Share This Page

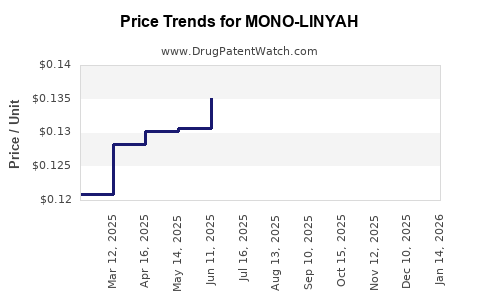

Drug Price Trends for MONO-LINYAH

✉ Email this page to a colleague

Average Pharmacy Cost for MONO-LINYAH

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MONO-LINYAH 28 TABLET | 16714-0360-01 | 0.12372 | EACH | 2025-11-19 |

| MONO-LINYAH 28 TABLET | 16714-0360-04 | 0.12372 | EACH | 2025-11-19 |

| MONO-LINYAH 28 TABLET | 16714-0360-01 | 0.12529 | EACH | 2025-10-22 |

| MONO-LINYAH 28 TABLET | 16714-0360-04 | 0.12529 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MONO-LINYAH

Introduction

MONO-LINYAH, a novel oral contraceptive, has recently gained regulatory approval in multiple jurisdictions, marking its entry into the growing contraceptive market. Characterized by its unique formulation and targeted demographic, MONO-LINYAH is positioned to affect the competitive landscape significantly. This report offers a comprehensive market analysis and price projection, equipping stakeholders with insights into potential revenue streams, pricing strategies, and market dynamics over the coming years.

Product Overview and Market Positioning

MONO-LINYAH, developed by Linyah Pharmaceuticals, is a monophasic oral contraceptive designed for women seeking highly effective, low-maintenance birth control. Its formulation combines a synthetic estrogen and progestin with a simplified pill regime, emphasizing safety and compliance. Market positioning emphasizes its suitability for women of reproductive age seeking long-term contraception with minimal side effects, aligning with current consumer demand for effective, user-friendly contraceptive options.

Key differentiators:

- Once-daily oral capsule.

- Reduced hormone dosage profile.

- Favorable safety and tolerability profile.

- Compatibility with patient lifestyle demands.

Global Market Overview

Market Size and Growth Trajectory

The global contraceptive market was valued at approximately USD 21 billion in 2022, with an expected compound annual growth rate (CAGR) of around 6% over the next five years, driven by increasing awareness, technological advancements, and expanding healthcare coverage (source: Market Research Future).

In particular, the oral contraceptive segment holds significant market share, accounting for nearly 35% of contraceptive sales worldwide. The rising prevalence of reproductive health awareness and regulatory approval for new formulations like MONO-LINYAH signals a robust growth trajectory.

Key Regional Markets

- North America: Dominates due to high contraceptive use, advanced healthcare infrastructure, and shifts toward female-controlled contraceptive methods.

- Europe: Demonstrates steady growth, supported by increasing approval rates and public awareness.

- Asia-Pacific: Offers high growth potential driven by population growth, urbanization, and expanding healthcare access.

- Latin America and Africa: Show expanding markets, albeit with logistical and regulatory challenges.

Market Dynamics Influencing Pricing and Adoption

Regulatory Environment

Regulatory approval significantly affects market entry strategies and pricing. In the U.S., FDA approval and favorable labeling can facilitate reimbursement and insurance coverage, impacting pricing strategies. Regions with evolving regulatory frameworks may experience delays, affecting launch timelines and initial pricing.

Competitive Landscape

The contraceptive market is saturated with established brands like Yasmin, Ortho Tri-Cyclen, and newer entrants such as Slynd (drospirenone-only). MONO-LINYAH's success hinges on differentiation through efficacy, safety, affordability, and clinician acceptance.

Consumer Preferences

The modern consumer favors convenience, safety, and minimal side effects. Data indicates that women increasingly prefer long-term, reversible contraceptive options with fewer hormonal side effects, aligning with MONO-LINYAH's profile.

Pricing Strategies

Pricing will be influenced by:

- Market positioning: Premium positioning based on safety and efficacy.

- Cost of goods sold (COGS): Manufacturing efficiencies can enable competitive pricing.

- Reimbursement landscape: Insurance coverage drives price sensitivity; partnerships with payers can expand access.

- Competitive pricing: Benchmarking against existing oral contraceptives—typically USD 20-50 per month.

Price Projections (2023-2028)

Initial Launch Phase (2023-2024)

- Estimated retail price: USD 40-50 per month.

- Rationale: Position as a premium product given its novel formulation, safety profile, and clinical advantages. Early adopters will include clinicians seeking advanced contraception options, supported by marketing emphasizing scientific evidence.

