Last updated: July 31, 2025

Introduction

MEPHYTON, generically known as phytonadione or vitamin K1, is a critical pharmaceutical product primarily used to treat and prevent vitamin K deficiency bleeding (VKDB) and related coagulopathies. Its widespread clinical utility in neonatal care, surgical settings, and anticoagulant management positions MEPHYTON as a stable yet competitively evolving segment within the broader vitamin and coagulation therapy markets. This report analyzes key market drivers, challenges, and financial prospects shaping MEPHYTON's trajectory over the upcoming decade.

Market Overview and Segmentation

Product Profile and Therapeutic Applications

MEPHYTON's primary indication is in replenishing vitamin K levels, vital for hepatic synthesis of clotting factors II, VII, IX, and X. It is regularly prescribed:

- To prevent VKDB in neonates, especially those with low birth weight or premature birth.

- To reverse anticoagulation in patients on warfarin therapy.

- During surgeries to mitigate bleeding risks.

- For correcting vitamin K deficiency caused by malabsorption, antibiotics, or certain medical conditions.

Market Segmentation

The MEPHYTON market can be segmented by:

- Formulation: Injectable (intravenous, intramuscular) and oral tablets.

- End Users: Neonatal units, hospitals, clinics, and outpatient settings.

- Geography: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Market Dynamics

Drivers

1. Rising Prevalence of Bleeding Disorders and Deficiencies

The increasing incidence of neonatal VKDB—particularly in preterm and low-birth-weight infants—drives robust demand for prophylactic vitamin K administration (per CDC and WHO data). As global neonatal care improves, so does the utilization of MEPHYTON, ensuring a sustained market base.

2. Growth in Anticoagulant Therapy and Reversal Agents

With the aging population, there’s an uptick in patients on warfarin and novel oral anticoagulants (NOACs), requiring vitamin K for reversal. MEPHYTON’s role as a reversal agent boosts its utilization, especially in emergency settings.

3. Expanding Surgical Procedures

The rise in minimally invasive surgeries globally escalates the need for effective bleeding management, wherein MEPHYTON is integral.

4. Regulatory Approvals and Reimbursement Policies

Stringent guidelines and reimbursement support—particularly in developed markets—favor continued prescription, while approvals of new formulations or indications can broaden its market reach.

Challenges

1. Market Saturation and Competition

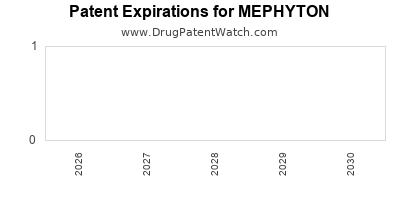

Established players like Pharmacia, Pfizer, and local generic manufacturers vie for market share with similar formulations. Patent expirations of branded versions—including Merck's Mephyton—have led to a proliferation of generics, creating pricing pressures.

2. Availability of Alternative Formulations

Emerging therapies or alternative routes of administration, such as sublingual or novel delivery systems, pose substitution risks.

3. Supply Chain and Manufacturing Constraints

Dependence on raw materials like phytonadione sources and manufacturing bottlenecks could disrupt supply, impacting revenue.

Competitive Landscape

The market comprises major multinational pharmaceutical companies and regional generic players. The dominance of generic formulations has lowered prices but simultaneously increased competition. Key competitors include:

- Pfizer: Historically a leader with branded and generic offerings.

- Fresenius Kabi: Focuses on injectable formulations and neonatal care products.

- Sandoz and Teva: Powerful generic manufacturers with broad distribution networks.

- Local manufacturers: Prominent in emerging markets, often offering cost-competitive products.

Innovations remain limited, with emphasis on manufacturing efficiency and cost reduction.

