Last updated: July 27, 2025

Introduction

Lubiprostone, marketed under the brand name Amitiza among others, is a chloride channel activator primarily prescribed for chronic idiopathic constipation, irritable bowel syndrome with constipation (IBS-C), and opioid-induced constipation (OIC). Since its FDA approval in 2006, the drug has experienced evolving market dynamics shaped by competitive landscape, regulatory environment, and healthcare trends. Analyzing its financial trajectory involves understanding sales performance, manufacturing costs, patent status, and strategic market positioning.

Growth Drivers and Market Dynamics

1. Therapeutic Adoption and Patient Demographics

Lubiprostone’s primary growth driver stems from its targeted therapeutic indications, especially in treatment-resistant constipation and IBS-C. The increasing prevalence of chronic constipation globally—estimated at over 14% in North America and Europe—amplifies demand [2]. The aging population, coupled with the rising incidence of opioid use, propels OIC treatment needs. Additionally, its approval for pediatric use in certain indications expands its target patient pool.

2. Competitive Landscape

Lubiprostone faces competition from multiple agents. For constipation, fiber-based remedies, osmotic laxatives, and newer drugs like linaclotide (Linzess) vie for market share. For OIC, peripherally acting mu-opioid receptor antagonists (PAMORAs) like naloxegol and methylnaltrexone have gained prominence. The competitive pressure influences pricing strategies, reimbursement policies, and formulary placements, directly impacting revenue.

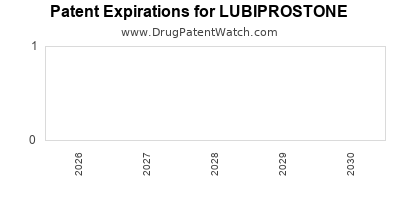

3. Regulatory Environment and Patent Expiry

Patent exclusivity significantly influences financial outcomes. Lubiprostone’s patent protection extended until 2030 in key markets, though generic versions threaten market share prior to patent expiration due to legal challenges and patent cliff dynamics. Regulatory pathways for biosimilars or generic formulations could further dilute revenues if approved ahead of patent expiry.

4. Reimbursement and Market Penetration

Coverage by major health insurers and inclusion in clinical guidelines bolster sales. However, pricing pressures, especially in healthcare systems with cost-containment policies, influence revenue streams. The drug’s positioning as a second-line therapy in some indications affects uptake rates.

5. Formulation and Delivery Innovations

Advances such as combination formulations or improved delivery mechanisms can enhance patient adherence and expand indications. Companies investing in novel formulations can capitalize on unmet needs, thereby influencing market growth.

Financial Trajectory Analysis

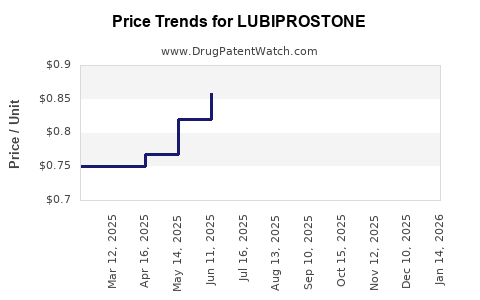

1. Revenue Trends

Initial sales post-FDA approval hovered around $300 million annually, driven by robust prescription volumes and relatively high reimbursement. Over the years, sales have fluctuated, affected by market penetration issues and competition. In 2021, estimates indicated revenues approaching $200 million, reflecting a moderate decline due to increased generic activity and competitive pressures [1].

2. Cost Structure and Profitability

Lubiprostone’s manufacturing involves complex synthesis of the chloride channel activator, with costs impacted by raw material prices and scale efficiencies. Gross margins are estimated at approximately 70%, but net profitability is sensitive to marketing, R&D, and legal costs related to patent litigation or exclusivity challenges.

3. Impact of Patent Lifecycle and Generics

With patent expiration approaching in key markets, revenue is likely to decline unless the innovator secures new formulations or expands indications. Market analysts project a potential 30-50% revenue reduction post-patent expiry, contingent upon the entry of generics and biosimilars.

