Last updated: July 27, 2025

Introduction

Naftin, the brand name for nifurate, is a topical antifungal medication primarily used to treat superficial fungal skin infections, including athlete’s foot, ringworm, and jock itch. Since its market introduction, Naftin has maintained a consistent presence within dermatology and anti-infective portfolios. Analyzing its current market dynamics and financial trajectory necessitates an understanding of its historical performance, competitive landscape, regulatory environment, and emerging trends influencing its future.

Market Overview and Current Position

Naftin holds a moderate but stable share within the dermatological antifungal segment. The global antifungal market is projected to grow at a compound annual growth rate (CAGR) of approximately 4% from 2022 to 2028, driven by rising incidence of fungal infections, expanding dermatological healthcare awareness, and increased prescription rates [1]. Naftin's niche focuses primarily on topical formulations, which constitute a significant segment of the antifungal market due to their favorable safety profile and ease of use.

Segment Performance and Regional Trends

North America and Europe dominate the antifungal topical market, attributed to high healthcare expenditures, rigorous diagnostic protocols, and widespread consumer awareness. Emerging economies, particularly in Asia-Pacific, demonstrate rapid growth fueled by increasing urbanization, changing lifestyles, and expanding pharmaceutical infrastructure.

Naftin's revenues are predominantly derived from these mature markets, with potential headroom in emerging economies. Its performance in these regions remains contingent on regulatory approval, local manufacturing partnerships, and market penetration strategies.

Competitive Landscape

Naftin faces competition from several antifungal agents, both topical and systemic. Key competitors include:

- Clotrimazole and miconazole: Over-the-counter and prescription antifungals with wider availability and lower costs.

- Terbinafine: A systemic and topical antifungal with a broader spectrum and strong efficacy profile.

- Efinaconazole and tavaborole: Newer topical agents with advanced formulations targeting resistant strains.

Despite competitive pressure, Naftin maintains a distinctive position owing to its proven efficacy, tolerability, and brand recognition established over decades.

Differentiators and Market Positioning

Naftin’s differentiators include:

- Proven safety profile with minimal adverse effects.

- Clinical data supporting efficacy in various superficial fungal infections.

- Established physician trust and familiarity.

However, the trend toward OTC availability for certain antifungals and the rising preference for combination therapies challenge Naftin’s exclusivity.

Regulatory Landscape and Patent Considerations

Naftin’s patent expirations vary by jurisdiction but generally occurred several years ago, leading to increased generic competition. This has pressed down prices and margins in several markets. Regulatory bodies like the FDA and EMA continue to oversee manufacturing standards, while regional approvals influence geographic market access.

As patent protections decline, manufacturers often adopt strategies such as formulation improvements or combination products to extend exclusivity, though such interventions are less prevalent for older drugs like Naftin.

Innovation and Future Opportunities

To sustain growth, stakeholders are exploring several avenues:

- Formulation enhancements: Developing novel delivery systems (e.g., liposomal or nanoemulsion formulations) to improve penetration and efficacy.

- Therapeutic expansions: Investigating off-label uses or broader indications, such as resistant fungal infections or dermatophytic conditions.

- Combination therapies: Pairing Naftin with anti-inflammatory agents or other antifungals to enhance outcomes.

- Digital health integration: Leveraging telemedicine for prescription and adherence monitoring.

Investments in research and development (R&D) may bring incremental innovations, but the core product faces intrinsic limitations due to its age and the commoditization trend in topical antifungals.

Market Dynamics Influencing Financial Trajectory

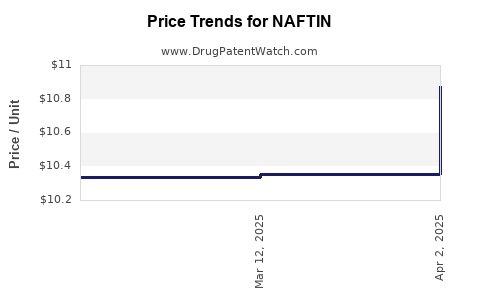

Pricing and Reimbursement

Prices for topical antifungals like Naftin are sensitive to generic entry, insurance coverage policies, and healthcare payer negotiations. With increased generic competition, profit margins have declined, emphasizing the importance of cost management and strategic market positioning.