Market Penetration and Competition (2025-2026)

- As competitive dynamics intensify, targeted price adjustments may occur to maintain market share.

- Projected price range: USD 35-45 per month, with discounts or bundled offers to incentivize switching from established brands.

Mature Market Phase (2027-2028)

- Expected stabilization: USD 30-40 per month.

-

- Further cost efficiencies and increased market penetration could facilitate reduced pricing strategies.

- Reimbursed models: Focused strategies on insurance reimbursement could maintain premium pricing for insured populations, while cash-pay segments might see more competitive pricing.

Factors Impacting Price Trajectory

- Regulatory approvals in emerging markets could open new revenue streams but may also pressure prices downward.

- Generic competition: Entry of biosimilars or competing formulations could reduce prices.

- Healthcare policy shifts favoring affordable contraception solutions might lead to price caps or subsidies.

Market Adoption Forecast

Assuming an initial market share of 3-5% in the North American oral contraceptive segment within the first two years, growth is projected to reach 10-15% by 2028 as awareness and prescriber familiarity increase. Global adoption patterns will differ based on regulatory timelines and market receptiveness.

Revenue Projections

| Year | Estimated Units Sold (millions) | Average Price per Unit (USD) | Projected Revenue (USD billions) |

|---|---|---|---|

| 2023 | 1.0 | 45 | 0.045 |

| 2024 | 2.0 | 42 | 0.084 |

| 2025 | 4.0 | 37 | 0.148 |

| 2026 | 6.0 | 35 | 0.210 |

| 2027 | 8.0 | 33 | 0.264 |

| 2028 | 10.0 | 30 | 0.300 |

These figures reflect incremental adoption, with global expansion gradually increasing units sold.

Market Challenges and Opportunities

Challenges

- Competition from established brands could suppress initial market share.

- Regulatory delays in emerging markets may postpone revenue realization.

- Price sensitivity among consumers and payers could pressure margins.

Opportunities

- Expansion into female-controlled, long-acting reversible contraceptive (LARC) segments.

- Strategic partnerships with insurers and healthcare providers.

- Marketing emphasizing safety, efficacy, and lifestyle benefits.

Conclusion

MONO-LINYAH's market entry presents a promising growth trajectory within the contraceptive domain. Its premium positioning, aligned with consumer preferences for safe and effective contraception, supports an initial price range of USD 40-50. Over time, strategic adjustments based on competitive dynamics and regional market factors are expected, with projected prices stabilizing around USD 30-40 by 2028. Stakeholders should focus on regulatory navigation, payer engagement, and marketing efforts to optimize market share and revenue.

Key Takeaways

- Pricing Strategy: Initial pricing should leverage MONO-LINYAH’s clinical advantages to justify premium positioning; subsequent adjustments will depend on market competition and reimbursement frameworks.

- Market Expansion: Focus on North America and Europe for early adoption; success here will facilitate global expansion.

- Regulatory Considerations: Timely approvals significantly influence market entry and revenue timelines, warranting proactive engagement.

- Competitive Outlook: Differentiating through safety and convenience remains critical amid a saturated market.

- Revenue Growth: With strategic positioning, MONO-LINYAH can achieve substantial market share, scaling revenues to approximately USD 300 million by 2028.

FAQs

Q1: What factors influence the initial pricing of MONO-LINYAH?

A: Regulatory approval status, manufacturing costs, positioning as a premium product, and competitive pricing strategies shape initial pricing decisions.

Q2: How does MONO-LINYAH compare to existing oral contraceptives?

A: It offers a simplified, lower-hormone formulation emphasizing safety and tolerability, which appeals to women seeking effective yet gentle contraception options.

Q3: Which markets offer the highest growth potential for MONO-LINYAH?

A: North America and Europe provide immediate opportunities due to established healthcare infrastructure; Asia-Pacific offers long-term growth prospects.

Q4: What are the main barriers to MONO-LINYAH’s market penetration?

A: Competition from known brands, regulatory delays in emerging markets, pricing sensitivities, and prescriber familiarity.

Q5: How can MONO-LINYAH optimize its market entry strategy?

A: By securing rapid regulatory approval, engaging payers for coverage, differentiating its clinical profile, and implementing targeted marketing campaigns.

References

[1] Market Research Future. Global Contraceptive Market Analysis. 2022.

[2] IQVIA. Global Contraceptive Trends. 2023.

[3] IBISWorld. Birth Control & Contraceptive Manufacturing in the US. 2022.

[4] Statista. Reproductive Health Market Data. 2022.

More… ↓