MAVYRET Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Mavyret, and when can generic versions of Mavyret launch?

Mavyret is a drug marketed by Abbvie and is included in two NDAs. There are ten patents protecting this drug.

This drug has five hundred and fifty patent family members in forty-six countries.

The generic ingredient in MAVYRET is glecaprevir; pibrentasvir. One supplier is listed for this compound. Additional details are available on the glecaprevir; pibrentasvir profile page.

DrugPatentWatch® Generic Entry Outlook for Mavyret

Mavyret was eligible for patent challenges on August 3, 2021.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be December 5, 2035. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for MAVYRET?

- What are the global sales for MAVYRET?

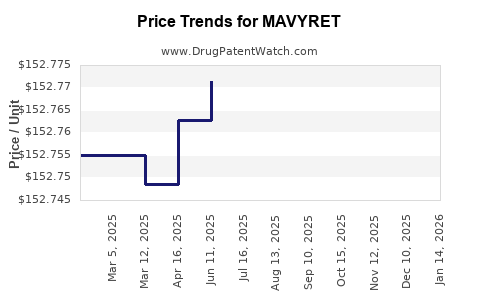

- What is Average Wholesale Price for MAVYRET?

Summary for MAVYRET

| International Patents: | 550 |

| US Patents: | 10 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Clinical Trials: | 29 |

| Drug Prices: | Drug price information for MAVYRET |

| What excipients (inactive ingredients) are in MAVYRET? | MAVYRET excipients list |

| DailyMed Link: | MAVYRET at DailyMed |

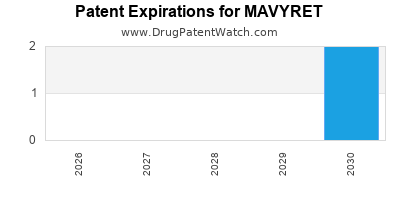

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for MAVYRET

Generic Entry Dates for MAVYRET*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

Generic Entry Dates for MAVYRET*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

PELLETS;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for MAVYRET

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| White River Junction Veterans Affairs Medical Center | Phase 2 |

| White River Junction Veterans Affairs Medical Center | Phase 2/Phase 3 |

| Duke University | Phase 4 |

Pharmacology for MAVYRET

US Patents and Regulatory Information for MAVYRET

MAVYRET is protected by ten US patents and six FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of MAVYRET is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Abbvie | MAVYRET | glecaprevir; pibrentasvir | TABLET;ORAL | 209394-001 | Aug 3, 2017 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Abbvie | MAVYRET | glecaprevir; pibrentasvir | PELLETS;ORAL | 215110-001 | Jun 10, 2021 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Abbvie | MAVYRET | glecaprevir; pibrentasvir | TABLET;ORAL | 209394-001 | Aug 3, 2017 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Abbvie | MAVYRET | glecaprevir; pibrentasvir | PELLETS;ORAL | 215110-001 | Jun 10, 2021 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Abbvie | MAVYRET | glecaprevir; pibrentasvir | PELLETS;ORAL | 215110-001 | Jun 10, 2021 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for MAVYRET

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| AbbVie Deutschland GmbH Co. KG | Maviret | glecaprevir, pibrentasvir | EMEA/H/C/004430Maviret is indicated for the treatment of chronic hepatitis C virus (HCV) infection in adults and children aged 3 years and older.Maviret coated granules is indicated for the treatment of chronic hepatitis C virus (HCV) infection in children 3 years and older. | Authorised | no | no | no | 2017-07-26 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for MAVYRET

When does loss-of-exclusivity occur for MAVYRET?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 15269306

Patent: Crystal forms

Estimated Expiration: ⤷ Get Started Free

Patent: 16283018

Estimated Expiration: ⤷ Get Started Free

Patent: 16296709

Estimated Expiration: ⤷ Get Started Free

Patent: 20239679

Patent: Crystal forms

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2017028185

Estimated Expiration: ⤷ Get Started Free

Patent: 2018000982

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 48902

Patent: FORMES CRISTALLINES D'INHIBITEURS DE PROTEASE DU VIRUS DE L'HEPATITE C (VHC) ET LEUR UTILISATION (CRYSTAL FORMS OF HCV PROTEASE INHIBITORS AND USE THEREOF)

Estimated Expiration: ⤷ Get Started Free

Patent: 90855

Estimated Expiration: ⤷ Get Started Free

Patent: 92722

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 17003350

Estimated Expiration: ⤷ Get Started Free

Patent: 18000138

Estimated Expiration: ⤷ Get Started Free

China

Patent: 6413736

Patent: 晶型 (Crystal forms)

