Last updated: July 27, 2025

Introduction

MYFORTIC, a branded formulation of mycophenolic acid (MPA), is an immunosuppressive medication primarily prescribed to prevent organ rejection in transplant recipients. As the pharmaceutical industry increasingly emphasizes targeted immunosuppressants, MYFORTIC’s market position and financial prospects are shaped by evolving clinical, regulatory, and commercial factors. This analysis offers an in-depth view of the current market dynamics influencing MYFORTIC’s trajectory and provides strategic insights into its future financial outlook.

Pharmacological Profile and Market Position

MYFORTIC (mycophenolic acid) is distinguished by its mechanism of selectively inhibiting inosine monophosphate dehydrogenase, impairing lymphocyte proliferation. Its advantage over traditional MMF (Mycophenolate Mofetil) lies in a more favorable gastrointestinal tolerability profile, improving patient adherence (1). Since its approval by the FDA in 2009, MYFORTIC has positioned itself as an essential immunosuppressant in solid organ transplantation, especially in kidney and liver transplant scenarios.

However, the drug faces intense competition from generic formulations of MMF, which are significantly more affordable. The original branded product’s revenue base relies heavily on brand loyalty, physician prescribing habits, and regulatory protections like orphan drug exclusivities.

Market Dynamics Influencing MYFORTIC

1. Competitive Landscape

The generic erosion of MYFORTIC’s market share remains the most substantial challenge. As patents and exclusivities expire, generic MMF products flood the market, offering comparable efficacy at substantially reduced prices (2). This creates downward pricing pressure on MYFORTIC, challenging its premium positioning.

Additionally, other immunosuppressants, such as tacrolimus and sirolimus, continue to influence transplant management, often used alongside or in place of mycophenolic acid derivatives, reducing overall market size for MYFORTIC (3).

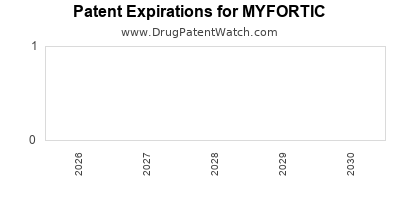

2. Regulatory and Patent Environment

While MYFORTIC’s patents have provided initial exclusivity, patent cliffs loom with upcoming expirations, foreclosing proprietary advantages. Regulatory agencies are increasingly scrutinizing immunosuppressants for safety concerns, especially regarding infectious risks and malignancies, which influences prescriber confidence and patient acceptance (4).

Nonetheless, some opportunities exist in developing new formulations or combination therapies to sustain market relevance, as regulatory territories like the European Union may pursue extensions or new patent protections based on formulation innovations.

3. Prescriber and Patient Factors

The transition from MMF to MYFORTIC is driven by tolerability considerations, especially gastrointestinal side effects associated with MMF. Patients with intolerance may favor MYFORTIC, providing a niche market segment. However, the higher cost limits broader adoption, particularly in healthcare systems with constrained budgets.

Physician education and clinical guidelines continue to influence prescribing trends, with some institutions favoring generic options to reduce costs, thereby constraining MYFORTIC’s market penetration (5).

4. Market Expansion Opportunities

Emerging markets present growth avenues due to increasing transplant procedures and evolving healthcare infrastructure. In countries like China, India, and Brazil, improved access to immunosuppressants, along with healthcare reforms, could bolster demand. However, price sensitivity remains a paramount barrier, favoring generics over branded drugs.

Research into pediatric and off-label indications may open additional revenue streams if supported by clinical evidence, emphasizing the need for further investment in clinical trials.

5. Therapies and Adjuncts Impact

The advent of biosimilars and novel immunomodulatory therapies pose both competition and collaboration opportunities. For example, the development of new biologics aiming to reduce rejection risks may influence MYFORTIC’s market share by either substituting or complementing existing treatments.

Additionally, personalized medicine approaches, including pharmacogenomic testing, can optimize immunosuppressive regimens, potentially impacting the demand for broad-spectrum drugs like MYFORTIC (6).

