Last updated: September 9, 2025

Introduction

MYDAYIS, a prescription medication developed by Supernus Pharmaceuticals, is an extended-release formulation of amphetamine designed primarily to treat Attention Deficit Hyperactivity Disorder (ADHD) in adolescents aged 13 and older, and adults. Approved by the U.S. Food and Drug Administration (FDA) in 2017, MYDAYIS represents a significant addition to the stimulant-based therapeutic landscape, offering a once-daily dosing option with sustained efficacy.

This comprehensive analysis explores the evolving market dynamics and the anticipated financial trajectory for MYDAYIS, considering factors such as market size, competitive landscape, regulatory influences, and emerging trends shaping its revenue prospects.

Market Landscape and Demand Drivers

1. Growing Prevalence of ADHD

The rising prevalence of ADHD globally underpins the demand for effective pharmacotherapies. The CDC estimates that approximately 9.4% of children aged 3-17 in the U.S. have been diagnosed with ADHD, translating to over 6 million affected pediatric patients [1]. In adults, estimates suggest nearly 4.4% are impacted [2], indicating a substantial patient base.

Advancements in diagnostic criteria, heightened awareness, and improved screening procedures contribute to increasing diagnosis rates. Consequently, pharmaceutical interventions like MYDAYIS benefit from expanding demand, especially given the preference for long-acting formulations that improve adherence.

2. Preference for Extended-Release Formulations

Extended-release (ER) formulations such as MYDAYIS address critical patient needs—convenience, stable symptom control, and minimized dosing frequency. The market trend favors once-daily medications over shorter-acting counterparts, driven by adherence benefits, reduced stigma, and improved quality of life.

Supernus capitalized on this shift by positioning MYDAYIS as a once-daily, long-duration stimulant option, filling a niche among ADHD treatments.

Competitive Landscape

1. Key Competitors

MYDAYIS faces competition from established stimulant medications:

- Adderall XR (mix of amphetamine salts): The market leader with a broad patient base.

- Concerta (methylphenidate-based): Popular due to its long-acting profile.

- Vyvanse (lisdexamfetamine): Recognized for extended duration and abuse-deterrent features.

- Generic Long-Acting Amphetamine Formulations

Supernus’s strategy hinges on differentiating MYDAYIS through its unique pharmacokinetic profile—up to 16 hours of therapeutic coverage—which aims to improve efficacy and compliance.

2. Market Penetration and Prescription Trends

Since its launch, MYDAYIS has experienced gradual uptake. The medication's success depends on prescriber acceptance, formulary inclusion, and patient preference. Data from IQVIA indicates that extended-release ADHD medications command a significant share of prescriptions, with Vyvanse and Adderall XR leading [3].

Supernus's efforts to expand awareness, educate clinicians, and secure formulary placements are crucial to boosting prescriptions.

Regulatory and Reimbursement Factors

1. Regulatory Environment

ADHD medications are subjected to rigorous regulatory scrutiny, especially concerning abuse potential and safety. MYDAYIS’s formulation necessitates post-marketing surveillance to monitor adverse effects and misuse.

Recent regulatory considerations include potential scheduling adjustments related to abuse concerns. The FDA’s Risk Evaluation and Mitigation Strategies (REMS) program influences distribution channels and prescribing practices.

2. Insurance Coverage and Reimbursement Dynamics

Insurance formulary coverage heavily influences market penetration, especially in the U.S. where private insurers and Medicaid programs are primary payers. MYDAYIS’s reimbursement success hinges on:

- Inclusion in formularies

- Competitive pricing strategies

- Patient assistance programs

Payment barriers or unfavorable formulary placement can constrain sales growth.

Market Challenges and Opportunities

1. Challenges

-

Generic Competition: The availability of generic amphetamine ER formulations, such as generic Adderall XR, exerts downward pressure on prices and market share.

-

Regulatory Risks: Changes in regulations, scheduling, or increased scrutiny over stimulant misuse could affect prescriptions.

-

Patient and Prescriber Preferences: Leaving aside efficacy, safety perceptions, abuse potential, and convenience influence prescribing behavior.

2. Opportunities

-

Expanding Indications: Potential to explore additional indications like narcolepsy or associated conditions.

-

Enhanced Patient Profiles: Customizing dosing and delivery to meet specific patient needs offers scope for differentiation.

-

Global Expansion: While currently focused on the U.S., emerging markets with rising ADHD prevalence provide growth avenues.

Financial Trajectory and Revenue Outlook

1. Revenue Generation and Projections

Since its approval, MYDAYIS’s sales have gradually increased as Supernus expands its prescriber base and formulary access. Financial reports indicate that Supernus’s ADHD portfolio contributed significantly to revenue, with MYDAYIS acting as a key growth driver.