Demand Drivers

Rising prevalence of fungal skin infections (approximately 20-25% globally) correlates directly with Naftin’s revenue potential. Demographic shifts, particularly aging populations and increased immunosuppression, may further elevate demand, provided the product remains competitive.

Market Penetration and Expansion Strategies

Pharmaceutical companies focus on expanding access in emerging markets through licensing, partnerships, and local manufacturing. Differentiated branding initiatives aimed at clinicians also influence prescribing patterns.

Regulatory and Patent Risks

Patent expirations and regulatory hurdles introduce revenue volatility. Intellectual property protections that previously secured long-term market exclusivity are weakening, requiring ongoing adaptation and innovation.

Impact of Digital and Prescriptive Trends

The modernization of healthcare delivery—through teledermatology and electronic prescriptions—enhances the reach for topical therapies like Naftin. Conversely, the proliferation of OTC options and transfer of some antifungal sales outside prescription channels restrain growth.

Financial Outlook and Earnings Trajectory

The financial trajectory for Naftin hinges on multiple factors:

- Revenue projections suggest plateauing or marginal declines in mature markets due to generic competition.

- Cost optimization and manufacturing efficiencies may mitigate margins erosion.

- Potential expansion in emerging markets can generate incremental revenue streams, though margins may be somewhat thinner.

- R&D expenditures on formulation innovation are small relative to overall sales but could yield moderate long-term benefits.

Overall, Naftin’s financial growth is expected to be modest, aligning with the broader trend of mature dermatological products—that is, slow but resilient performance informed by market penetration management and incremental innovation.

Strategic Considerations for Stakeholders

- Manufacturers should prioritize differentiated formulations or combination therapies to maintain market share.

- Investors and licensees need to monitor patent landscapes and regulatory changes closely to manage revenue risks.

- Market analysts should consider regional growth potential, especially in underserved geographies, to project future revenue streams.

Key Challenges and Opportunities

Challenges:

- Declining patent protections leading to intense price competition.

- Increased OTC availability reducing prescription-driven sales.

- Regulatory barriers in emerging markets delaying growth.

Opportunities:

- Innovating formulations for better efficacy and patient adherence.

- Expanding into new indications with clinical trial support.

- Strengthening presence in emerging regions through strategic partnerships.

Conclusion

Naftin’s market dynamics reveal a product navigating mature phase attributes—marked by competition, price pressures, and patent expirations. Its financial trajectory is anticipated to stabilize with slow growth, contingent upon innovation, regional expansion, and strategic repositioning. Stakeholders who effectively harness these levers may preserve or enhance Naftin’s value amid evolving dermatological therapy landscapes.

Key Takeaways

- Naftin maintains a stable yet competitive position within the topical antifungal market, with growth driven chiefly by regional expansion and incremental innovation.

- Patent expirations and generic entry have pressured margins but also spurred differentiation through formulation improvements.

- Emerging markets offer significant growth potential, contingent on regulatory approval and local manufacturing collaborations.

- Ongoing innovations such as advanced delivery systems and combination therapies are vital strategies for prolonging product lifecycle.

- The shifting landscape toward OTC options and digital health solutions necessitates adaptable marketing and distribution approaches.

FAQs

-

What is the primary use of Naftin?

Naftin (nifurate) is primarily used to treat superficial fungal infections like athlete's foot, ringworm, and jock itch through topical application.

-

How has patent expiration affected Naftin’s market?

Patent expirations have led to increased generic competition, reducing prices and profit margins, and emphasizing the need for product differentiation.

-

Are there significant growth opportunities for Naftin in emerging markets?

Yes. Rising demand for dermatological treatments, improving healthcare infrastructure, and increasing awareness make emerging markets promising for Naftin’s expansion.

-

What strategies can extend Naftin’s market life cycle?

Formulation improvements, exploring new indications, combination therapies, and leveraging digital health tools can help prolong its relevance.

-

What are the main challenges facing Naftin’s future?

Major challenges include generic price competition, OTC market shifts, regulatory barriers, and the need for continual innovation.

References

[1] MarketWatch. "Global Antifungal Market Size, Share & Trends Analysis," 2022–2028.