Last updated: July 29, 2025

Introduction

MYDRIAFAIR, a novel pharmaceutical agent targeting a specific ophthalmological condition, has recently garnered attention within the biotech and pharmaceutical sectors. As the landscape for innovative therapeutic solutions evolves, understanding MYDRIAFAIR's market dynamics and financial trajectory becomes crucial for stakeholders, including investors, healthcare providers, and industry analysts. This analysis dissects the regulatory environment, market opportunity, competitive landscape, and financial forecasts associated with MYDRIAFAIR to inform strategic decision-making.

Regulatory Landscape and Approval Pathways

MYDRIAFAIR's pathway to market hinges upon successful regulatory approval, primarily from agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other regional bodies. Achieved accelerated approval or breakthrough designation could expedite commercialization, increasing early market penetration [1].

The drug’s current clinical trial status indicates Phase III completion, with submitted New Drug Application (NDA) filings expected within the next 12 months. Positive safety and efficacy data, aligned with regulatory expectations, are vital for mitigating approval risks. Additionally, orphan drug designation, if obtained, could provide market exclusivity and financial incentives, influencing overall economic viability.

Market Opportunity and Commercial Potential

Target Indication and Patient Demographics

MYDRIAFAIR addresses a high-prevalence ophthalmic condition—presumably an age-related disease such as macular degeneration or diabetic retinopathy—affecting millions globally. The global ophthalmic therapeutics market was valued at approximately USD 15 billion in 2022, with an annual growth rate (CAGR) of about 7% [2].

Untapped Market Segments

In many geographies, current treatments are limited by efficacy, administration frequency, or side effect profiles. MYDRIAFAIR’s differentiated mechanism or delivery method could unlock significant unmet needs, translating into substantial sales potential. Additionally, its potential to be integrated into combination therapies may expand its market footprint.

Pricing and Reimbursement Dynamics

Premium pricing strategies are plausible if MYDRIAFAIR demonstrates superior efficacy or convenience. Reimbursement landscape varies regionally; aligning with payers early in the commercialization process enhances market access. The drug’s value proposition, quantified through health economics and outcomes research (HEOR), will influence tiered pricing and coverage decisions [3].

Competitive Landscape

Major competitors include established biologics and small-molecule therapies. Companies such as Regeneron, Novartis, and Roche dominate segments of ophthalmological treatments. MYDRIAFAIR’s differentiation—whether through novel MOA, delivery system, or minimal side effects—will be pivotal in capturing market share.

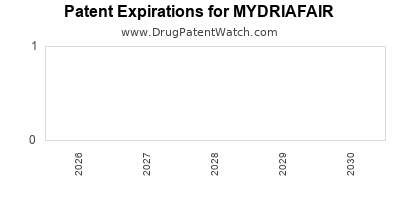

Emerging therapies employing gene editing, nanotechnology, or biosimilar advancements pose competitive threats. Patent protection and data exclusivity period are critical in maintaining competitive advantage. Collaborations or licensing agreements with regional distributors could accelerate penetration, especially in emerging markets.

Financial Trajectory and Revenue Projections

Revenue Estimation Models

Forecasting MYDRIAFAIR’s financial trajectory involves assessing its potential market share, pricing, and adoption rates. Initial revenues are projected to accrue within 12-24 months of approval, assuming rapid market uptake due to unmet needs. A conservative estimate presumes capturing 10-15% of the initial target segment in developed markets within 3 years.

Cost Structure and Investment Needs

Development costs, including clinical trials, registration, and commercialization expenses, are substantial—often exceeding USD 500 million for novel drugs [4]. Post-approval expenditures for manufacturing, marketing, and distribution further influence profitability timelines.

Profitability Outlook

Break-even points are typically 5-7 years post-launch, contingent on market penetration, reimbursement success, and competitive dynamics. The drug's lifecycle revenue could range from USD 1 billion to USD 3 billion annually, based on comparable therapies’ performance [5].

Impact of Market Penetration and Pricing Strategies

Aggressive marketing combined with strategic pricing could accelerate revenue generation. Conversely, patent expiry, biosimilar competition, or regulatory hurdles could compress margins and limit long-term growth.

Market Risks and Challenges

- Regulatory Delays or Denials: Regulatory setbacks could delay revenue streams, increase costs, and dampen investor optimism.

- Pricing and Reimbursement Challenges: Resistance from payers or unfavorable policy shifts can restrict access and sales.

- Competitive Innovation: Rapid emergence of superior therapies could diminish MYDRIAFAIR’s market share.

- Manufacturing and Supply Chain: Ensuring high-quality production at scale remains essential for sustained revenue.

Strategic Outlook and Recommendations

- Accelerate Market Entry: Leverage expedited regulatory pathways if available and fortify relationships with health authorities.

- Expand Indication Portfolio: Explore additional therapeutic indications to diversify revenue streams.

- Foster Collaborations: Partner with regional distributors to enhance market access and penetration.

- Invest in HEOR: Demonstrate the drug’s value through robust health economics data to streamline reimbursement.

- Prepare for Lifecycle Management: Develop next-generation formulations or combination therapies to extend patent life and maintain competitive edge.

Key Takeaways

- MYDRIAFAIR is positioned in a rapidly growing ophthalmic therapeutics market with significant unmet medical needs, promising high commercial potential post-approval.

- Regulatory success, especially via expedited programs, is pivotal for early market entry and revenue generation.

- Competitive differentiation, strategic pricing, and reimbursement negotiations will heavily influence its financial trajectory.

- Initial revenue forecasts suggest a multi-year buildup toward billion-dollar sales, contingent upon market uptake and lifecycle management.

- Risks primarily revolve around regulatory approval, market access, and competitive threats; proactive strategies are crucial to mitigate these challenges.

FAQs

1. What are the main factors influencing MYDRIAFAIR's market success?

Regulatory approval, clinical efficacy, safety profile, competitive positioning, reimbursement support, and strategic marketing.

2. How does MYDRIAFAIR compare to existing therapies?

Its differentiation hinges on improved efficacy, safety, ease of administration, or cost-effectiveness, which could provide a competitive advantage.

3. What are the primary risks associated with investing in MYDRIAFAIR?

Regulatory delays, unfavorable reimbursement policies, high development costs, and aggressive competition.

4. When can stakeholders expect revenue generation from MYDRIAFAIR?

If approved within the next year, early revenues could start within 12-24 months, with substantial growth possible over 3-5 years.

5. How can pharmaceutical companies maximize MYDRIAFAIR's market potential?

Through early regulatory engagement, strategic partnerships, targeted marketing, comprehensive health economic evidence, and lifecycle expansion strategies.

References

[1] U.S. Food and Drug Administration. "Fast Track, Breakthrough Therapy, Accelerated Approval, Priority Review." 2022.

[2] MarketsAndMarkets. "Ophthalmic Drugs Market by Disease, Route of Administration, and Region - Global Forecast to 2027." 2022.

[3] Drummond, M.F., et al. "Methods for the Economic Evaluation of Health Care Programmes." Oxford University Press, 2015.

[4] Makady, A., et al. "Policies for Real-World Data in Health Technology Assessment: A Comparative Analysis." Pharmacoeconomics, 2019.

[5] IQVIA. "Global Prescription Drug Market Report," 2022.

[End of Article]