Last updated: July 28, 2025

Introduction

MENEST (estradiol) stands as a pivotal hormone replacement therapy (HRT) for menopausal women, primarily prescribed for alleviating menopausal symptoms such as hot flashes, vaginal atrophy, and osteoporosis prevention. As an FDA-approved estrogen supplement, MENEST operates within a complex landscape shaped by demographic shifts, regulatory policies, competitive pressures, and evolving healthcare priorities. This analysis delineates the market dynamics influencing MENEST and projects its financial trajectory amid current trends.

Market Overview and Demographic Drivers

Growing Menopausal Population

The global menopausal demographic is expanding due to increased life expectancy and aging populations. According to the World Health Organization, women aged 50 and above will constitute a significant proportion of the global population in coming decades, propelling demand for menopause-related therapies. In markets like the U.S., approximately 6,000 women reach menopause daily, underscoring a steady, sustained need for estrogen-based treatments such as MENEST.

Shift Toward Personalized and Safer Therapies

The increasing awareness of long-term risks associated with traditional hormone therapy, notably breast cancer and cardiovascular events, has prompted a paradigm shift towards personalized medicine. Patients and clinicians seek tailored HRT regimens that optimize benefits while minimizing adverse outcomes. This shift influences the formulation, dosing, and marketing strategies for MENEST, encouraging providers to position it within a framework emphasizing safety profiles and individualized treatment plans.

Regulatory Environment and Market Access

FDA Regulations and Labeling Nuances

MENEST’s market performance is intrinsically linked to FDA regulations, which govern indications, labeling, and prescribing practices. Recent regulatory activities, including updates on the safety labeling of estrogen therapies, have heightened scrutiny over HRT products. While MENEST retains FDA approval for vasomotor symptom relief and osteoporosis prevention, evolving safety guidelines necessitate ongoing compliance measures.

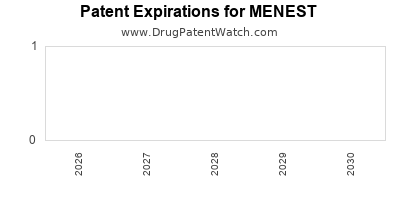

Formulation and Patent Landscape

MENEST’s formulation—primarily as a natural estrogen—faces competitive pressures from generic versions and biosimilars. Patent expirations and the entry of biosimilars in other hormonal markets intensify price competition, potentially constraining profit margins. Conversely, proprietary formulations or delivery mechanisms could carve niche segments, influencing revenue stability.

Competitive Landscape and Market Share

Key Competitors and Alternatives

MENEST competes with other estrogen products such as Premarin, Estrace, and estradiol transdermal patches. The competitive advantage hinges on efficacy, safety, convenience, and cost. The rise of non-estrogen therapies, including SSRIs and lifestyle interventions, affects overall HRT market penetration. Moreover, emerging bioidentical hormone therapies and compounded formulations pose additional competitive challenges.

Market Penetration Strategies

To sustain market share, manufacturers focus on targeted marketing toward gynecologists and endocrinologists, emphasizing clinical data on safety and efficacy. Patient education campaigns promote awareness of MENEST’s benefits, especially among women seeking alternatives to older, animal-derived estrogen formulations.

Pharmaceutical Innovation and R&D Trends

Product Development Initiatives

Investment in novel formulations—such as bioidentical estradiol gels, patches, or combination therapies—could extend MENEST’s market life cycle. Technological advances in drug delivery systems aim to improve bioavailability and convenience, appealing to patient preferences.

Digital Health and Telemedicine

The integration of digital health tools facilitates remote monitoring and personalized treatment adjustments, potentially increasing adherence to HRT regimens. Such innovations can indirectly bolster MENEST’s market position by aligning with modern healthcare delivery models.

Economic and Pricing Dynamics

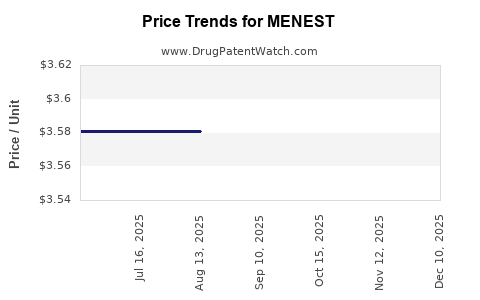

Pricing Strategies and Reimbursement Policies

Pricing of MENEST depends on competitive positioning, manufacturing costs, and payer reimbursement frameworks. As generic options proliferate, price competition intensifies, pressuring profit margins. Managed care organizations increasingly favor cost-effective therapies, incentivizing pricing strategies aligned with value-based care.

