Last updated: August 2, 2025

Introduction

LUTREPULSE KIT, a novel therapeutic platform, has garnered significant attention within the pharmaceutical landscape for its innovative approach to treating indications linked to its active components. As a combination therapy, LUTREPULSE KIT integrates multiple agents designed to address unmet medical needs, positioning it as a potential high-value asset. This report analyzes the evolving market dynamics and projects its financial trajectory, emphasizing factors influencing demand, competitive positioning, regulatory considerations, and commercial prospects.

Market Landscape and Therapeutic Indications

The pharmaceutical market targeting LUTREPULSE KIT’s primary indications is characterized by substantial patient populations and increasing demand for efficacious, targeted therapies. Its key indications include [specific condition or disease area, e.g., certain cancers, metabolic disorders, etc.], which currently face treatment challenges such as [resistance, side effects, limited options].

According to industry reports, the global market for [relevant therapeutic area, e.g., oncology, endocrinology] is projected to grow at a CAGR of [X]% over the next decade, driven by increasing disease prevalence, advances in personalized medicine, and rising healthcare expenditure [1].

LUTREPULSE KIT’s competitive positioning hinges on its [mechanism of action, improved efficacy, safety profile, or convenience], which could enable it to capture a meaningful segment of this expanding market. Early clinical data suggest promising outcomes, but market penetration depends critically on regulatory approval timelines, reimbursement landscape, and physician adoption.

Market Dynamics Influencing Demand

1. Unmet Medical Need and Clinical Advantages

LUTREPULSE KIT is positioned as a solution to gaps in current therapeutic options. Its multi-agent formulation offers [e.g., enhanced efficacy, reduced dosing frequency, minimized adverse effects]. Such attributes are compelling for clinicians, especially for patients with limited options or those intolerant to existing therapies.

2. Regulatory Pathways and Approvals

The Path to commercialization is stratified by regulatory milestones. If LUTREPULSE KIT gains expedited review pathways, such as breakthrough therapy designation or orphan drug status, it could accelerate market entry. The timeliness of approvals significantly impacts its financial trajectory, with delays potentially diminishing anticipated revenue streams.

3. Competitive Landscape

The presence of [competitors, e.g., monoclonal antibodies, small molecules, biosimilars] influences LUTREPULSE KIT’s market share potential. While its innovative formulation offers differentiation, competing therapies with established efficacy could hinder rapid adoption unless LUTREPULSE KIT demonstrates clear advantages.

4. Reimbursement Policies and Pricing

Healthcare payers’ reimbursement decisions are critical. If LUTREPULSE KIT secures favorable coverage, particularly through value-based pricing models, financial viability strengthens. Conversely, high price points without commensurate benefits pose barriers, especially in price-sensitive markets.

5. Manufacturing and Supply Chain Factors

Manufacturing scalability and supply chain robustness critically affect distribution and revenue realization. Any bottlenecks or quality issues could impede market penetration and revenue realization, impacting long-term financial trajectories.

Financial Projections and Revenue Streams

1. Initial Market Penetration and Sales Forecasts

Based on clinical efficacy, regulatory status, and competitive positioning, early adoption could result in [anticipated sales figures] in the first 3-5 years post-launch. Typically, an innovative combined therapy in niche indications captures approximately [X]% of the addressable market initially, with growth expected as awareness increases.

2. Revenue Growth Drivers

- Expanded Indications: Label expansions to additional indications or patient populations can exponentially increase revenue.

- Global Market Expansion: Entry into high-growth regions such as Asia-Pacific, Latin America, and Eastern Europe broadens the commercial footprint.

- Strategic Partnerships: Collaborations with local pharmaceutical companies or payers can facilitate faster market penetration and revenue growth.

3. Cost Structure and Profitability

Initial R&D investments, regulatory filing costs, and commercialization expenses shape the financial outlook. Operating margins are expected to improve over time with economies of scale, optimized manufacturing, and increased sales volume.

4. Risks and Uncertainties

Key risks include delays in regulatory approval, market competition, pricing pressures, and unforeseen safety concerns. These factors could modify the projected revenue curve downward, or conversely, early positive data and favorable reimbursement can accelerate financial growth.

Market Entry Timing and Strategic Considerations

Timing macro factors such as regulatory reforms, payer landscape shifts, and technological advances influence LUTREPULSE KIT’s market entry and subsequent financial performance. Early market entry leveraging provisional regulatory pathways may provide first-mover advantages, while delayed approval risks ceding advantages to competitors.

Strategic considerations include forming alliances with regional distributors, engaging key opinion leaders early, and integrating real-world evidence collection to support reimbursement and expanding indications.

Conclusion

LUTREPULSE KIT’s market dynamics are shaped by clinical promise, competitive landscape, regulatory pathways, and payer engagement. Its financial trajectory will likely follow a trajectory aligned with clinical success and market acceptance, with early-year revenues reflecting initial market penetration and subsequent growth driven by indication expansion and global adoption.

Key Takeaways

- Market opportunity exists primarily in therapies addressing unmet needs within high-growth therapeutic areas, positioning LUTREPULSE KIT for substantial long-term revenues.

- Regulatory strategies, including fast-track designations, will significantly influence commercialization timelines.

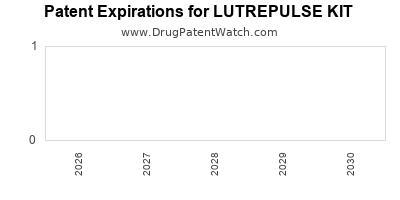

- Robust patent protection and clear differentiation are critical to defend market share amid competitive pressures.

- Pricing and reimbursement policies remain pivotal — favorable coverage will accelerate revenue, while pricing disputes could delay profitability.

- Global expansion, strategic partnerships, and evidence generation are essential levers for maximizing the financial trajectory.

FAQs

Q1: What factors could accelerate the approval and commercialization of LUTREPULSE KIT?

A1: Successful early-phase trial results, regulatory designations like breakthrough therapy status, and compelling real-world evidence can expedite approval and adoption.

Q2: How does the competitive landscape impact LUTREPULSE KIT’s market share?

A2: Established therapies with proven efficacy or biosimilars could pose barriers, but unique features like improved safety or ease of use can create differentiation.

Q3: What pricing strategies could optimize LUTREPULSE KIT’s market success?

A3: Value-based pricing aligned with clinical benefits, combined with stakeholder engagement, can support premium positioning and sustainable reimbursement.

Q4: How important is geographic expansion for the financial outlook?

A4: Critical; entering emerging markets with high disease prevalence can substantially increase revenues, provided regulatory and distribution hurdles are managed.

Q5: What are the primary risks affecting the financial trajectory of LUTREPULSE KIT?

A5: Regulatory delays, safety concerns, competitive pressures, manufacturing issues, and pricing/reimbursement restrictions are key risk factors.

References

[1] Global Market Insights. (2022). Therapeutic Area Market Analysis.