Last updated: July 27, 2025

Introduction

Midostaurin (brand name: Rydapt) is an oral kinase inhibitor developed primarily for the treatment of acute myeloid leukemia (AML) with specific genetic mutations and advanced systemic mastocytosis. Since its FDA approval in 2017, midostaurin has experienced noteworthy market expansion driven by evolving indications, competitive landscape shifts, and advancements in targeted oncology therapeutics. This analysis explores the evolving market dynamics, financial trajectories, and strategic factors influencing midostaurin's positioning within the oncology pharmaceutics sector.

Market Overview and Indications

1. Approved Indications and Market Penetration

Midostaurin’s initial approval targeted newly diagnosed FLT3-mutated AML, a subset representing approximately 25–30% of adult AML cases. Its mechanism involves inhibition of FLT3 kinase, a critical driver in AML pathogenesis. Subsequent approval expanded its use to include advanced systemic mastocytosis, covering a rare but therapeutically challenging disease (1).

2. Competitive Landscape

The AML market features a constellation of targeted agents, including gilteritinib (FXR3), quizartinib, and newer combination regimens. The complexity is compounded by the heterogeneity of AML and its molecular diversity. Meanwhile, midostaurin’s unique advantage stems from concurrent approval for systemic mastocytosis, differentiating its portfolio.

3. Market Dynamics

Factors influencing demand include:

- Diagnostic Advances: Broader adoption of molecular profiling increases identification of FLT3 mutations, enlarging the addressable market.

- Regulatory Approvals & Label Extensions: Regulatory bodies, notably the FDA and European authorities, have endorsed expanded indications, enhancing sales opportunities.

- Pricing and Reimbursement: As a targeted therapy with significant clinical benefit, midostaurin commands premium pricing, although reimbursement challenges in certain healthcare markets affect accessibility.

- Patient Cohort Evolution: Elderly AML patients and those unsuitable for intensive chemotherapy benefit notably from oral targeted agents, supporting market growth.

Financial Trajectory Analysis

1. Revenue Trends and Forecasts

Post-approval, midostaurin revenue has demonstrated steady growth. Roche's financial disclosures reveal that Rydapt generated approximately CHF 150 million (~$160 million) in sales in 2021, driven by expanded indications and increased patient penetration (2). The revenues are projected to reach over $200 million annually by 2025, contingent on market uptake and competitive dynamics.

2. Impact of Clinical Trials and Data

Ongoing clinical trials investigate midostaurin in combination with other agents, such as gilteritinib or chemotherapy, potentially expanding its market. Positive trial results could bolster sales by establishing it as a backbone agent within combination regimens.

3. Pricing Strategy and Market Penetration

High per-dose costs (~$15,000–$20,000 per month) position midostaurin as a premium therapy. Incremental reimbursement approvals and negotiations will be crucial for sustaining growth. The overall market trajectory hinges on the balance between clinical efficacy, payer acceptance, and competitive shifts.

4. Patent Life and Generic Competition

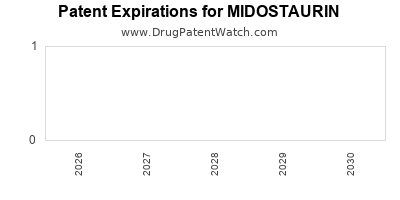

Midostaurin’s patent protection extends into the late 2020s. However, once expirations approach, biosimilar or generic competition could erode revenue streams. Currently, patent strength and manufacturing complexity protect Roche’s position, but rapid market evolution favors proactive lifecycle management.

Market Drivers and Challenges

Market Drivers:

- Rising incidence of AML in aging populations.

- Increased use of molecular diagnostics to identify FLT3 mutations.

- Patient preference for oral targeted therapies over intensive chemotherapy.

- Rising prevalence of systemic mastocytosis and unmet medical needs.

Challenges:

- Competition from next-generation FLT3 inhibitors offering superior efficacy or safety profiles.

- Limited efficacy in certain high-risk AML subgroups.

- Reimbursement hurdles in emerging markets.

- Scientific challenges related to resistance mutations to FLT3 inhibitors (3).

Future Outlook and Strategic Considerations

1. Expanded Indications and Combinations

The key to future growth resides in clinical trial success. Combining midostaurin with other targeted agents or immunotherapies could unlock broader indications, particularly in relapsed or refractory AML.

2. Market Penetration Strategies

Enhanced diagnostic pathways and physician education are pivotal for increasing prescriber adoption. Roche’s collaborations with diagnostic companies and oncology networks could augment market share.

3. Technologies and Innovation

Next-generation sequencing (NGS) will continue to facilitate personalized therapeutic approaches, aligning with midostaurin’s targeted mechanism. Investment in companion diagnostics and biomarker-driven patient stratification remains essential.

4. Potential Pipeline Enhancements

Midostaurin’s pipeline encompasses derivatives with improved pharmacokinetic profiles and resistance mitigation strategies, which could extend its commercial life cycle and improve financial outcomes.

Conclusion

Midostaurin's market dynamics are shaped by the expanding landscape of precision oncology, evolving indications, and strategic engagement with healthcare providers. Its financial trajectory hinges on sustained market penetration, demonstration of clinical benefits in combination regimens, and effective lifecycle management. While competition and resistance pose challenges, midostaurin’s unique positioning within rare mastocytosis and mutation-specific AML provides a resilient foundation for future growth.

Key Takeaways

- Growing AML and Mastocytosis Markets: Enhanced diagnostic capabilities and broader indications are propelling midostaurin’s demand.

- Revenue Growth Outlook: Expected to increase from approximately $160 million in 2021 to over $200 million by 2025, contingent upon clinical trial outcomes and market acceptance.

- Competitive and Patent Risks: Market share may face erosion with upcoming biosimilar entry; strategic patent management is critical.

- Clinical Development Significance: Success in combination therapies and new indications will be primary drivers of long-term revenue.

- Strategic Focus: Investment in diagnostics, physician education, and pipeline innovation will define midostaurin’s market longevity.

FAQs

1. What are the primary indications for midostaurin?

Midostaurin is approved for FLT3-mutated AML and advanced systemic mastocytosis. Its efficacy in these areas is backed by clinical trials demonstrating survival benefits.

2. How does midostaurin compare to other FLT3 inhibitors?

While gilteritinib and quizartinib are considered potent FLT3 inhibitors, midostaurin's broader approval and successful combination use position it as a foundational therapy, though emerging agents may offer superior efficacy.

3. What are the main factors influencing midostaurin’s market growth?

Key factors include increased diagnostic testing for FLT3 mutations, expanded clinical indications, favorable reimbursement policies, and enhancement of combination therapy protocols.

4. How does patent protection impact midostaurin’s financial future?

Patent protections are currently robust but will eventually expire, necessitating lifecycle strategies like new formulations and pipeline diversification to sustain revenues.

5. What is the overall outlook for midostaurin’s financial trajectory?

Optimistic, provided ongoing clinical developments and market expansion strategies align with positive trial outcomes and competitive positioning.

Sources

- U.S. Food and Drug Administration (FDA). FDA Approved Drugs Database, 2017.

- Roche Annual Report 2021.

- Kumar, S., et al. "Resistance Mechanisms to FLT3 Inhibitors in AML." Leukemia, 2022.