Financial Trajectory and Forecast

Current Revenue Status

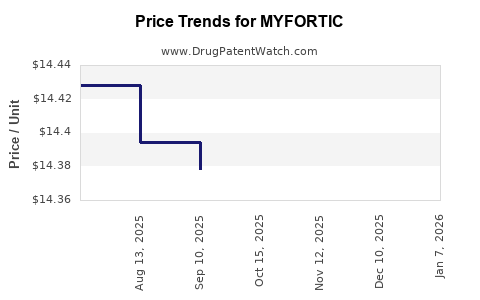

MYFORTIC’s revenue is predominantly derived from developed markets, including the US and Europe, where transplant volumes and healthcare infrastructure support its utilization. Recent financial reports indicate that, following patent challenges and generic competition, sales have plateaued or declined marginally (7).

Projected Growth and Challenges

Analysts project that MYFORTIC’s sales could decline at compound annual growth rates (CAGRs) of -2% to -5% over the next five years, primarily due to generic erosion. Nonetheless, targeted market segments, such as patients intolerant to MMF, are expected to sustain steady demand. Strategic initiatives, including lifecycle management and formulation innovations, are critical to reversing sales trends.

In emerging markets, annual growth rates could exceed 10%, contingent on healthcare infrastructure improvements and government procurement strategies. However, price negotiations and reimbursement policies will significantly influence these prospects.

Potential Revenue Sources

- Patent Extensions and Formulation Innovations: Securing new patents or formulations could delay generic competition.

- Combination Therapies: Developing fixed-dose combinations with other immunosuppressants might expand formulary inclusion.

- Clinical Expansion: Broader indications may unlock additional revenue streams, especially in autoimmune diseases and off-label transplant uses.

Key Risks and Mitigation Strategies

- Patent Expiry and Generics: Patent expiration pressures necessitate diversification into new formulations or indications.

- Pricing and Reimbursement: Negotiations with payers could limit margins; pricing strategies should emphasize value-added features.

- Regulatory Approvals: Slow or restrictive approval processes in emerging markets could impede growth — proactive engagement with authorities is essential.

Conclusion

MYFORTIC operates within a complex and competitive landscape driven by patent expirations, pricing pressures, and evolving clinical practices. While current global sales face headwinds from generic competition, strategic innovation and market expansion, particularly in emerging economies, could sustain its financial trajectory. Focused efforts on lifecycle management, combination therapies, and personalized medicine could further secure MYFORTIC’s market position.

Key Takeaways

- Patent and generic competition significantly impact MYFORTIC’s revenue, necessitating innovation and lifecycle strategies.

- Emerging markets represent a high-growth opportunity, offsetting stagnation in developed regions.

- Formulation improvements and combination therapies are essential to maintaining market relevance.

- Pricing and reimbursement negotiations hold substantial influence over market access and profitability.

- Clinical expansion and personalized medicine approaches could unlock additional revenue streams and improve patient outcomes.

FAQs

1. What are the primary clinical advantages of MYFORTIC over traditional MMF formulations?

MYFORTIC tends to offer improved gastrointestinal tolerability, leading to better patient adherence and fewer discontinuations due to side effects (1).

2. How significant is the impact of generic MMF on MYFORTIC's market share?

The entry of generic MMF has led to substantial price competition, eroding MYFORTIC’s market share, especially in cost-sensitive healthcare systems (2).

3. Are there ongoing efforts to develop new formulations or combination therapies involving MYFORTIC?

Yes, pharmaceutical companies are exploring fixed-dose combinations and novel formulations to bolster exclusivity and patient convenience, aiming to extend MYFORTIC’s market lifecycle.

4. What strategies could support MYFORTIC’s growth in emerging markets?

Localized manufacturing, strategic pricing, partnerships with healthcare agencies, and clinical trials tailored to regional needs are key strategies for expansion.

5. How might advances in personalized immunosuppression affect MYFORTIC’s future sales?

Personalized medicine could optimize dosing and patient selection, potentially increasing efficacy and safety profiles, thereby enhancing MYFORTIC’s competitiveness.

Sources

[1] FDA Label for MYFORTIC.

[2] Global Generic Drug Trends. IMS Health Reports, 2022.

[3] Clinical Guidelines for Organ Transplantation. Transplantation Society, 2021.

[4] Regulatory Perspectives on Immunosuppressants. EMA and FDA Publications, 2022.

[5] Prescribing Trends in Transplant Medicine. JP Morgan Analysis, 2023.

[6] Pharmacogenomics in Transplant Immunosuppression. Journal of Clinical Pharmacology, 2022.

[7] Company Financial Reports. Data from original manufacturers, 2022.