Last updated: October 29, 2025

Introduction

Mifepristone, also known by its brand name Mifeprex or RU-486, is a selective progesterone receptor modulator with a primary indication for medical abortion and other off-label therapeutic uses. Its introduction revolutionized reproductive health, offering a non-surgical alternative for termination of early pregnancy. The evolving regulatory landscape, shifting societal attitudes, and emerging clinical applications collectively influence the market dynamics and financial trajectory of Mifepristone.

Market Overview

The global pharmaceutical market for reproductive health drugs, including Mifepristone, is experiencing significant growth driven by increasing demand for non-invasive abortion alternatives, expanding access to reproductive healthcare, and changing legislative policies. The global abortion services market alone is projected to reach approximately $2 billion by 2025, with Mifepristone comprising a substantial share of this segment [1].

In addition to its core indication, clinical research is examining Mifepristone for other therapeutic areas such as Cushing’s syndrome, breast cancer, and hormone-related disorders, potentially diversifying its revenue streams (although these are still emerging).

Regulatory Environment

Regulatory policies substantially influence Mifepristone’s market access and growth potential. Historically approved in France in 1988 and later in the U.S. in 2000, the drug’s approval status varies globally, affecting availability and uptake. Recent regulatory gestures, such as the FDA’s removal of in-person dispensing mandates during the COVID-19 pandemic, have facilitated greater access, although political debates continue to impact regulatory pathways [2].

In countries with restrictive abortion laws, market penetration remains limited, constraining revenue growth. Conversely, expanding legal frameworks in regions such as Latin America, Africa, and parts of Asia could unlock significant market opportunities. The approval of Mifepristone for use up to 10–12 weeks of gestation in several countries reflects this trend, encouraging broader adoption.

Competitive Landscape

The primary competitor to Mifepristone in medical abortion is misoprostol, often used alone or in combination with Mifepristone for higher efficacy and safety. The combination regimen (Mifepristone followed by misoprostol) enjoys favorable clinical data and has become the established standard of care worldwide.

Innovative formulations, such as fixed-dose combination products and novel delivery platforms, are under development to enhance efficacy, safety, and convenience, potentially impacting market share.

Market Drivers

- Growing Acceptance of Medical Abortion: Increased acceptance, driven by advancements in reproductive rights and increased awareness, fuels demand.

- Expansion into Emerging Markets: Regulatory approvals and decreasing costs are enabling broader access in developing countries.

- Telemedicine Expansion: Digital health platforms facilitate remote prescriptions, especially relevant amidst the pandemic.

- Enhancement in Clinical Applications: Investigating new therapeutic indications could augment revenue streams.

Market Challenges

- Political and Legislative Barriers: Restrictions and bans in certain jurisdictions severely limit market access.

- Public and Political Debate: Ongoing societal debates can lead to regulatory uncertainty.

- Manufacturing and Supply Chain Issues: Ensuring consistent supply amid regulatory hurdles complicates scaling.

- Competition from Other Medical and Surgical Methods: Surgical options remain prevalent, especially where access to medications is limited.

Financial Trajectory

Revenue Trends and Forecasts

In 2021, the global sales of Mifepristone were estimated at approximately $200–300 million, with the majority concentrated in North America and Europe. The U.S. market alone accounts for roughly $50–80 million, driven by the widespread use of mifepristone-misoprostol combination regimens.

Projected compound annual growth rates (CAGR) of 6–8% over the next five years are anticipated, reflecting expanding access in developing markets, regulatory relaxations, and increasing acceptance [3].

Key Revenue Drivers

- Regulatory Approvals: Wider approvals translate directly into increased sales.

- Market Penetration: Penetration in underserved regions offers substantial growth potential.

- Pricing Strategies: Cost-effective formulations and strategic pricing support demand, especially in low-income regions.

- Off-Label Uses and New Indications: Clinical research into therapeutic repurposing can open new revenue avenues.

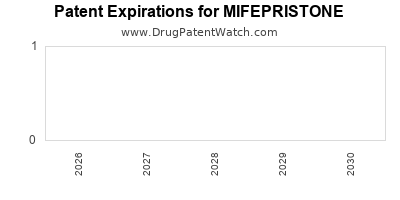

Impact of Patent Status and Generics

As patent protections for Mifepristone have expired or are nearing expiration in multiple jurisdictions, generic manufacturers are entering the space, leading to price erosion and increased competition. While this trend may pressure margins, it also improves affordability and access.

Future Outlook

The financial trajectory hinges on regulatory developments, societal attitudes, and clinical research outcomes. The expansion into emerging markets, coupled with decreased cost barriers, suggests a positive growth outlook. However, political opposition remains a significant headwind, particularly in periods of election cycles or legislative upheaval.

Key Market Opportunities

- Emerging Markets: Africa, Latin America, and parts of Asia present growth opportunities due to increasing legal acceptance and demand.

- Combination Therapies: Developing new formulations with partner drugs enhances efficacy and adherence.

- Telehealth Platforms: Digitization of services accelerates access, especially in remote areas.

Risks and Mitigation Strategies

Regulatory uncertainty necessitates proactive engagement with policymakers and stakeholders. Investing in clinical research to expand indications can diversify revenue. Strategic partnerships with local health authorities foster market entry and acceptance.

Key Takeaways

- The global Mifepristone market is poised for steady growth, driven by legislative shifts, technological advances, and increasing acceptance of medical abortion.

- Regulatory and political challenges, particularly in restrictive jurisdictions, remain key obstacles to market expansion.

- Competition from generics entails pricing pressures but also improves accessibility.

- Telemedicine and emerging markets constitute significant growth opportunities.

- Diversification into new therapeutic indications, combined with strategic regulatory engagement, can optimize the financial trajectory.

FAQs

1. What factors influence the global demand for Mifepristone?

Demand hinges on regulatory approvals, societal attitudes towards abortion, healthcare infrastructure, and advancements in telemedicine. Legislative liberalization, especially in emerging markets, significantly expands access.

2. How does patent expiration impact Mifepristone’s market?

Patent expiry introduces generic competition, which tends to lower prices but can also enable broader access. This shift usually results in increased volume but potentially reduced profit margins for original patentholders.

3. Are there emerging therapeutic uses of Mifepristone?

Research explores Mifepristone for indications like Cushing’s syndrome and certain cancers. Although promising, these are still in experimental phases and have yet to significantly influence the market.

4. How do regulatory policies affect Mifepristone’s availability?

Regulations dictate prescribing authority, dispensing methods, and gestational age limits. Restrictive laws hinder access, while supportive policies facilitate market expansion.

5. What strategies can companies adopt to capitalize on Mifepristone’s market potential?

Companies should engage proactively with regulators, invest in clinical research for new indications, leverage telemedicine channels, and form strategic partnerships to penetrate emerging markets.

References

[1] Market Research Future. (2022). Global Abortion Market Size and Share.

[2] U.S. Food and Drug Administration. (2021). Mitigation strategies for access to mifepristone.

[3] Grand View Research. (2022). Reproductive Health Drugs Market Analysis and Forecast.