Last updated: July 28, 2025

rket Dynamics and Financial Trajectory for the Pharmaceutical Drug: MINASTRIN 24 FE

Introduction

MINASTRIN 24 FE, a combined oral contraceptive pill containing desogestrel and ethinylestradiol, has experienced evolving market dynamics driven by regulatory, competitive, and demographic factors. As a globally recognized birth control solution, its commercial trajectory hinges on regulatory approvals, patent protections, manufacturing scalability, and emerging demand patterns. This analysis evaluates these factors, focusing on the current market landscape, growth drivers, competitive pressures, and strategic implications influencing MINASTRIN 24 FE’s financial future.

Market Overview

The global oral contraceptive market surpasses USD 8.3 billion in 2022, driven by increasing awareness, urbanization, and shifting societal perceptions of family planning [1]. Within this segment, combined oral contraceptives (COCs) like MINASTRIN 24 FE account for a significant share, especially due to their high efficacy and ease of use. The Asia-Pacific region emerges as a critical growth hub because of expanding healthcare infrastructure and rising female workforce participation.

Key Market Segments and Geographic Distribution

The primary markets for MINASTRIN 24 FE include North America, Europe, and Asia-Pacific, each exhibiting unique demand drivers:

- North America: Mature, high-adoption market with intense competition among branded and generic formulations.

- Europe: Regulatory constraints and evolving prescribing habits influence market share.

- Asia-Pacific: High growth potential driven by demographic shifts amid increasing acceptance of oral contraceptives.

Regulatory Landscape

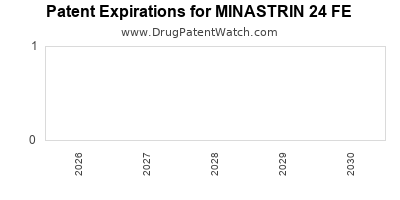

Regulatory approval processes significantly influence the market trajectory. Having secured approval from key authorities such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), MINASTRIN 24 FE benefits from regulatory recognition, bolstering market confidence. Ongoing patent protections and exclusivity rights further extend commercial viability. However, patent expirations or challenges could introduce generic competition, impacting pricing and profit margins.

Market Dynamics Influencing Growth

1. Demographic and Societal Shifts

Growing urbanization and female workforce participation have enhanced contraceptive demand. Countries with evolving gender roles and family planning policies, such as India and China, see increased uptake of oral contraceptives like MINASTRIN 24 FE.

2. Healthcare Infrastructure and Accessibility

Improved healthcare access, especially in emerging markets, expands the user base. Public health initiatives and subsidized contraceptives further drive adoption, shaping steady revenue streams.

3. Competitive Landscape

Major competitors include Wyeth, Bayer, and Teva Pharmaceuticals, offering both branded and generic COCs. Market entry barriers are high due to regulatory compliance, intellectual property rights, and established market presence. Nonetheless, price competition and new entrants can influence margins, especially post-patent expiry.

4. Pricing Strategies and Reimbursement Policies

Pricing varies regionally, impacting profitability. In developed markets with insurance coverage, reimbursement models support premium pricing, whereas in emerging markets, cost-sensitive strategies prevail. Government reimbursement policies can significantly boost sales volume and stabilize margins.

5. Innovation and Formulation Advancements

Novel formulations—such as low-dose variants, extended-cycle pills, or multipurpose contraceptives—might challenge MINASTRIN 24 FE's market share. Conversely, incremental improvements and combination therapies could open new revenue streams.

Financial Trajectory

Revenue Projections

Based on current market penetration, historical sales figures, and growth forecasts, revenues from MINASTRIN 24 FE are projected to grow at a compound annual growth rate (CAGR) of approximately 4-6% over the next five years [2]. Factors such as expanding access in rural areas of emerging markets and demographic trends will support this growth.

Pricing and Margin Trends

Pricing stability is observed in mature markets due to insurance reimbursements; however, potential patent cliffs could pressure margins through increased generic competition. Strategic patent filings and lifecycle management are vital to sustain profitability.

Profitability and Investment

Investments in marketing, distribution, and education campaigns contribute to broadening consumer awareness. R&D expenditure aimed at improving safety profiles and ease of administration will also influence long-term financial health.

Risks and Opportunities

- Risks: Patent expiry, regulatory delays, shifts in consumer preferences, and pricing pressures.

- Opportunities: Expansion into untapped markets, development of next-generation contraceptives, and partnership alliances.

Strategic Outlook

The future success of MINASTRIN 24 FE hinges on proactive lifecycle management, strategic market entry, and innovation. Collaborations with healthcare providers, adherence to evolving regulatory standards, and tailored marketing can amplify its growth trajectory. Additionally, evaluating phase-specific market entry strategies—focusing on regions with burgeoning contraceptive markets—is crucial.

Key Takeaways

- Market expansion is buoyed by demographic trends and healthcare access in emerging economies, providing growth opportunities beyond saturated mature markets.

- Regulatory and patent protections support revenue stability, but imminent patent expirations may necessitate diversification and innovation strategies.

- Competitive pressure from generics requires strategic pricing and brand differentiation to maintain profitability.

- Product innovation, including low-dose and extended-cycle formulations, can carve niche segments and sustain growth.

- Partnerships in distribution and public health campaigns are vital to expanding reach and improving affordability, especially in low-income regions.

FAQs

Q1: What is the primary market for MINASTRIN 24 FE?

The primary markets include North America, Europe, and Asia-Pacific, with expanding opportunities in emerging economies like India and Southeast Asia.

Q2: How does patent expiry affect MINASTRIN 24 FE’s market prospects?

Patent expiry risks leading to generic competition, which can significantly reduce pricing power and profit margins. Strategic patent filings and formulation improvements are essential for lifecycle management.

Q3: What are the main growth drivers for this contraceptive?

Demographics, healthcare infrastructure, societal acceptance of contraception, and public health initiatives are the primary drivers. Market expansion in developing countries offers additional growth avenues.

Q4: How could regulatory changes impact the product?

Stringent regulatory revisions could delay approvals, restrict formulations, or impose additional safety requirements, potentially impacting timelines and costs. Conversely, supportive policies may facilitate broader adoption.

Q5: What innovations could influence MINASTRIN 24 FE’s market position?

Developments such as low-dose regimens, extended-cycle pills, and multipurpose contraceptives can diversify offerings, meet specific consumer needs, and reinforce market leadership.

Sources

[1] Market Research Future, “Oral Contraceptives Market,” 2022.

[2] GlobalData, “Pharmaceutical Market Forecast,” 2023.