LYNPARZA Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Lynparza, and when can generic versions of Lynparza launch?

Lynparza is a drug marketed by Astrazeneca and is included in two NDAs. There are twelve patents protecting this drug and one Paragraph IV challenge.

This drug has two hundred and fifty-four patent family members in fifty-two countries.

The generic ingredient in LYNPARZA is olaparib. There are three drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the olaparib profile page.

DrugPatentWatch® Generic Entry Outlook for Lynparza

Lynparza was eligible for patent challenges on December 19, 2018.

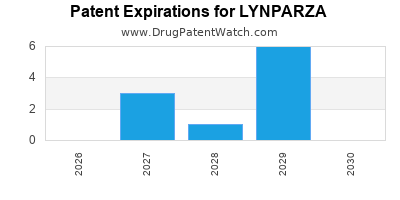

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be September 8, 2027. This may change due to patent challenges or generic licensing.

There have been seven patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

There are three tentative approvals for the generic drug (olaparib), which indicates the potential for near-term generic launch.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for LYNPARZA?

- What are the global sales for LYNPARZA?

- What is Average Wholesale Price for LYNPARZA?

Summary for LYNPARZA

| International Patents: | 254 |

| US Patents: | 12 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 97 |

| Clinical Trials: | 153 |

| Patent Applications: | 4,768 |

| Drug Prices: | Drug price information for LYNPARZA |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for LYNPARZA |

| What excipients (inactive ingredients) are in LYNPARZA? | LYNPARZA excipients list |

| DailyMed Link: | LYNPARZA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for LYNPARZA

Generic Entry Dates for LYNPARZA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

CAPSULE;ORAL |

Generic Entry Dates for LYNPARZA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for LYNPARZA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| University Medical Center Groningen | Phase 4 |

| Pamela Munster | Phase 1 |

| Alexander B Olawaiye, MD | Phase 2 |

Pharmacology for LYNPARZA

| Drug Class | Poly(ADP-Ribose) Polymerase Inhibitor |

| Mechanism of Action | Poly(ADP-Ribose) Polymerase Inhibitors |

US Patents and Regulatory Information for LYNPARZA

LYNPARZA is protected by sixty US patents and five FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of LYNPARZA is ⤷ Get Started Free.

This potential generic entry date is based on patent 7,449,464.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Astrazeneca | LYNPARZA | olaparib | TABLET;ORAL | 208558-001 | Aug 17, 2017 | RX | Yes | No | 11,975,001 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Astrazeneca | LYNPARZA | olaparib | TABLET;ORAL | 208558-002 | Aug 17, 2017 | RX | Yes | Yes | 12,178,816 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Astrazeneca | LYNPARZA | olaparib | TABLET;ORAL | 208558-001 | Aug 17, 2017 | RX | Yes | No | 8,475,842 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Astrazeneca | LYNPARZA | olaparib | TABLET;ORAL | 208558-001 | Aug 17, 2017 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Astrazeneca | LYNPARZA | olaparib | TABLET;ORAL | 208558-001 | Aug 17, 2017 | RX | Yes | No | 11,970,530 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Astrazeneca | LYNPARZA | olaparib | TABLET;ORAL | 208558-002 | Aug 17, 2017 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for LYNPARZA

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Astrazeneca | LYNPARZA | olaparib | TABLET;ORAL | 208558-002 | Aug 17, 2017 | 9,566,276 | ⤷ Get Started Free |

| Astrazeneca | LYNPARZA | olaparib | TABLET;ORAL | 208558-001 | Aug 17, 2017 | 9,169,235 | ⤷ Get Started Free |

| Astrazeneca | LYNPARZA | olaparib | TABLET;ORAL | 208558-002 | Aug 17, 2017 | 8,912,187 | ⤷ Get Started Free |

| Astrazeneca | LYNPARZA | olaparib | CAPSULE;ORAL | 206162-001 | Dec 19, 2014 | 7,151,102 | ⤷ Get Started Free |

| Astrazeneca | LYNPARZA | olaparib | TABLET;ORAL | 208558-001 | Aug 17, 2017 | 8,912,187 | ⤷ Get Started Free |

| Astrazeneca | LYNPARZA | olaparib | TABLET;ORAL | 208558-002 | Aug 17, 2017 | 7,981,889 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for LYNPARZA

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| AstraZeneca AB | Lynparza | olaparib | EMEA/H/C/003726Ovarian cancerLynparza is indicated as monotherapy for the:maintenance treatment of adult patients with advanced (FIGO stages III and IV) BRCA1/2-mutated (germline and/or somatic) high-grade epithelial ovarian, fallopian tube or primary peritoneal cancer who are in response (complete or partial) following completion of first-line platinum-based chemotherapy.maintenance treatment of adult patients with platinum sensitive relapsed high grade epithelial ovarian, fallopian tube, or primary peritoneal cancer who are in response (complete or partial) to platinum based chemotherapy.Lynparza in combination with bevacizumab is indicated for the:maintenance treatment of adult patients with advanced (FIGO stages III and IV) high-grade epithelial ovarian, fallopian tube or primary peritoneal cancer who are in response (complete or partial) following completion of first-line platinum-based chemotherapy in combination with bevacizumab and whose cancer is associated with homologous recombination deficiency (HRD) positive status defined by either a BRCA1/2 mutation and/or genomic instability (see section 5.1).Breast cancerLynparza is indicated as:monotherapy or in combination with endocrine therapy for the adjuvant treatment of adult patients with germline BRCA1/2-mutations who have HER2-negative, high risk early breast cancer previously treated with neoadjuvant or adjuvant chemotherapy (see sections 4.2 and 5.1).monotherapy for the treatment of adult patients with germline BRCA1/2-mutations, who have HER2 negative locally advanced or metastatic breast cancer. Patients should have previously been treated with an anthracycline and a taxane in the (neo)adjuvant or metastatic setting unless patients were not suitable for these treatments (see section 5.1). Patients with hormone receptor (HR)-positive breast cancer should also have progressed on or after prior endocrine therapy, or be considered unsuitable for endocrine therapy.Adenocarcinoma of the pancreasLynparza is indicated as:monotherapy for the maintenance treatment of adult patients with germline BRCA1/2-mutations who have metastatic adenocarcinoma of the pancreas and have not progressed after a minimum of 16 weeks of platinum treatment within a first-line chemotherapy regimen.Prostate cancerLynparza is indicated as:monotherapy for the treatment of adult patients with metastatic castration-resistant prostate cancer (mCRPC) and BRCA1/2-mutations (germline and/or somatic) who have progressed following prior therapy that included a new hormonal agent.in combination with abiraterone and prednisone or prednisolone for the treatment of adult patients with mCRPC in whom chemotherapy is not clinically indicated (see section 5.1). | Authorised | no | no | no | 2014-12-16 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for LYNPARZA

