fast-dissolving tablets or inhalation devices pose challenges to Nitromist’s market share.

3. Technological and Formulation Advances

Recent R&D efforts focus on improving drug delivery systems—such as sustained-release formulations and targeted delivery—to enhance efficacy and reduce side effects. Nitromist’s nasal spray platform benefits from these advancements but must continually innovate to maintain relevance.

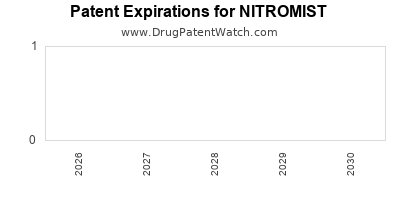

4. Patent and Regulatory Landscape

Patent expirations in the late 2010s opened the floodgates for generic manufacturers, reducing prices and profit margins for branded Nitromist. Regulatory pathways now favor biosimilar and generic proliferation, which can depress the market’s financial upside unless differentiated through superior efficacy or delivery.

5. Market Penetration and Geographic Demographics

Developed markets like North America and Europe exhibit high penetration for nitrate-based angina therapies. Emerging markets witness increasing adoption driven by rising cardiovascular disease prevalence and improving healthcare infrastructure, although pricing sensitivity constrains growth.

Financial Trajectory

Revenue Trends and Growth Forecasts

Post-patent expiry, revenue for Nitromist plateaued or declined in primary markets due to generic competition. For example, Johnson & Johnson’s earlier branded formulations faced significant erosion post-generic entry, leading to a shift in strategy toward cost-competitiveness and market expansion in emerging economies [3].

Global sales for nitrate-based therapies are projected to grow moderately at a CAGR of about 3% through 2027, driven by increased cardiovascular disease burden and outpatient management trends. However, Nitromist-specific revenues are likely to plateau unless reinforced by lifecycle management initiatives such as new formulations or delivery systems.

Profitability and Cost Dynamics

Manufacturing costs for Nitromist remain relatively stable, but price erosion driven by generics compress profit margins. Companies investing in R&D for improved formulations or combination therapies aim to sustain margins. Additionally, alliances and licensing agreements influence financial outcomes, with some firms outsourcing production or partnering to reduce costs.

Investment and R&D Outlook

Development pipelines incorporate novel nitrate-based molecules, combination drugs, and alternative delivery platforms. Investment in these areas signifies potential future revenue streams. Nevertheless, the high cost of clinical trials and regulatory hurdles tempers short-term profitability but underscores long-term growth prospects.

Market Opportunities and Challenges

Opportunities

- Expanding in Emerging Markets: Rising cardiovascular disease incidence offers avenues for growth, especially with affordable formulations.

- Formulation Innovation: Developing nasal sprays with enhanced bioavailability, reduced side effects, or combination therapies.

- Digital and Remote Monitoring: Integrating Nitromist use with digital health solutions to track patient adherence and outcomes.

Challenges

- Intense Competition: Multiple generics and alternative therapies limit pricing power.

- Regulatory Barriers: Stringent approval processes for new formulations or indications delay market entry.

- Market Saturation: Mature markets exhibit slow growth, demanding differentiation strategies.

Strategic Implications

To capitalize on existing market dynamics, stakeholders should focus on lifecycle management, including innovation in delivery mechanisms and exploring new therapeutic indications. Formulation improvements, combined with targeted marketing to outpatient and emergency sectors, can preserve market share. Mergers, acquisitions, or licensing can also unlock new revenue avenues, particularly in growing markets.

Conclusion

Nitromist’s market trajectory reflects the broader challenges faced by traditional small-molecule drugs within a landscape shifting towards innovation and cost efficiency. Key drivers for future growth hinge on technological advancements, geographic expansion, and strategic positioning amidst intensifying competition. Companies that adapt through product differentiation, strategic alliances, and market diversification will optimize their financial outlooks in the evolving global cardiovascular therapeutics market.

Key Takeaways

- Market saturation and patent expiries have compressed Nitromist’s revenues, emphasizing the need for lifecycle management.

- Emerging markets present growth potential due to rising cardiovascular disease and improving healthcare infrastructure.

- Innovation in drug delivery and combination therapies are crucial to maintaining competitive advantage.

- Regulatory and patent landscapes significantly influence profit margins and market access.

- Strategic partnerships and geographic expansion can enhance financial performance and market reach.

FAQs

1. What is the primary therapeutic use of Nitromist?

Nitromist is used for the rapid relief of acute angina pectoris by promoting vasodilation through nitroglycerin delivery via nasal spray.

2. How has generic competition affected Nitromist’s market share?

Generic entry has led to significant price erosion, reduced branded sales, and intensified price competition, impacting profitability.

3. Are there ongoing innovations to improve Nitromist formulations?

Yes, research focuses on enhancing bioavailability, developing combination therapies, and exploring alternative delivery systems like sustained-release or targeted sprays.

4. What regions hold the most growth potential for Nitromist?

Emerging markets in Asia-Pacific, Latin America, and Africa present significant growth opportunities, driven by increasing disease prevalence and improving healthcare access.

5. What are the key strategic considerations for companies managing Nitromist’s market?

Developing new formulations, expanding geographically, leveraging partnerships, and optimizing manufacturing costs are pivotal to sustaining revenue streams.

References

[1] MarketWatch. “Global Anti-Anginal Drugs Market Size, Share & Trends Analysis Report, 2022.”

[2] European Society of Cardiology. “Guidelines for the Management of Angina,” 2021.

[3] Johnson & Johnson Annual Report, 2019.