LOVENOX Drug Patent Profile

✉ Email this page to a colleague

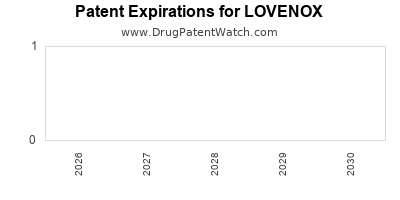

When do Lovenox patents expire, and when can generic versions of Lovenox launch?

Lovenox is a drug marketed by Sanofi Aventis Us and is included in one NDA.

The generic ingredient in LOVENOX is enoxaparin sodium. There are thirteen drug master file entries for this compound. Sixteen suppliers are listed for this compound. Additional details are available on the enoxaparin sodium profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Lovenox

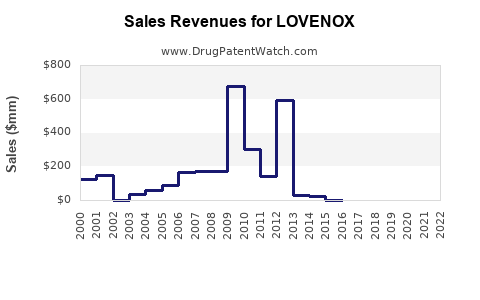

A generic version of LOVENOX was approved as enoxaparin sodium by SANDOZ INC on November 28th, 2011.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for LOVENOX?

- What are the global sales for LOVENOX?

- What is Average Wholesale Price for LOVENOX?

Summary for LOVENOX

| US Patents: | 0 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 3 |

| Raw Ingredient (Bulk) Api Vendors: | 17 |

| Clinical Trials: | 63 |

| Patent Applications: | 2,858 |

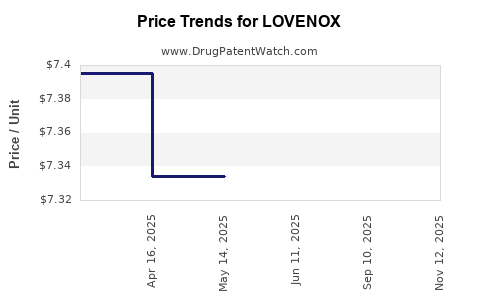

| Drug Prices: | Drug price information for LOVENOX |

| What excipients (inactive ingredients) are in LOVENOX? | LOVENOX excipients list |

| DailyMed Link: | LOVENOX at DailyMed |

Recent Clinical Trials for LOVENOX

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Fertility Center of Las Vegas | Phase 4 |

| Regeneron Pharmaceuticals | Phase 2 |

| Children's Hospital Medical Center, Cincinnati | Phase 2/Phase 3 |

Pharmacology for LOVENOX

| Drug Class | Low Molecular Weight Heparin |

US Patents and Regulatory Information for LOVENOX

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Sanofi Aventis Us | LOVENOX | enoxaparin sodium | INJECTABLE;INTRAVENOUS, SUBCUTANEOUS | 020164-009 | Jan 23, 2003 | AB | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Sanofi Aventis Us | LOVENOX (PRESERVATIVE FREE) | enoxaparin sodium | INJECTABLE;SUBCUTANEOUS | 020164-005 | Mar 27, 1998 | AP | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Sanofi Aventis Us | LOVENOX (PRESERVATIVE FREE) | enoxaparin sodium | INJECTABLE;SUBCUTANEOUS | 020164-003 | Mar 27, 1998 | AP | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Sanofi Aventis Us | LOVENOX (PRESERVATIVE FREE) | enoxaparin sodium | INJECTABLE;SUBCUTANEOUS | 020164-007 | Jun 2, 2000 | AP | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for LOVENOX

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Sanofi Aventis Us | LOVENOX | enoxaparin sodium | INJECTABLE;INTRAVENOUS, SUBCUTANEOUS | 020164-009 | Jan 23, 2003 | ⤷ Get Started Free | ⤷ Get Started Free |

| Sanofi Aventis Us | LOVENOX | enoxaparin sodium | INJECTABLE;INTRAVENOUS, SUBCUTANEOUS | 020164-009 | Jan 23, 2003 | ⤷ Get Started Free | ⤷ Get Started Free |

| Sanofi Aventis Us | LOVENOX | enoxaparin sodium | INJECTABLE;INTRAVENOUS, SUBCUTANEOUS | 020164-009 | Jan 23, 2003 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for LOVENOX

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Techdow Pharma Netherlands B.V. | Inhixa | enoxaparin sodium | EMEA/H/C/004264Inhixa is indicated for adults for:Prophylaxis of venous thromboembolism, particularly in patients undergoing orthopaedic, general or oncological surgery.Prophylaxis of venous thromboembolism in patients bedridden due to acute illnesses including acute heart failure, acute respiratory failure, severe infections, as well as exacerbation of rheumatic diseases causing immobilisation of the patient (applies to strengths of 40 mg/0.4 mL).Treatment of deep vein thrombosis (DVT), complicated or uncomplicated by pulmonary embolism.Treatment of unstable angina and non Q wave myocardial infarction, in combination with acetylsalicylic acid (ASA).Treatment of acute ST segment elevation myocardial infarction (STEMI) including patients who will be treated conservatively or who will later undergo percutaneous coronary angioplasty (applies to strengths of 60 mg/0.6 mL, 80 mg/0.8 mL, and 100 mg/1 mL).Blood clot prevention in the extracorporeal circulation during haemodialysis. | Authorised | no | yes | no | 2016-09-15 | |

| Pharmathen S.A. | Thorinane | enoxaparin sodium | EMEA/H/C/003795Thorinane is indicated for adults for:, , - Prophylaxis of venous thromboembolism, particularly in patients undergoing orthopaedic, general or oncological surgery., , - Prophylaxis of venous thromboembolism in patients bedridden due to acute illnesses including acute heart failure, acute respiratory failure, severe infections, as well as exacerbation of rheumatic diseases causing immobilisation of the patient (applies to strengths of 40 mg/0.4 mL)., , - Treatment of deep vein thrombosis (DVT), complicated or uncomplicated by pulmonary embolism., , - Treatment of unstable angina and non Q wave myocardial infarction, in combination with acetylsalicylic acid (ASA)., , - Treatment of acute ST segment elevation myocardial infarction (STEMI) including patients who will be treated conservatively or who will later undergo percutaneous coronary angioplasty (applies to strengths of 60 mg/0.6 mL, 80 mg/0.8 mL, and 100 mg/1 mL)., , - Blood clot prevention in the extracorporeal circulation during haemodialysis., , Prevention and treatment of various disorders related to blood clots in adults., | Withdrawn | no | yes | no | 2016-09-14 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for LOVENOX

See the table below for patents covering LOVENOX around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Hungary | T57796 | ⤷ Get Started Free | |

| Denmark | 511381 | ⤷ Get Started Free | |

| Japan | H04226101 | MIXTURE OF LOW MOLECULAR POLYSACCHARIDES, AND ITS PREPARATION AND USE | ⤷ Get Started Free |

| Denmark | 247981 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for LOVENOX (Enoxaparin Sodium)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.