Last updated: July 29, 2025

Introduction

NASONEX 24HR ALLERGY, a nasal corticosteroid spray containing mometasone furoate, has established itself as a leading treatment option for allergic rhinitis and nasal congestion. Its market presence is shaped by evolving consumer preferences, regulatory environments, competitive dynamics, and healthcare policies. Analyzing these factors provides insights into its current market trajectory and future financial potential.

Product Overview and Market Positioning

NASONEX 24HR ALLERGY is marketed as a once-daily, effective nasal spray tailored for allergy sufferers seeking long-lasting relief. Its efficacy, combined with a favorable safety profile, enables it to penetrate a competitive landscape dominated by both prescription and over-the-counter (OTC) therapies. Its inclusion in treatment guidelines positions it as a preferred option for moderate to severe allergic rhinitis, especially in developed markets.

Market Dynamics

1. Growing Prevalence of Allergic Rhinitis

Global prevalence studies indicate an increase in allergic rhinitis, impacting approximately 10-30% of the worldwide population [1]. Urbanization, environmental pollution, and climate change contribute to rising incidence, expanding the potential patient pool for NASONEX and similar therapies.

2. Consumer Shift Toward Pharmacist-Available OTC Options

Recent regulatory shifts in several markets allow nasal corticosteroids like NASONEX to be available OTC, broadening access. This transition favors over-the-counter availability, especially in developed markets like the United States, leading to increased volume sales but potentially impacting premium pricing strategies.

3. Competition and Market Share

NASONEX faces competition from generics, other nasal steroids (e.g., fluticasone, mometasone), antihistamines, and novel biologics for allergic conditions. While patent exclusivity benefits the product temporarily, patent expirations and the entry of generics are expected to exert downward pressure on prices and margins.

4. Regulatory Landscape

Regulatory agencies, including the FDA, EMA, and counterparts globally, impose strict standards for efficacy, safety, and labeling. Positive regulatory reviews and streamlined approval pathways for biosimilars and generics influence market entry strategies for competitors, affecting NASONEX's financial outlook.

5. Healthcare Policy and Reimbursement Trends

In markets with value-based care initiatives, reimbursement policies increasingly favor cost-effective treatments. NASONEX’s positioning as an effective, cost-efficient treatment supports favorable reimbursement terms, although formulary restrictions could limit accessibility in certain regions.

Financial Trajectory Analysis

1. Revenue Growth Drivers

- Market Expansion: Rising allergy prevalence and increased OTC availability serve as primary drivers.

- Geographic Expansion: Entry into emerging markets with expanding healthcare infrastructure can unlock new revenue streams.

- Product Line Extension: Development of variants, combination formulations, or new delivery systems enhances market penetration and consumer retention.

2. Revenue and Profitability Trends

Historically, NASONEX has experienced consistent growth in markets where it maintains patent protection and positive reimbursement policies. However, imminent patent expirations in key regions could lead to increased generic competition, eroding profit margins. Companies often counteract this through patent extensions, line extensions, or marketing intensification.

3. Cost Structure and Investment

Research and development (R&D) investments, regulatory compliance costs, and marketing expenditures form significant components of associated costs. Operational efficiency and strategic partnerships can mitigate costs, bolstering margins.

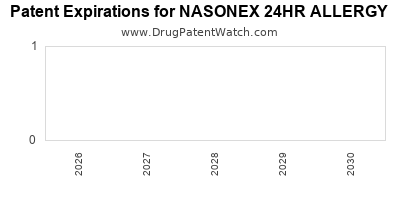

4. Impact of Patent and Pipeline Developments

Patent protections typically last 10-15 years from filing, with extensions possible. A lapse opens the market to biosimilars or generics, which generally erode revenue. Conversely, pipeline innovations, such as improved delivery systems or combination drugs, could sustain sales beyond initial patent expiries.

5. Market Penetration and Pricing Strategies

Maximizing market share involves balancing competitive pricing with brand positioning. Premium pricing in markets with high medical standards preserves margins temporarily but risks substitution as generics become available.

Competitive Landscape and Its Effect on Financial Trajectory

As the patent cliff approaches, NASONEX’s financial trajectory hinges on strategic responses to competition. Acquiring new formulations, patient adherence innovations, or repositioning in emerging markets offer avenues to stabilize revenue streams. Additionally, capturing market share via formulary placements and clinician advocacy remains critical.

Emerging Trends and Future Prospects

1. Digital Health Integration

Adoption of digital health platforms and adherence monitoring can enhance patient outcomes and foster brand loyalty. This approach could foster incremental revenue growth through enhanced engagement.

2. Personalized Medicine and Biomarker Research

Advancements in allergy diagnostics may enable targeted therapy, supporting niche positioning and potentially premium pricing for tailored NASONEX formulations.

3. Consumer Preferences for Natural and Multi-purpose Therapies

A shift toward natural remedies and multi-modal treatments may challenge traditional corticosteroid sprays unless NASONEX offers clear advantages in efficacy and safety.

Conclusion

NASONEX 24HR ALLERGY's market dynamics are characterized by increasing demand, regulatory complexities, and intensifying competition. Financially, its trajectory will be shaped by patent protections, market expansion, and strategic innovation. Companies that adapt through pipeline development, market diversification, and technological integration are positioned to sustain growth.

Key Takeaways

- Rising Allergy Prevalence: Demographic trends favor increased demand for NASONEX, especially in urbanized regions.

- Patent Expiration Risks: Approaching patent cliffs threaten revenue stability; proactive pipeline and formulation strategies are essential.

- Market Expansion Opportunities: Emerging markets present significant upside, contingent on regulatory approval and local healthcare infrastructure development.

- Competitive Dynamics: Generics and biosimilars are primary threats; patent extensions and product innovation are key defenses.

- Integrated Digital Strategies: Leveraging digital health tools can improve patient adherence and foster brand loyalty, supporting long-term revenue.

FAQs

1. What factors influence NASONEX's market share longevity?

Patents, regulatory approvals, market expansion, and innovation in delivery systems determine its market longevity, with patent protection providing a temporary moat until generics enter.

2. How do patent expirations impact NASONEX’s financial performance?

Patent expirations typically lead to increased generic competition, reducing prices and profit margins, necessitating strategic responses like line extensions or new formulations.

3. What emerging markets offer significant growth potential for NASONEX?

Regions such as Asia-Pacific, Latin America, and parts of Africa show promising growth due to rising allergy prevalence and expanding healthcare access.

4. How does regulation affect NASONEX's competitiveness?

Stringent efficacy, safety, and manufacturing standards shape development costs and market access, influencing pricing and reimbursement landscape.

5. What role does digital health play in the future of NASONEX?

Digital health tools can enhance adherence, track outcomes, and foster patient engagement, which are critical for sustaining revenues and competitive positioning.

References

[1] World Allergy Organization. "Allergic Rhinitis." Accessed 2023.

[2] Centers for Disease Control and Prevention. "Prevalence of Allergic Rhinitis." 2022.