Last updated: July 29, 2025

Introduction

Miglitol, marketed primarily under the brand name Glyset among others, is an alpha-glucosidase inhibitor used to manage type 2 diabetes mellitus (T2DM). Approved by regulatory agencies such as the FDA in 1997, Miglitol functions by delaying carbohydrate absorption, thereby reducing post-prandial blood glucose spikes. The drug’s market landscape is shaped by evolving diabetes management protocols, competitive positioning among antidiabetic agents, and regional healthcare policies. This article presents an in-depth analysis of Miglitol’s market dynamics and its financial trajectory within the global pharmaceutical industry.

Market Overview and Demand Drivers

The global prevalence of T2DM continues to rise, driven by sedentary lifestyles, obesity, aging populations, and urbanization. The International Diabetes Federation estimates approximately 537 million adults worldwide had diabetes in 2021, with projections exceeding 700 million by 2045 [1]. Such growth fosters sustained demand for antidiabetic therapeutics, including Miglitol.

Key Drivers:

- Increasing Global Diabetes Burden: The expanding patient population creates a sizeable and expanding market for oral antidiabetics, with Miglitol positioned as an adjunct therapy.

- Preference for Oral Medications: Patients and physicians favor oral gluco-regulators over injectables, bolstering demand for drugs like Miglitol.

- Post-prandial Hyperglycemia Management: As treatment guidelines emphasize controlling post-meal glucose surges, Miglitol’s mechanism aligns with contemporary standards.

- Cost-effectiveness: Compared to newer, more expensive agents like SGLT2 inhibitors and GLP-1 receptor agonists, Miglitol’s development and manufacturing costs position it as an affordable alternative, especially in emerging markets.

Regional Market Dynamics

North America

The North American market, dominated by the US, is mature with high adoption rates of newer antidiabetics. Despite the presence of innovative drugs, Miglitol maintains niche relevance among patients with contraindications to injectables or in cost-sensitive segments. However, patent expirations and generic competition have somewhat dampened revenue growth. The market is characterized by:

- High prevalence of T2DM (approx. 37.3 million Americans, or 11.3% of the population), supporting sustained demand.

- Evolving treatment guidelines promoting combination therapies, often reducing monotherapy with agents like Miglitol.

- Generic competition entering the market post-patent expiry, pressuring prices and overall revenue streams.

Europe

European countries follow strict regulatory pathways, with some withdrawing older drugs like Miglitol due to safety concerns and limited market penetration of alpha-glucosidase inhibitors compared to DPP-4 inhibitors. Nonetheless, significant demand persists in specific segments, particularly in countries with robust healthcare systems and emphasis on cost-effective care.

Asia-Pacific

This region represents the most promising growth corridor. Countries such as China, India, and Southeast Asian nations witness burgeoning diabetes prevalence. The affordability and efficacy of Miglitol in managing post-prandial hyperglycemia favor its utilization, especially where newer, high-cost therapies are less accessible. Local manufacturing often mitigates import costs, boosting sales volumes.

Emerging Markets

Emerging markets are characterized by:

- Cost sensitivity, favoring generic and older drugs.

- Growing awareness and diagnosis, fueling drug utilization.

- Limited access to newer agents, positioning Miglitol favorably as an affordable therapy.

Competitive Landscape

The antidiabetic market is saturated with multiple drug classes competing on efficacy, safety, and cost. Miglitol’s primary competitors include:

- DPP-4 inhibitors (e.g., sitagliptin, saxagliptin): Offer better tolerability and convenience.

- SGLT2 inhibitors (e.g., canagliflozin, empagliflozin): Provide additional cardiovascular and renal benefits.

- GLP-1 receptor agonists (e.g., liraglutide): Demonstrate significant weight loss and glycemic control.

Despite these options, Miglitol's niche persists in specific subpopulations, driven by its mechanism, safety profile, and cost considerations. However, regulatory scrutiny and safety concerns (such as gastrointestinal side effects) have affected its market penetration in some regions.

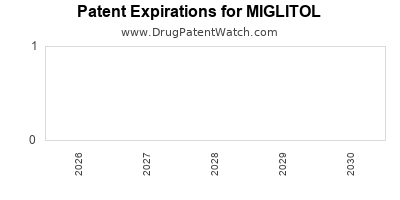

Regulatory Environment and Patent Landscape

The regulatory landscape impacts Miglitol’s market due to safety evaluations, clinical efficacy data, and pricing regulations. Patent protections have largely expired, resulting in generic versions that exert price pressures.

- Patent Expiry: Many formulations have lost patent protection over the past decade, leading to increased generic competition.

- Regulatory Disqualifications: Some regions have limited approval or usage of alpha-glucosidase inhibitors following safety concerns, such as liver enzyme elevation.