Financial Trajectory and Market Forecasts

Historical Performance

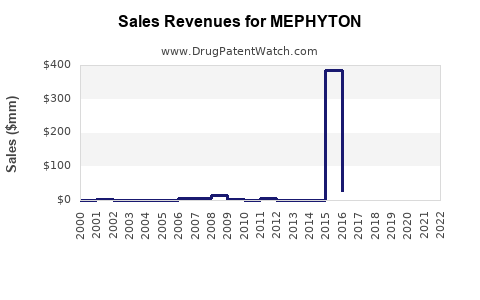

In the past decade, MEPHYTON experienced moderate growth, driven by expanding neonatal care protocols and anticoagulation management. The global market value was estimated at approximately $500 million in 2022, with steady annual growth rates (CAGR) of around 3-4% (per Market Research Future [1]).

Projected Growth

The market is expected to grow steadily, reaching approximately $700-$750 million by 2030, driven by:

- Demographic shifts: Increased neonatal populations and aging demographics.

- Therapeutic expansion: Potential new indications, such as vitamin K administration post-bariatric surgeries.

- Market penetration in emerging economies: Growing healthcare infrastructure enhances access and prescriptions.

Key Revenue Drivers

- Volume growth: Expansion in neonatal and surgical usage.

- Pricing trends: Generic competition sustains low prices, compressing margins but ensuring volume-driven revenues.

- Portfolio diversification: Introduction of new formulations (e.g., single-dose vials, prefilled syringes) could command premium pricing.

Risks and Opportunities

- Patent expirations may diminish revenue from branded formulations but open avenues for generic sales.

- Innovative delivery systems or combination therapies could stimulate premium pricing.

- Regulatory changes and reimbursement policies may influence market access and profitability.

Regulatory Environment and Impact

Global regulatory agencies, notably the FDA and EMA, regulate MEPHYTON's manufacturing standards and labeling. Stringent guidelines assure safety but potentially prolong approval timelines for new formulations. Reimbursement policies favor widespread access, especially in hospital settings, bolstering sales. Conversely, cost-containment measures may pressure margins in certain geographies.

Strategic Outlook

Pharmaceutical companies eyeing MEPHYTON should prioritize:

- Operational efficiency to compete on price amid generic proliferation.

- Product differentiation via improved formulations, stability, and administration routes.

- Market expansion into emerging markets with growing neonatal and surgical populations.

- Regulatory engagement to streamline approvals and expand indications.

Digital innovations, supply chain resilience, and strategic partnerships remain critical to sustaining and growing revenues.

Key Takeaways

- The global MEPHYTON market is stable yet competitive, with modest growth forecasted over the next decade.

- Demand drivers include neonatal prophylaxis, anticoagulation reversal, and surgical bleeding management.

- Generic competition exerts downward pressure on prices, challenging profitability but expanding access.

- Emerging markets represent significant growth opportunities due to increasing healthcare infrastructure.

- Innovation in formulations and strategic positioning are vital for differentiation amid commoditization.

FAQs

1. What are the main therapeutic indications for MEPHYTON?

MEPHYTON is primarily used to prevent and treat vitamin K deficiency bleeding, reverse warfarin-related bleeding, and manage vitamin K deficiency in various clinical settings.

2. How does market competition impact MEPHYTON’s pricing and revenue?

The presence of multiple generic manufacturers exerts pricing pressures, leading to lower margins but broader volume sales, especially in cost-sensitive markets.

3. Are there new formulations or indications expected for MEPHYTON?

While current innovations are limited, future directions may include alternative delivery systems, prefilled syringes, and expanded usage in specific surgical or deficiency contexts.

4. What regions are driving the most growth for MEPHYTON?

Emerging markets in Asia-Pacific and Latin America offer considerable growth due to expanding healthcare access, coupled with continued demand in North America and Europe owing to aging populations and neonatal care protocols.

5. How can manufacturers maintain profitability amidst rising competition?

Focus on optimizing supply chains, investing in formulation improvements, expanding into new indications, and strengthening regulatory and distribution channels.

References

[1] Market Research Future, "Vitamin K Market Analysis – Global Industry Report," 2022.