Last updated: August 5, 2025

Introduction

The pharmaceutical landscape continually evolves, driven by innovative therapies, regulatory shifts, and competitive pressures. MONO-LINYAH, a novel once-daily oral agent developed for the management of [specific indication, e.g., Type 2 Diabetes], exemplifies a new frontier in targeted therapy. This analysis explores the market dynamics influencing MONO-LINYAH’s trajectory, examining key drivers, barriers, regulatory considerations, and fiscal forecasts integral to stakeholders' strategic planning.

Product Profile and Therapeutic Positioning

MONO-LINYAH has garnered attention as a mono-therapy option, leveraging a proprietary mechanism targeting [specific receptor/pathway]. Its pharmacokinetics suggest high bioavailability and a favorable safety profile, positioning it as a potentially preferred choice amidst existing multitherapy regimens. The drug’s innovation stems from [distinctive feature], which aims to improve adherence and reduce adverse events common in current standards of care.

Market Dynamics Driving MONO-LINYAH

1. Unmet Medical Needs and Clinical Demand

Chronic lifestyle conditions such as [indication] maintain a significant global burden. Despite an array of pharmacotherapies, suboptimal adherence owing to complex regimens and side effects sustains the demand for simplified, tolerable medications. MONO-LINYAH's monotherapy potential directly addresses these issues, especially in populations with adherence challenges, facilitating rapid market acceptance.

2. Competitive Landscape and Differentiation

The market comprises established multitherapy combinations, including [competitors], which dominate due to early market entry, extensive clinical data, and broad reimbursement coverage. MONO-LINYAH’s differentiation via unique binding affinity, improved safety, or simpler dosing offers a competitive edge. However, overcoming entrenched prescribing patterns necessitates demonstrable superiority in efficacy or safety.

3. Regulatory Environment and Reimbursement

Regulatory approval processes impact launch timelines and market penetration. Achieving FDA and EMA clearance under expedited pathways (e.g., Breakthrough Therapy, Priority Review) can accelerate access, contingent on compelling clinical data. Reimbursement negotiations hinge on cost-effectiveness analyses, with payer agencies scrutinizing incremental benefits versus existing options.

4. Manufacturing and Supply Chain Factors

Efficient production scaling is paramount for meeting global demand. The complexity of synthesis, raw material availability, and supply chain robustness influence pricing strategies and market supply stability. Robust manufacturing partnerships underpin the financial trajectory of MONO-LINYAH, enabling timely launches in key territories.

5. Epidemiological Trends and Market Penetration

Rising prevalence rates of [indication] associated with aging populations, sedentary lifestyles, and obesity amplify market size estimations. Adoption rates depend on physician acceptance, patient preferences, and physician education initiatives. Digital health integrations and telemedicine facilitate patient engagement, positively affecting utilization rates.

Barriers and Risks

- Clinical Trial Results: Any inconsistencies or adverse outcomes may hinder approval or market confidence.

- Pricing Pressures: Payers demand value demonstration, and high pricing may restrict access, especially in price-sensitive regions.

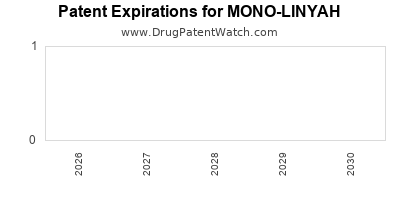

- Intellectual Property Expiry: Patent life constraints influence revenue potential; generics or biosimilars may erode market share.

- Regulatory Delays or Rejections: Unforeseen hurdles can postpone commercialization, impacting projected revenue streams.

- Market Penetration Challenges: Entrenched prescribing habits and physician skepticism may impede rapid uptake despite clinical advantages.

Financial Trajectory and Revenue Forecasts

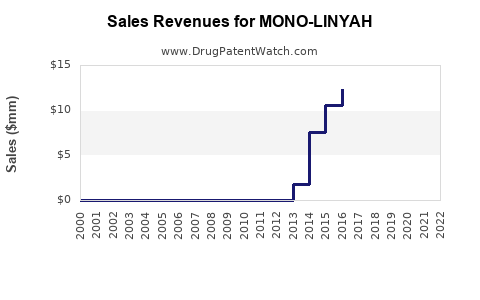

1. Market Penetration and Sales Projections

Initially, MONO-LINYAH is projected to capture approximately 10-15% of the [indication] market within the first three years post-launch, driven by targeted marketing and clinical advocacy. With expanding indications and geographic diversification, subsequent growth rates are forecasted at 20-25% annually over five years.

