Last updated: July 28, 2025

Introduction

LUCEMYRA (lofexidine) represents a significant pharmaceutical innovation aimed at addressing opioid withdrawal management. Approved by the U.S. Food and Drug Administration (FDA) in June 2018, LUCEMYRA is marketed as the first non-opioid medication specifically designed to alleviate withdrawal symptoms in adults undergoing opioid detoxification. As the global opioid crisis persists, understanding LUCEMYRA's market dynamics and price trajectory is crucial for stakeholders including pharmaceutical companies, healthcare providers, policymakers, and investors.

Market Overview

1. Market Size and Demand Drivers

The global opioid withdrawal management market is expanding due to the rising prevalence of opioid use disorder (OUD). According to the Substance Abuse and Mental Health Services Administration (SAMHSA), over 10 million individuals aged 12 or older in the U.S. misused opioids in 2020, fueling demand for effective withdrawal therapies.

LUCEMYRA primarily targets adults in detox programs, a subset within the broader OUD treatment market. The core drivers include:

- Rising opioid overdose deaths, which peaked at over 107,000 in the U.S. in 2021 (CDC), emphasizing the necessity of detoxification therapies.

- Increasing adoption of non-opioid treatments for withdrawal management, driven by safety concerns and regulatory pressures.

- Expanding healthcare infrastructure supporting comprehensive addiction treatment programs.

2. Market Penetration and Adoption

Despite its innovative profile, LUCEMYRA's market penetration remains moderate predominantly due to factors such as limited awareness among prescribers, competition from established therapies, and cost considerations.

Key competitors include:

- Sympathomimetic agents like clonidine and lofexidine (used off-label in some jurisdictions).

- Fluvoxamine and other off-label options.

- Behavioral interventions and supportive care, which often accompany pharmacologic treatments.

Given that LUCEMYRA is the only FDA-approved non-opioid treatment of its kind, its market potential hinges on prescriber education, insurance reimbursement policies, and integration into existing detox protocols.

3. Regulatory and Reimbursement Factors

Reimbursement and pricing policies significantly influence LUCEMYRA's market deployment. The drug’s inclusion in insurance formularies, particularly Medicaid and Medicare, determines accessibility.

- As of mid-2022, LUCEMYRA was priced approximately $1,050 for a 30-dose supply, translating to $35 per dose ([2]).

- The Centers for Medicare & Medicaid Services (CMS) had not yet listed specific reimbursement codes initially, but subsequent coding inclusion and formulary approvals are expected to facilitate broader access.

4. Geographic and Demographic Expansion

Currently approved solely within the United States, LUCEMYRA’s international availability is limited. However, global markets such as Europe and Asia exhibit rising opioid misuse, presenting an opportunity for expansion. Regulatory approval processes and pricing negotiations will determine timeline and market share growth outside North America.

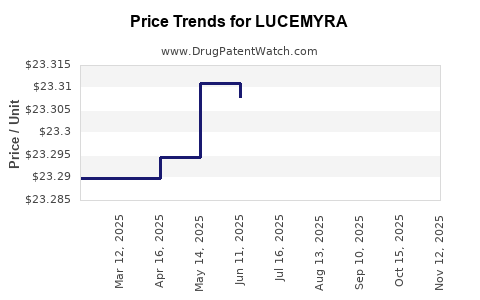

Price Projections

Short-Term (1-3 Years)

- Price stability with slight reductions: Given the novelty, initial pricing likely maintains around $1,000–$1,200 per treatment course, depending on negotiations with payers and market uptake.

- Potential discounts: Payers may negotiate discounts or rebates, especially with expanded formulary inclusion, reducing per-course costs by 10–15%.

Medium-Term (4-7 Years)

- Price adjustments driven by market competition: While currently the sole FDA-approved non-opioid, competition from off-label or emerging therapies may exert downward pressure.

- Possible price decline to $800–$1,000 per course through increased volume, biosimilar development, or generic manufacturing agreements, pending patent exclusivity periods.

Long-Term (8+ Years)

- Patent expiry and biosimilars: Patent protection expiration may open the market to generics, dramatically reducing prices to $200–$500 per course.

- Market maturation: Widespread acceptance and international approval could diversify pricing pressures and reimbursement models, stabilizing prices within a broader range depending on economic factors and healthcare systems.

Factors Influencing Price Dynamics

- Patent and Regulatory Milestones: Patent expiry or regulatory challenges threaten pricing power.

- Market Penetration Rates: Broader adoption boosts volume, potentially decreasing per-unit costs.

- Reimbursement Policies: Favorable payer coverage supports higher pricing, whereas restrictive policies exert downward pressure.

- Emergence of Alternatives: New therapies or shifts toward behavioral interventions could diminish demand.

Strategic Outlook for Stakeholders

Pharmaceutical companies should prioritize expanding LUCEMYRA’s clinical evidence base, advocating for formulary inclusion, and exploring international regulatory pathways. Payers and providers should focus on evidence-based value assessments to support favorable reimbursement terms. Investors need to monitor patent landscapes, regulatory developments, and market adoption rates to inform valuation models.

Key Takeaways

- LUCEMYRA’s market is driven by escalating opioid withdrawal cases and the need for non-opioid treatments.

- Current pricing (~$1,000 per course) reflects its novel status; market expansion and competition will influence future pricing.

- Regulatory approvals outside the U.S. and streamlined reimbursement processes are vital for increasing accessibility.

- Patent expirations and biosimilar entries anticipate significant price reductions over the next decade.

- Strategic stakeholder actions—including clinical evidence generation and payer negotiations—are essential to maximize market potential and optimize price trajectories.

FAQs

1. What factors are most likely to impact LUCEMYRA’s market growth?

Key factors include increased awareness among healthcare providers, expanded insurance coverage, regulatory approvals in international markets, and competitive product development.

2. How does LUCEMYRA compare cost-wise to alternative withdrawal therapies?

LUCEMYRA’s estimated treatment cost ($1,000 per course) is competitive when contrasted with inpatient detox programs and off-label use of other medications, though actual costs vary depending on healthcare settings and coverage.

3. What are the primary barriers to LUCEMYRA’s wider adoption?

Limited prescriber familiarity, reimbursement challenges, initial high costs, and its exclusive US approval restrict broader use.

4. How might patent expirations influence LUCEMYRA’s pricing?

Patent expiry would allow generic manufacturers to enter the market, likely reducing prices by 50–70%, increasing accessibility, and expanding patient reach.

5. Are there emerging therapies that could challenge LUCEMYRA’s market position?

Yes, ongoing research into alternative non-opioid agents, behavioral therapies, and combination approaches could provide competitive options in the future.

References

[1] CDC. (2022). Drug overdose deaths increasing.

[2] GoodRx. (2022). LUCEMYRA pricing and coverage details.