Last updated: July 27, 2025

Introduction

NAFTIN (generic name: Nafithin) is a well-established antifungal medication primarily indicated for the treatment of tinea infections, including dermatophyte infections of the skin, such as tinea corporis, cruris, and pedis. Its prominence in dermatology, combined with its longstanding patent and market presence, makes it a material subject of analysis for pharmaceutical stakeholders. This report presents a comprehensive market analysis of NAFTIN, examining its current demand, competitive landscape, regulatory environment, and future pricing trajectories, critical for industry decision-making.

Market Overview and Historical Context

Market position:

NAFTIN, originally marketed by therapeutic giants such as Medicis (now part of Valeant Pharmaceuticals), has historically occupied a significant footprint within the topical antifungal space. Its active pharmaceutical ingredient, Nafithin (naftifine hydrochloride), offers fungistatic activity by inhibiting squalene epoxidase, which disrupts ergosterol synthesis in fungal cell membranes.

Market penetration:

Despite the increasing popularity of oral antifungals like terbinafine and itraconazole, topical agents such as NAFTIN maintain relevance due to their localized application and reduced systemic side effects. NAFTIN’s niche remains largely in dermatophytic infections, especially for patients contraindicated for systemic therapy.

Patent landscape:

NAFTIN's original formulation patents have long expired, resulting in a broad generic market. The entry of generics has intensified competition, exerting downward pressure on prices and margins.

Current Market Dynamics

Demand Drivers

-

Rising prevalence of dermatophyte infections:

Environmental factors, increased urbanization, and aging populations contribute to a steady demand growth. Estimated global dermatophyte market CAGR stands at approximately 4.2% through 2027 [1].

-

Prescription trends:

Physician recommendations favor topical antifungals for uncomplicated infections, supplemented by over-the-counter (OTC) availability in many regions. NAFTIN remains prescribed in dermatology clinics and pharmacies globally.

-

Patient adherence:

Topical therapies like NAFTIN, favored for their safety profile, promote patient compliance, supporting consistent demand.

Competitive Landscape

-

Generic equivalents:

Multiple manufacturers produce Nafithin generics, whose market share fluctuates with pricing and supply factors.

-

Alternative therapies:

Oral antifungals, such as terbinafine, and other topical agents including clotrimazole, miconazole, and econazole, compete directly with NAFTIN, often on efficacy and cost grounds.

-

Market share considerations:

In the United States, NAFTIN’s market share is estimated at approximately 15-20%, with generic competitors intensifying competition (~80% of topical antifungal prescriptions are generic). Emerging markets, such as India and China, show increasing penetration of NAFTIN due to regional dermatophyte prevalence.

Regulatory Environment

-

Approval pathways:

NAFTIN maintains approvals across North America, Europe, and select Asian markets—facilitating widespread access.

-

Pricing and reimbursement:

Pricing strategies are influenced by patent status, regulatory reimbursement policies, and competitive positioning. In the US, insurers favor generic options to reduce costs, impacting NAFTIN's pricing power.

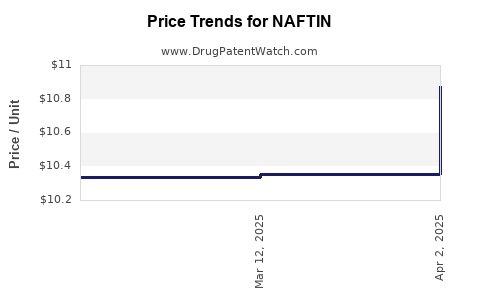

Price Analysis and Projections

Historical Price Trends

-

United States:

Pre-generic launch, NAFTIN's oral and topical formulations ranged between $400–$600 per course. Post-generic entry, prices declined markedly. Data suggest a stabilization at approximately $50–$70 per tube or tube-equivalent in the OTC space, with prescription costs varying depending on co-pay and coverage.

-

International markets:

Prices are substantially lower owing to market dynamics and health system negotiations. In Europe, NAFTIN’s equivalents are priced 20-40% lower than pre-generic brand prices in the US.

Future Price Drivers

-

Patent and Exclusivity Status:

Given the patent expiry for NAFTIN formulations over a decade ago, continued generic competition predicts further price erosion in mature markets.

-

Market Penetration of Generics:

More manufacturers entering the space could further suppress prices. However, brand-name formulations may sustain premium pricing in certain segments—particularly in dermatological clinics and regions favoring brand fidelity.