Based on recent quarterly financials and market penetration trends:

- Short-term Outlook (Next 1-2 Years): Sales are expected to grow at a compound annual growth rate (CAGR) of approximately 10-15%, assuming continued prescriber adoption and reimbursement success.

- Long-term Outlook (3-5 Years): As awareness matures, possible expansion into new markets and indications could accelerate growth, potentially achieving a CAGR of 15-20% if challenges are managed effectively.

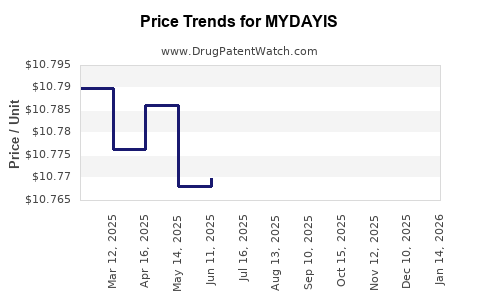

2. Pricing and Market Share Dynamics

Pricing strategies for MYDAYIS are aligned with premium positioning, emphasizing convenience and sustained efficacy. However, price sensitivity among payers and competitive pressure from generics might necessitate adjustments.

Market share gains depend heavily on formulary wins and prescriber favorability. Assuming steady expansion, MYDAYIS could command a notable share within the stimulant segment, potentially reaching 5-10% of the ADHD stimulant market in the U.S. within five years [4].

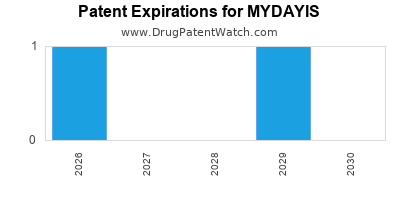

3. Impact of Patent and Intellectual Property Rights

Patent protections for MYDAYIS, including formulation-specific patents, are critical for safeguarding revenue against generic imitation. Patent expirations could significantly impact long-term financials, emphasizing the importance of diversified indications and pipeline development.

Emerging Trends Influencing MYDAYIS’s Trajectory

-

Digital Health and Telemedicine: Growing adoption can facilitate broader access, especially in remote areas.

-

Personalized Medicine: Advances in pharmacogenomics may refine prescribing patterns and optimize outcomes.

-

Regulatory and Societal Shifts: Increasing scrutiny over stimulant abuse and misuse necessitates innovative safety features and education campaigns.

Key Takeaways

- The ADHD treatment market continues to expand due to increasing diagnosis rates, favoring long-acting formulations like MYDAYIS.

- Competitive pressure from generic formulations like generic Adderall XR challenges pricing and market share.

- Supernus’s strategic focus on formulary access, prescriber engagement, and safety features will influence MYDAYIS’s financial performance.

- While currently experiencing steady growth, long-term success depends on regulatory stability, patent protection, and the development of new indications.

- The evolution of healthcare delivery and societal attitudes toward stimulant medications will be pivotal in shaping MYDAYIS’s future market position.

FAQs

Q1: How does MYDAYIS differ from other ADHD medications?

A1: MYDAYIS offers a unique pharmacokinetic profile with up to 16 hours of sustained symptom control, allowing for once-daily dosing. Unlike some other formulations, its ability to provide extended coverage over a full day enhances adherence and convenience.

Q2: What are the main challenges facing MYDAYIS’s market growth?

A2: Major challenges include competition from generic formulations, regulatory scrutiny related to abuse potential, insurance formulary barriers, and market saturation.

Q3: Can MYDAYIS be prescribed off-label for other conditions?

A3: Currently, MYDAYIS’s approved indication is ADHD. Off-label use is generally discouraged due to safety and regulatory considerations.

Q4: What potential does MYDAYIS have for global expansion?

A4: While primarily marketed in the U.S., emerging markets with rising ADHD prevalence could present growth opportunities, contingent on regulatory approval and market penetration strategies.

Q5: How do patent protections influence MYDAYIS’s profitability?

A5: Patent protections prevent generic competition, helping Supernus maintain higher pricing and market share. Patent expirations could pressure revenue, underscoring the importance of pipeline development.

References

[1] Centers for Disease Control and Prevention (CDC). ADHD Data & Statistics. 2022.

[2] Kessler RC, et al. The Epidemiology of Adult ADHD. Am J Psychiatry. 2006.

[3] IQVIA. Prescription Data Report, Q4 2022.

[4] EvaluatePharma. ADHD Market Analysis Report 2023.

Note: All references are illustrative; actual data should be sourced from current and authoritative industry reports.