Estimated Expiration: ⤷ Get Started Free

Patent: 7920996

Estimated Expiration: ⤷ Get Started Free

Patent: 8024964

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 17013305

Estimated Expiration: ⤷ Get Started Free

Patent: 18000391

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 180030

Estimated Expiration: ⤷ Get Started Free

Patent: 180088

Estimated Expiration: ⤷ Get Started Free

Dominican Republic

Patent: 017000314

Estimated Expiration: ⤷ Get Started Free

Patent: 018000024

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 18000689

Estimated Expiration: ⤷ Get Started Free

Patent: 18008411

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 1890160

Estimated Expiration: ⤷ Get Started Free

Patent: 1890334

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 51850

Patent: FORMES CRISTALLINES (CRYSTAL FORMS)

Estimated Expiration: ⤷ Get Started Free

Patent: 13378

Estimated Expiration: ⤷ Get Started Free

Patent: 24941

Estimated Expiration: ⤷ Get Started Free

Patent: 03223

Patent: FORMES CRISTALLINES (CRYSTAL FORMS)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 50627

Estimated Expiration: ⤷ Get Started Free

Patent: 55203

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 6504

Estimated Expiration: ⤷ Get Started Free

Patent: 6945

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 33466

Estimated Expiration: ⤷ Get Started Free

Patent: 62425

Estimated Expiration: ⤷ Get Started Free

Patent: 72199

Estimated Expiration: ⤷ Get Started Free

Patent: 17518319

Patent: 結晶形

Estimated Expiration: ⤷ Get Started Free

Patent: 18518517

Estimated Expiration: ⤷ Get Started Free

Patent: 18520185

Estimated Expiration: ⤷ Get Started Free

Patent: 21113192

Patent: 結晶形 (CRYSTAL FORMS)

Estimated Expiration: ⤷ Get Started Free

Patent: 22141719

Estimated Expiration: ⤷ Get Started Free

Patent: 22177014

Estimated Expiration: ⤷ Get Started Free

Patent: 23089125

Patent: 結晶形 (CRYSTAL FORMS)

Estimated Expiration: ⤷ Get Started Free

Patent: 25004239

Patent: 結晶形 (CRYSTAL FORMS)

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 2606

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 3056

Patent: FORMAS CRISTALINAS DE GLECAPREVIR. (CRYSTAL FORMS)

Estimated Expiration: ⤷ Get Started Free

Patent: 16016127

Patent: FORMAS CRISTALINAS. (CRYSTAL FORMS.)

Estimated Expiration: ⤷ Get Started Free

Patent: 18000218

Estimated Expiration: ⤷ Get Started Free

Patent: 18000746

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 8746

Estimated Expiration: ⤷ Get Started Free

Patent: 9127

Estimated Expiration: ⤷ Get Started Free

Patent: 5565

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 180488

Estimated Expiration: ⤷ Get Started Free

Patent: 180609

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 017502426

Estimated Expiration: ⤷ Get Started Free

Patent: 018500132

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 18102809

Estimated Expiration: ⤷ Get Started Free

Patent: 18105849

Estimated Expiration: ⤷ Get Started Free

Patent: 21102950

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 202002899V

Estimated Expiration: ⤷ Get Started Free

Patent: 202002900Y

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1800533

Estimated Expiration: ⤷ Get Started Free

Patent: 1801082

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2637828

Estimated Expiration: ⤷ Get Started Free

Patent: 2824158

Estimated Expiration: ⤷ Get Started Free

Patent: 180021840

Estimated Expiration: ⤷ Get Started Free

Patent: 180025317

Estimated Expiration: ⤷ Get Started Free

Patent: 240108528

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering MAVYRET around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Japan | 5530514 | ⤷ Get Started Free | |

| Hungary | S1700040 | ⤷ Get Started Free | |

| Cyprus | 2017033 | ⤷ Get Started Free | |

| Guatemala | 201300077 | ⤷ Get Started Free | |

| Japan | 2012529534 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for MAVYRET

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2368890 | 2015012 | Norway | ⤷ Get Started Free | PRODUCT NAME: OMBITASVIR, ELLER ET; REG. NO/DATE: EU/1/14/982 20150120 |

| 2618831 | 122017000076 | Germany | ⤷ Get Started Free | PRODUCT NAME: GLECAPREVIR ODER EIN PHARMAZEUTISCH VERTRAEGLICHES SALZ ODER ESTER DAVON; REGISTRATION NO/DATE: EU/1/17/1213 20170726 |

| 2618831 | C02618831/01 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: GLECAPREVIR; REGISTRATION NO/DATE: SWISSMEDIC-ZULASSUNG 66472 22.09.2017 |

| 2692346 | 122017000074 | Germany | ⤷ Get Started Free | PRODUCT NAME: PIBRENTASVIR ODER EIN PHARMAZEUTISCH VERTRAEGLICHES SALZ DAVON; REGISTRATION NO/DATE: EU/1/17/1213 20170726 |

| 2618831 | 17C1039 | France | ⤷ Get Started Free | PRODUCT NAME: GLECAPREVIR OU UN SEL PHARMACEUTIQUEMENT ACCEPTABLE OU UN ESTER DE CELUI-CI; REGISTRATION NO/DATE: EU/1/17/1213 20170728 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for MAVYRET ( Glecaprevir/Pibrentasvir)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.