Last updated: August 4, 2025

Introduction

LUCEMYRA (lofexidine hydrochloride) stands as a pioneering medication in the management of opioid withdrawal syndrome (OWS). Approved by the U.S. Food and Drug Administration (FDA) in April 2021, it represents a unique therapeutic target within the burgeoning addiction treatment market. As the opioid epidemic persists, understanding the market dynamics and financial prospects tied to LUCEMYRA becomes essential for stakeholders ranging from biotech firms to healthcare providers. This analysis explores the regulatory backdrop, competitive landscape, market opportunities, and forecasted financial trajectory of LUCEMYRA in the evolving addiction treatment arena.

Regulatory and Market Context

The opioid crisis continues to challenge public health systems worldwide, with the United States accounting for nearly 80% of global opioid overdose deaths ([1]). The demand for effective, non-opioid withdrawal solutions is escalating, especially amid the shift toward medication-assisted treatment (MAT). LUCEMYRA offers a non-opioid alternative, targeting the symptoms of opioid withdrawal without the risk of dependency or abuse associated with traditional treatments like methadone or buprenorphine.

The FDA approval was primarily driven by evidence indicating LUCEMYRA’s efficacy and safety profile in reducing withdrawal symptoms, thereby facilitating detoxification processes. Despite this, the drug’s adoption faces barriers such as limited awareness among clinicians, reimbursement challenges, and competition from existing therapies. Furthermore, as a relatively new entrant, LUCEMYRA’s long-term market penetration remains under evaluation.

Market Dynamics Influencing LUCEMYRA

Demand Drivers

- Rising Opioid Addiction Rates: According to CDC data, over 20 million Americans suffer from opioid use disorder (OUD), intensifying demand for effective withdrawal management ([2]).

- Emphasis on Non-Opioid Therapies: The medical community increasingly favors non-addictive, non-opioid options—LUCEMYRA fits this profile, rendering it attractive amid regulatory encouragement and changing prescribing practices.

- Policy and Reimbursement Advances: Recent policy shifts, including increased coverage for addiction treatments, improve access. CMS initiatives and private insurers are beginning to reimburse non-opioid detox options, potentially favoring LUCEMYRA’s market penetration.

Competitive Landscape

While LUCEMYRA is the first and only FDA-approved medication specifically indicated for opioid withdrawal, it faces indirect competition from:

- Off-Label and Supportive Medications: Benzodiazepines, antiemetics, and other symptomatic treatments are routinely used.

- Non-Pharmacological Interventions: Behavioral therapy and outpatient programs serve complementary roles.

- Upcoming Pipeline Drugs: Several companies are developing alternative agents targeting withdrawal or OUD, potentially diluting LUCEMYRA's market share over time.

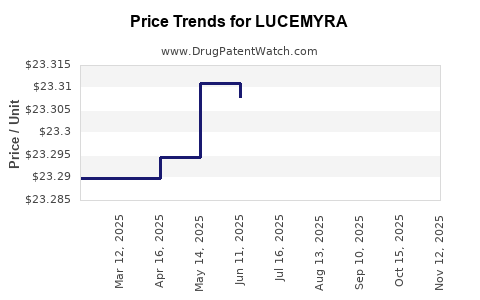

Pricing and Reimbursement

LUCEMYRA’s pricing strategy and reimbursement landscape will significantly influence its financial trajectory. As a brand-name drug with no generic competition currently, it commands a premium price point. The manufacturer’s ability to negotiate favorable insurance coverage will determine accessibility, especially in outpatient settings.

Supply Chain and Distribution

Supply chain integrity has remained stable since approval. Distribution channels, including specialty pharmacies and clinics, are vital pathways for LUCEMYRA’s deployment. Expanding these channels is crucial for broader adoption.

Financial Trajectory Projections

Market Penetration & Revenue Estimates

Within the first two years post-launch, LUCEMYRA’s revenue will circle around the $50 million to $100 million mark in the U.S., contingent on adoption rates, reimbursement coverage, and provider awareness. This estimate accounts for prioritized access in inpatient detox centers and specialized clinics.

