Share This Page

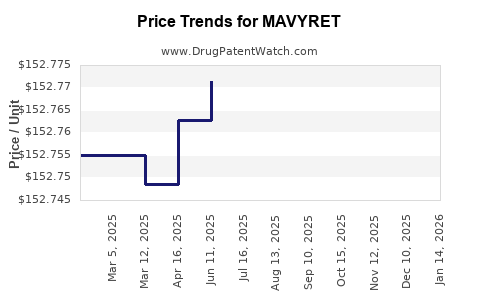

Drug Price Trends for MAVYRET

✉ Email this page to a colleague

Average Pharmacy Cost for MAVYRET

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| MAVYRET 100-40 MG TABLET | 00074-2625-04 | 152.94878 | EACH | 2025-12-17 |

| MAVYRET 100-40 MG TABLET | 00074-2625-84 | 152.94878 | EACH | 2025-12-17 |

| MAVYRET 100-40 MG TABLET | 00074-2625-28 | 152.94878 | EACH | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for MAVYRET (Mavyret)

Introduction

MAVYRET (glecaprevir/pibrentasvir), developed by AbbVie, is an oral, fixed-dose combination antiviral medication approved by the FDA for the treatment of various genotypes of hepatitis C virus (HCV) infection. Since its approval, MAVYRET has become a critical component in the HCV treatment landscape due to its high efficacy, favorable safety profile, and abbreviated treatment regimens. This analysis assesses the current market environment for MAVYRET, examines strategic factors influencing its pricing, and projects future price trends based on industry dynamics, competitive pressures, and regulatory developments.

Market Landscape for Hepatitis C Treatments

Global Burden of Hepatitis C

HCV remains a significant global health challenge, affecting approximately 58 million individuals worldwide, with a substantial burden in the United States, Europe, and emerging markets in Asia and Africa [1]. Chronic HCV can lead to severe complications including cirrhosis, hepatocellular carcinoma, and liver failure, driving demand for effective antiviral therapies.

Current Treatment Paradigm

The advent of direct-acting antivirals (DAAs), including MAVYRET, has revolutionized HCV therapy, achieving sustained virologic response (SVR) rates exceeding 95%. According to IQVIA data, the global HCV treatment market was valued at approximately USD 12 billion in 2021, with a projected CAGR of 8% through 2028 [2].

Competitive Landscape

MAVYRET faces competition from several DAA regimens, notably:

- Gilead Sciences’ Epclusa (sofosbuvir/velpatasvir)

- Zepatier (elbasvir/grazoprevir)

- Vosevi (sofosbuvir/velpatasvir/voxilaprevir)

- Genotype-specific treatments and emerging therapies, including AbbVie's own VIEKIRA PAK and investigational agents.

Key differentiators for MAVYRET include its pangenotypic efficacy, shortened 8-week treatment durations in many patient populations, and favorable safety profile, which enhances its demand.

Market Dynamics Influencing MAVYRET

Pricing Strategies and Reimbursement

AbbVie's initial pricing for MAVYRET set a list price of approximately USD 26,400 for an 8-week course, consistent with other top-tier DAAs [3]. Payer negotiations, utilization of patient assistance programs, and price rebates significantly influence the net price.

Regulatory Changes and Patent Landscape

- Patent protections extend until 2030 in key markets, including the US and EU [4].

- Patent litigations and the entry of biosimilars or generics could influence pricing strategies moving forward.

Market Access and Adoption

MAVYRET's broad coverage, including insurance formularies and pharmacy benefit managers, supports widespread adoption, but pricing pressures from payers may catalyze re-evaluation of reimbursement levels.

Price Projections (2023-2028)

Factors Supporting Price Stability

Despite the potential for generic or biosimilar entry in the late 2020s, currently, MAVYRET’s high efficacy and convenience sustain premium pricing. The high barriers to competing directly with brand efficacy and safety also endorse some degree of price stability during patent exclusivity.

Anticipated Price Trends

-

Short to Mid-Term (2023–2025):

Marginal reductions in net prices are expected due to payer negotiations, with list prices remaining relatively stable. Price discounts, rebates, and assistance programs may lower effective costs by an estimated 10–15%. -

Long Term (2026–2028):

As patent expiry approaches, generic competition may induce significant price erosion—anticipated to decline by up to 50% unless additional patents or exclusivities are secured. However, such reductions are unlikely to impact current fixed-dose combination formulations significantly until that period.

Influencing Factors

- Expanding use in underserved populations and developing countries could promote volume-driven revenue but exert downward pressure on unit prices.

- Value-based pricing models, emphasizing SVR rates and treatment duration, may reshape pricing negotiations.

- Future regulatory decisions and patent litigations could either extend exclusivity or accelerate generic entry.

Opportunities and Risks

Opportunities:

- Growing global HCV elimination initiatives increase treatment uptake.

- Strategic expansion into pediatric or specific genotype subpopulations could broaden market share.

- Differential pricing in emerging markets potentially enhances revenue streams.

Risks:

- Patent expirations threaten market share.

- Competitive innovations with improved efficacy, safety, or cost-effectiveness may pressure prices.

- Policy shifts favoring price reductions or generic proliferation.

Conclusion and Strategic Implications

MAVYRET remains a leading therapy within the HCV treatment market, with stable pricing expected in the next few years. Long-term profitability will hinge on patent protections, competitive actions, and evolving reimbursement landscapes. Stakeholders should closely monitor patent litigation outcomes, pricing negotiations, and global market expansion opportunities to optimize value.

Key Takeaways

- MAVYRET’s current list price (~USD 26,400 per course) is aligned with premium HCV therapies, balancing efficacy and convenience.

- Market stability is foreseen until patent expiration, with gradual price concessions driven by payer negotiations and potential generics entering the market after 2030.

- Expansion into emerging markets and underserved populations can augment total revenue, offsetting downward pricing pressures.

- Strategic patent management and innovation are critical to sustaining MAVYRET’s market position and pricing power.

- Industry shifts toward value-based pricing and global health initiatives offer pathways for sustained commercial success.

FAQs

1. What is the current market price of MAVYRET?

The approximate list price for a standard 8-week course of MAVYRET is around USD 26,400 in the United States. Actual net prices are often lower due to rebates and discounts negotiated with payers.

2. How does MAVYRET compare price-wise to competing therapies?

MAVYRET’s pricing is comparable to other leading DAA regimens such as Epclusa, with differences largely driven by negotiated rebates, formulary positioning, and regional pricing strategies.

3. When is patent expiry expected for MAVYRET?

AbbVie’s MAVYRET patent protections are expected to extend until approximately 2030 in major markets, after which generic competition is anticipated.

4. Will the price of MAVYRET decrease significantly before patent expiry?

Minor reductions may occur due to payer negotiations and market dynamics, but substantial price drops are unlikely until the patent expires and generics become available.

5. How might emerging market trends impact MAVYRET’s pricing?

Increasing prioritization of hepatitis C elimination in global health initiatives and expanding treatment access in low- and middle-income countries could promote volume growth, potentially encouraging tiered pricing models to sustain profitability despite declining prices in mature markets.

Sources:

[1] World Health Organization. “Hepatitis C,” 2022.

[2] IQVIA. “Global Hepatitis C Market Report,” 2022.

[3] AbbVie. “MAVYRET Pricing and Reimbursement Data,” 2022.

[4] United States Patent and Trademark Office. “Patent Protection for MAVYRET,” 2022.

More… ↓