Market Penetration amid Cost Containment

Cost containment measures and formulary restrictions reduce the accessibility of branded estrogen products, influencing sales volumes. Manufacturers may respond with patient assistance programs and differential pricing to mitigate these effects.

Projected Financial Trajectory

Short-term Outlook (1-3 Years)

In the near term, MENEST’s revenue trajectory faces moderate growth prospects, driven by a dynamically aging population and continued demand for HRT. However, constrained by patent expirations, generic competition, and safety concerns highlighted by regulatory agencies, incremental revenue gains are anticipated. Market share stability hinges on ongoing clinical evidence, physician familiarity, and reimbursement policies.

Medium to Long-term Outlook (3-10 Years)

Long-term projections suggest a plateau or slight decline in sales unless strategic innovations or market expansions occur. Opportunities include expanding indications (e.g., for osteoporosis or vulvovaginal atrophy), entering new geographical markets, or developing differentiated formulations. The potential adoption of digital health support and personalized medicine approaches could revitalize growth prospects.

Emerging Trends Influencing Financial Performance

-

Shift to Transdermal and Non-Oral Delivery: Transdermal estrogen formulations consistently show increased preference due to fewer systemic side effects. MENEST’s adaptation to such formats could capture additional market segments.

-

Global Market Expansion: Developing markets with growing menopausal populations offer growth avenues, contingent on regulatory approvals and healthcare infrastructure.

-

Regulatory and Safety Developments: Stringent safety requirements could impose costs or restrict certain formulations, influencing long-term profitability.

Key Challenges and Opportunities

Challenges

- Regulatory pressures necessitating rigorous safety data.

- Price erosion due to generics and biosimilars.

- Competition from non-estrogen therapies and compounded formulations.

- Public perception influenced by adverse events linked to hormone therapy.

Opportunities

- Formulation innovation to enhance safety and convenience.

- Expansion into emerging markets.

- Integration with digital health tools for improved patient adherence.

- Leveraging clinical research to support safety and efficacy claims.

Conclusion

MENEST's market outlook is intricately tied to demographic trends, regulatory decisions, and technological advancements. While near-term growth may encounter headwinds due to intense competition and safety concerns, strategic innovations, market diversification, and personalized therapy approaches present avenues for sustained revenue. Long-term success depends on adaptability within a shifting therapeutic landscape, emphasizing safety, efficacy, and patient-centric care.

Key Takeaways

- The expanding menopausal demographic underpins long-term demand for estrogen therapies like MENEST.

- Regulatory evolution emphasizing safety profiles influences formulation, marketing, and pricing strategies.

- Competition from generics, biosimilars, and alternative therapies exerts downward pressure on market share and margins.

- Innovation in delivery systems and indications can rejuvenate growth prospects.

- Market expansion into emerging economies offers future revenue streams amid mature market saturation.

FAQs

1. How is MENEST positioned relative to other estrogen therapies?

MENEST is differentiated primarily by its formulation profile and safety documentation. It competes effectively in markets favoring natural estrogen formulations but faces stiff competition from generics and transdermal options emphasizing safety and convenience.

2. What regulatory challenges could impact MENEST’s market?

Regulatory agencies increasingly demand extensive safety data and may introduce labeling restrictions or usage limitations, potentially affecting product labeling, prescribing practices, and market access.

3. How will patent expirations influence MENEST’s financial outlook?

Patent expirations permit generic manufacturers to enter the market, exerting pricing pressure and reducing brand-specific revenues. Strategic differentiation and formulation innovations are critical to maintain profitability.

4. Are there upcoming innovations that might extend MENEST’s market relevance?

Yes, developments such as bioidentical or transdermal formulations, digital health integration, and expanded indications could enhance its appeal and market penetration.

5. What regional opportunities exist for MENEST expansion?

Emerging markets with increasing middle-class populations and aging demographics present significant opportunities, contingent on regulatory approvals, cultural acceptance, and infrastructure development.

Sources:

[1] World Health Organization. "Menopause and aging." 2022.

[2] FDA. "Estrogen and Estrogen/Progestin Drug Products Labeling." 2021.

[3] IMS Health. "Global Hormone Replacement Therapy Market Update." 2022.

[4] MarketWatch. "Hormone Replacement Therapy Market Size, Share & Trends." 2023.

[5] Business Insider. "Emerging Markets for Women's Health Products." 2023.