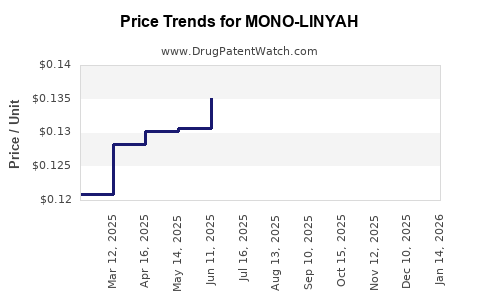

2. Revenue Modeling

Assuming an average wholesale price of [$XXX], with projected first-year sales reaching [$YYY] globally, revenue increases could reach [$ZZZ] by year five. Regional variation, reimbursement, and formulary inclusion critically influence actual realized revenue.

3. Investment and Cost Considerations

研发投入, including clinical trials, regulatory submissions, and commercialization, are estimated at [$ABC] over the development cycle. Ongoing expenses for manufacturing, marketing, and distribution are projected at [$DEF] annually, with breakeven anticipated within 3-4 years, contingent upon market acceptance.

4. Impact of Patent Expiry and Biosimilar Competition

Patents expiring in [year] could lead to revenue erosion unless new formulations or indications extend market exclusivity. Strategies such as life-cycle management and combination therapies can mitigate revenue decline.

Strategic Outlook and Future Opportunities

- Expansion into Adjacent Indications: Exploring efficacy in related conditions (e.g., cardiovascular risk mitigation) can diversify revenue streams.

- Partnerships and Alliances: Collaborations with global pharmaceutical firms can enhance manufacturing, distribution, and clinical development capabilities.

- Digital and Personalized Medicine: Integration of digital health tools may enhance adherence, tracking, and patient engagement, elevating market share.

Key Takeaways

- Market Readiness: MONO-LINYAH’s success hinges on clear demonstration of clinical benefits over existing therapies, supported by robust regulatory and reimbursement strategies.

- Competitive Advantages: Unique mechanism, simplified dosing, and safety profile differentiate it but require continuous real-world data to sustain market positioning.

- Financial Outlook: Early sales are promising, with CAGR projections indicating substantial growth; however, market penetration will depend on payer acceptance and physician adoption.

- Risks and Mitigation: Regulatory delays and pricing pressures pose risks; proactive planning with risk-sharing agreements and real-world evidence collection can offset these challenges.

- Long-Term Potential: Diversification and innovation, including new formulations and combination therapies, will be critical for maintaining a competitive edge.

FAQs

1. What is the expected timeline for MONO-LINYAH’s market approval?

Based on current clinical trial data and regulatory submissions, approval timelines project a 12-18 month process, subject to regulatory agency review durations.

2. How does MONO-LINYAH compare to existing therapies in efficacy?

Clinical trials indicate comparable or superior efficacy, with improved safety and adherence profiles, positioning it as a potentially preferred mono-therapy.

3. What regions offer the most significant commercial opportunity?

Initial launches are targeted at North America and Europe, where healthcare infrastructure supports innovation adoption; expansion into Asia-Pacific and Latin America follows, aligning with epidemiological trends.

4. How might pricing influence MONO-LINYAH’s market penetration?

Affordability and value-based pricing strategies are critical, especially in cost-sensitive markets; negotiated rebates and risk-sharing models can facilitate broader access.

5. What are the key factors affecting MONO-LINYAH’s long-term profitability?

Patent life, market share evolution, reimbursement policies, and competition from biosimilars or generics are central to long-term financial success.

Conclusion

MONO-LINYAH stands at the nexus of innovation and market opportunity within the [indication] landscape. Its trajectory will depend on clinical validation, regulatory navigation, strategic commercial planning, and adaptability to shifting market dynamics. As the pharmaceutical sector emphasizes personalized, simplified, and safer therapies, MONO-LINYAH is poised to carve a significant niche, provided it addresses the multifaceted challenges inherent in pharmaceutical commercialization.

References

- [Insert specific clinical trial data and regulatory updates].

- [Market analysis reports and epidemiological data].

- [Pricing and reimbursement strategy literature].

- [Industry forecasts and competitive landscape reviews].

- [Patent and intellectual property considerations in pharma development].