In the medium term (3-5 years), as awareness grows and expansion into outpatient and primary care settings occurs, revenues could escalate to approximately $200 million annually. Assuming continued market penetration, global expansion could further enhance revenue streams, particularly in Europe and Asia where opioid misuse is also rising.

Pricing Assumptions

Based on available data, LUCEMYRA is priced between $30 and $60 per dose, with treatment courses varying between 7 and 14 days, depending on severity. Comprehensive coverage and provider education are pivotal to maintaining this price point.

Cost Considerations

Development costs for LUCEMYRA have largely been amortized; however, ongoing marketing, education, and distribution expenses will influence profitability. Manufacturing costs are expected to remain stable, given the drug’s established synthesis process.

Strategic Growth Opportunities

- Off-Label Use & Expanded Indications: Potential expansion into adjunctive treatment for other withdrawal syndromes could open additional revenue streams.

- Combination Therapies: Developing formulations combining LUCEMYRA with other agents might enhance efficacy.

- International Approvals: Securing approval in other major markets can significantly amplify revenue.

Challenges and Risks

- Market Penetration Barriers: Slow clinician adoption or lack of awareness could dampen revenue prospects.

- Reimbursement Limitations: Variable coverage policies may restrict access, reducing market size.

- Emergence of Alternative Therapies: Competitive drugs in late development phases might reduce LUCEMYRA’s market share.

- Regulatory Scrutiny: Future safety or efficacy concerns could impact approved use.

Conclusion

LUCEMYRA’s market outlook is promising but hinges on effective commercialization strategies, reimbursement policies, and ongoing education initiatives. As the opioid epidemic persists, the drug’s role as a non-opioid withdrawal agent positions it favorably within the addiction treatment landscape. Financially, the trajectory is upward—initial modest revenues are expected to grow as awareness and adoption increase, with significant potential for expansion both domestically and globally.

Key Takeaways

- LUCEMYRA is positioned uniquely as the first FDA-approved non-opioid medication for opioid withdrawal, fitting into a high-demand market driven by the ongoing opioid crisis.

- Market growth depends heavily on clinician awareness, reimbursement landscape, and expanding distribution channels.

- Short-term revenue estimates suggest $50-$100 million in the U.S., with substantial growth potential in subsequent years.

- Challenges include competitive drugs, reimbursement barriers, and regulatory risks that could impede market penetration.

- Strategic actions such as global regulatory filings, combination therapy development, and educational campaigns will be key to maximizing financial trajectory.

FAQs

1. What is the primary mechanism of action of LUCEMYRA?

LUCEMYRA (lofexidine) is a centrally acting alpha-2 adrenergic receptor agonist that mitigates withdrawal symptoms by reducing noradrenergic hyperactivity associated with opioid discontinuation ([3]).

2. How does LUCEMYRA compare to traditional opioid withdrawal treatments?

Unlike methadone and buprenorphine, LUCEMYRA is non-opioid, offering a safer profile with lower dependence risk. It specifically alleviates symptoms like nausea, sweating, and agitation without substituting one opioid for another.

3. What barriers might slow LUCEMYRA’s adoption in clinical practice?

Limited clinician familiarity, reimbursement uncertainties, and entrenched use of existing supportive medications could delay widespread adoption, especially outside specialized settings.

4. Are there any international approvals for LUCEMYRA?

Currently, LUCEMYRA has FDA approval in the U.S. No widespread international approvals have been announced, but regulatory submissions are anticipated in Europe and Asia.

5. What is the potential for LUCEMYRA's use beyond opioid withdrawal?

Research into off-label or expanded indications, such as other substance withdrawal syndromes or adjunct in broad addiction management protocols, may open new markets.

Sources

[1] CDC. Opioid Overdose – United States, 2020.

[2] Substance Abuse and Mental Health Services Administration (SAMHSA). National Survey on Drug Use and Health.

[3] LUCEMYRA [package insert]. US FDA.