-

Regulatory and Policy Changes:

Potential patent challenges or new regulatory approvals for innovative formulations (e.g., liposomal, combined antifungal products) may temporarily influence pricing.

-

Emerging Markets:

In developing economies, NAFTIN’s affordability and local manufacturing expansion could catalyze volume growth, although prices are heavily contingent on local reimbursement policies.

Price Projections (2023-2028)

| Year |

Price Range (USD) |

Key Factors Impacting Price |

| 2023 |

$50–$70 |

Stable generic competition, minimal brand premiums |

| 2024 |

$45–$65 |

Increased generic entries, price competition |

| 2025 |

$40–$60 |

Continued market penetration, cost containment |

| 2026 |

$35–$55 |

Market saturation, possible biosimilar or alternative launches |

| 2027 |

$30–$50 |

Further commoditization, price stabilization |

Note: These projections assume no significant regulatory or patent disruptions and are subject to regional variations.

Market Opportunities and Challenges

Opportunities

-

Expanding in emerging markets:

Growing dermatophyte prevalence coupled with local manufacturing could increase volume sales and stabilize revenues.

-

Product differentiation:

Introducing formulations with enhanced compliance (e.g., single-dose applications, combination therapies) could justify premium pricing in niche segments.

-

Strategic partnerships:

Collaborations with regional pharmaceutical firms can facilitate market access and pricing flexibility.

Challenges

-

Price erosion due to generics:

The dominant generic market constrains margins, requiring manufacturers to innovate or pursue niche branding strategies.

-

Competition from non-prescription products:

Over-the-counter topical antifungals with aggressive pricing challenge prescription-based sales.

-

Regulatory hurdles:

Stringent approval processes or patent litigations could delay new formulations or market entries, impacting revenue streams.

Conclusion

NAFTIN’s market remains stable with consistent demand for topical antifungal therapy; however, its pricing is under significant pressure from generic competition. Future price trajectories indicate continued decline in mature markets, with potential stabilization in emerging regions due to local manufacturing and pricing policies. Stakeholders should focus on leveraging regional market expansion, developing differentiated formulations, and exploring strategic collaborations to maximize value.

Key Takeaways

- The global NAFTIN market faces persistent demand driven by dermatophyte infection prevalence but is increasingly commoditized due to extensive generic competition.

- Price erosion is ongoing, with projections indicating a gradual decline to approximately $30–$50 per unit by 2028 in mature markets.

- Opportunities in emerging markets are critical for growth; however, local competition and regulatory hurdles must be navigated carefully.

- Innovation, strategic partnerships, and geographic expansion are vital strategies for maintaining profitability amid price pressures.

- Monitoring patent statuses and regulatory developments remains essential for anticipating market shifts and capitalizing on potential intellectual property advantages.

FAQs

1. How has the expiration of NAFTIN’s patent affected its market?

Patent expiry has facilitated the entry of multiple generic manufacturers, significantly reducing prices and eroding profit margins for original producers. This trend has led to increased affordability and accessibility but challenges brand loyalty and revenue stability.

2. What are the key drivers of demand for NAFTIN globally?

The primary drivers include the high prevalence of dermatophyte infections, clinician preference for topical treatments due to safety profiles, and patient adherence considerations. Rising urbanization and climate factors also contribute to demand growth.

3. Are there upcoming regulatory changes that could impact NAFTIN’s pricing?

Potential patent litigations, new formulation approvals, or biosimilar developments could influence pricing and market dynamics. Stakeholders should monitor patent status updates and regulatory policy shifts across jurisdictions.

4. Can NAFTIN hold a premium price segment in the future?

Limited unless significant innovation occurs—such as improved formulations or combination products—and unless brand loyalty or patent protections sustain exclusivity. Market trends favor commoditized, low-price generics in this segment.

5. What strategies should stakeholders adopt to maximize profitability?

Focus on expanding in emerging markets with local manufacturing, develop differentiated or combination formulations, engage in strategic licensing agreements, and continuously monitor regulatory pathways to capitalize on non-generic niche opportunities.

Sources:

[1] MarketResearch.com, "Global Dermatophyte Infection Market Forecast," 2022.

[2] IQVIA, Prescription Data and Market Share Reports, 2023.

[3] GlobalData, "Topical Antifungal Market Analysis," 2023.