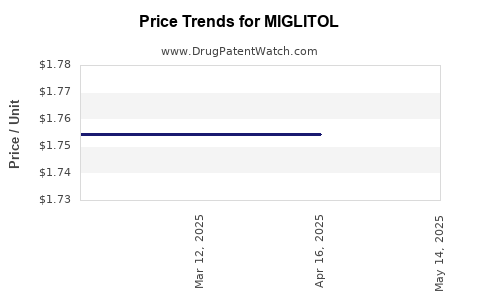

Financial Trajectory and Revenue Trends

Historical Performance

Miglitol’s revenues have historically been modest relative to newer antidiabetic drugs. For example, in the late 1990s and early 2000s, its sales peaked in certain markets but have since plateaued or declined. The key factors influencing financial performance include:

- Patent expiration and generic entry, reducing per-unit pricing power.

- Market saturation in mature markets like North America and Europe.

- Shift in prescribing patterns towards newer agents with additional benefits.

Current and Projected Revenue Trends

Forecast models suggest that Miglitol’s worldwide sales will grow moderately, primarily driven by Asia-Pacific markets. Key projections include:

- Compound Annual Growth Rate (CAGR): Estimated at 2-3% over the next five years, mainly due to increasing diabetes prevalence in emerging markets.

- Regional Variability: Rapid growth anticipated in China and India, where local manufacturers produce affordable generic formulations.

- Pharmaceutical Company Strategies: Some companies are maintaining or even increasing formulations' availability in developing regions through strategic partnerships and price reductions.

Impact of Healthcare Policies

Government reimbursement schemes, pricing regulations, and inclusion in national formularies significantly influence Miglitol’s financial trajectory in various markets. For instance:

- In the US: Limited reimbursement options and competition have constrained revenue growth.

- In emerging economies: Government-led procurement and subsidization spur sales.

Future Outlook and Market Challenges

Miglitol’s future prospects hinge upon several factors:

- Innovation and New Formulations: Development of combination therapies and extended-release formulations may enhance usage.

- Safety Profile: Ongoing safety data influence regulatory and prescriber confidence.

- Market Penetration Strategies: Targeted marketing in emerging markets and inclusion in treatment guidelines can support growth.

- Competitive Pressures: The rise of newer drug classes, particularly those with additional cardiovascular and renal benefits, may erode Miglitol's market share.

- Regulatory Restrictions: Safety concerns and regulatory limitations can impact market access and sales.

Despite these challenges, Miglitol’s affordability and mechanism of action sustain its relevance, particularly in resource-limited settings, underpinning a cautiously optimistic financial trajectory.

Key Takeaways

- The global increase in T2DM prevalence supports a steady, albeit competitive, demand for Miglitol, especially in emerging markets.

- Patent expirations and generic influx have limited revenue growth in mature markets, emphasizing the importance of regional strategic positioning.

- Asia-Pacific presents significant growth opportunities driven by affordability, rising diabetes burden, and local manufacturing.

- The evolving antidiabetic therapeutic landscape, favoring drugs with additional benefits, poses a competitive challenge to Miglitol's market share.

- Strategic focus on cost-effective formulations, safety profile enhancement, and regional market expansion can sustain Miglitol's financial trajectory.

Frequently Asked Questions

1. How does Miglitol compare to other oral antidiabetics in terms of efficacy?

Miglitol effectively reduces post-prandial blood glucose levels but has a modest impact on fasting glucose. Compared to DPP-4 inhibitors, it may be less potent and is associated with gastrointestinal side effects. Its primary advantage is in controlling post-meal hyperglycemia rather than comprehensive glycemic management.

2. What are the main safety concerns associated with Miglitol?

Gastrointestinal discomfort, including flatulence, diarrhea, and abdominal cramps, are common. Rarely, aberrant liver enzyme elevations have been reported, prompting safety reviews. These issues can limit its use in certain patient populations.

3. In which regions is Miglitol currently most competitive?

Emerging markets in Asia-Pacific, including China and India, offer the most favorable environments due to affordability, high diabetes prevalence, and less stringent regulatory restrictions. In North America and Europe, its prominence has diminished owing to competition from newer agents.

4. What strategies could extend Miglitol’s market relevance?

Developing combination therapies, improving formulations to reduce side effects, aggressive regional marketing, and inclusion in clinical guidelines can bolster its market presence. Additionally, partnerships with local manufacturers can facilitate market expansion.

5. How might future developments in diabetes treatment affect Miglitol’s financial outlook?

Advancements leading to multi-benefit agents such as SGLT2 inhibitors and GLP-1 receptor agonists may reduce reliance on traditional agents like Miglitol. However, its cost-effectiveness and utility in specific patient subgroups can sustain niche demand, especially in resource-constrained settings.

References

[1] International Diabetes Federation. (2021). IDF Diabetes Atlas, 10th Edition.