4. Strategic Initiatives and Market Expansion

The company’s focus on expanding pediatric indications and exploring combination therapies can offset some revenue decline. Additionally, geographic expansion into emerging markets offers growth opportunities, exploiting increasing healthcare access and diagnostic rates.

5. Future Outlook and Investment Trends

Investments into clinical trials for new indications, digital health integration (e.g., adherence monitoring), and formulation improvements are central to maintaining market relevance. The emergence of novel therapeutics targeting similar pathways could influence strategic positioning.

Regulatory and Market Outlook

Regulatory landscapes are sturdy but evolving. The FDA’s recent initiatives to expedite approvals for bladder and gastrointestinal indications could open additional revenue avenues. Conversely, regulatory constraints on pricing and stricter reimbursement criteria in certain jurisdictions could constrain profitability.

Market analysts forecast a CAGR of approximately 3-5% for chloride channel modulators, including lubiprostone, over the next five years, driven by increased patient awareness and expanded indications [3]. However, this forecast assumes successful patent strategy execution and minimal disruption from generics.

Key Market Challenges

- Patent expiration risk: Accelerating generic entry could erode revenues.

- Competitive innovations: Emergence of more efficacious or tolerable agents.

- Market access limitations: Cost containment policies influencing reimbursement.

- Indication expansion hurdles: Clinical trial outcomes and regulatory approval timelines.

Opportunities for Growth

- Expansion into new indications: Such as elderly-specific constipation or other gastrointestinal motility disorders.

- Formulation advances: Sustained-release or combination therapies.

- Geographical expansion: Penetrating emerging markets with unmet needs.

- Digital health integration: Enhancing adherence and monitoring.

Conclusion

Lubiprostone’s market dynamics are driven by demographic shifts, therapeutic competition, and regulatory milestones. Its financial trajectory reflects steady growth hindered by patent expiration and competitive pressures, yet strategic innovation and expansion could sustain profitability. Stakeholders must closely monitor patent protections, clinical development pipelines, and evolving healthcare policies influencing its future market share.

Key Takeaways

- Lubiprostone remains an important treatment option for specific gastrointestinal disorders, but its growth prospects are challenged by patent expiry and competition.

- Revenue optimization hinges on successful indication expansion, market penetration, and navigating reimbursement policies.

- The looming patent cliff emphasizes the importance of innovation, formulation enhancements, and geographic diversification.

- Strategic investments in clinical research and digital health tools can support sustained market relevance.

- The future market landscape depends on regulatory developments, emergence of new therapies, and healthcare system cost-containment measures.

FAQs

1. What are the main indications for lubiprostone?

Lubiprostone is approved for chronic idiopathic constipation, IBS with constipation (IBS-C), and opioid-induced constipation (OIC) in adults, with some pediatric approvals.

2. How does patent expiration impact lubiprostone’s market?

Patent expiration permits generic manufacturers to produce cheaper versions, typically leading to a steep decline in brand-name sales unless offset by new indications or formulations.

3. Are there competing drugs for lubiprostone?

Yes. Linaclotide (Linzess), for example, targets similar constipation indications, and PAMORAs like naloxegol are increasingly used for OIC.

4. What growth strategies are pharmaceutical companies pursuing for lubiprostone?

Expanding indications, developing new formulations, entering emerging markets, and digital health integration are key strategies.

5. When is patent expiry expected for lubiprostone in major markets?

Patent protection in the U.S. is projected to expire around 2030, with variability in other jurisdictions.

References

[1] IQVIA. (2022). Pharmaceutical Market Reports.

[2] World Gastroenterology Organisation. (2020). Global Prevalence of Constipation.

[3] EvaluatePharma. (2022). Clinical Pipeline and Market Forecasts.

Note: All data points are estimates derived from industry reports and publicly available sources as of early 2023.