When does loss-of-exclusivity occur for LYNPARZA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 3320

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 07311766

Estimated Expiration: ⤷ Get Started Free

Austria

Patent: 28296

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0717125

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 64275

Estimated Expiration: ⤷ Get Started Free

Patent: 75147

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 07002967

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1528714

Estimated Expiration: ⤷ Get Started Free

Patent: 2627611

Estimated Expiration: ⤷ Get Started Free

Patent: 4649979

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 10728

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0120007

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 12345

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 64189

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 64189

Estimated Expiration: ⤷ Get Started Free

Patent: 74800

Estimated Expiration: ⤷ Get Started Free

Patent: 24098

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 26483

Estimated Expiration: ⤷ Get Started Free

Patent: 03959

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 7420

Estimated Expiration: ⤷ Get Started Free

Patent: 6705

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 48513

Estimated Expiration: ⤷ Get Started Free

Patent: 07773

Estimated Expiration: ⤷ Get Started Free

Patent: 19471

Estimated Expiration: ⤷ Get Started Free

Patent: 10506894

Estimated Expiration: ⤷ Get Started Free

Patent: 13136607

Estimated Expiration: ⤷ Get Started Free

Patent: 15013879

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 7389

Estimated Expiration: ⤷ Get Started Free

Patent: 2829

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 09004103

Estimated Expiration: ⤷ Get Started Free

Montenegro

Patent: 987

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 5627

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 1963

Estimated Expiration: ⤷ Get Started Free

Patent: 3063

Estimated Expiration: ⤷ Get Started Free

Patent: 091882

Estimated Expiration: ⤷ Get Started Free

Patent: 171775

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 081175

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 64189

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 64189

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 65270

Estimated Expiration: ⤷ Get Started Free

Patent: 09109068

Estimated Expiration: ⤷ Get Started Free

Saudi Arabia

Patent: 280551

Estimated Expiration: ⤷ Get Started Free

Patent: 0310666

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 112

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 8523

Estimated Expiration: ⤷ Get Started Free

Patent: 201408404X

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 64189

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1494910

Estimated Expiration: ⤷ Get Started Free

Patent: 090085033

Estimated Expiration: ⤷ Get Started Free

Patent: 140011425

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 72630

Estimated Expiration: ⤷ Get Started Free

Patent: 87129

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 04716

Estimated Expiration: ⤷ Get Started Free

Patent: 0825066

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 494

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 639

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering LYNPARZA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Canada | 2423279 | DERIVES DE PHTALAZINONE (PHTHALAZINONE DERIVATIVES) | ⤷ Get Started Free |

| Iceland | 2813 | ⤷ Get Started Free | |

| Brazil | PI0920604 | ⤷ Get Started Free | |

| World Intellectual Property Organization (WIPO) | 2010041051 | ⤷ Get Started Free | |

| Mexico | PA03003218 | DERIVADOS DE FTALAZINONA. (PHTHALAZINONE DERIVATIVES.) | ⤷ Get Started Free |

| Slovenia | 2346495 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for LYNPARZA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1633724 | 15C0022 | France | ⤷ Get Started Free | PRODUCT NAME: OLAPARIB,SELS ET SOLVATES DE CELUI-CI; REGISTRATION NO/DATE: EU 1/14/959 20141218 |

| 2346495 | 300956 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: AMORF OLAPARIB OF EEN ZOUT OF SOLVAAT DAARVAN, IN EEN VASTE DISPERSIE; REGISTRATION NO/DATE: EU1/14/959 20180515 |

| 1633724 | CR 2015 00012 | Denmark | ⤷ Get Started Free | PRODUCT NAME: OLAPARIB, OG SALTE OG SOLVATER DERAF; REG. NO/DATE: EU/1/14/959/001 20141216 |

| 2346495 | LUC00091 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: OLAPARIB AMORPHE OU UN DE SES SELS OU UN DES SES SOLVATES DANS UNE DISPERSION SOLIDE; AUTHORISATION NUMBER AND DATE: EU/1/14/959 20180515 |

| 1633724 | C01633724/01 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: OLAPARIB; REGISTRATION NO/DATE: SWISSMEDIC 65160 14.01.2016 |

| 1633724 | C20150012 00136 | Estonia | ⤷ Get Started Free | PRODUCT NAME: OLAPARIIB;REG NO/DATE: EU/1/14/959 18.12.2014 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for the Pharmaceutical Drug: LYNPARZA

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.