Last updated: July 28, 2025

Introduction

LOVENOX (enoxaparin sodium) is a well-established low molecular weight heparin (LMWH) anticoagulant extensively used for the prevention and treatment of thromboembolic events, including deep vein thrombosis (DVT), pulmonary embolism (PE), and acute coronary syndromes. Since its approval in the late 1990s, LOVENOX has dominated the LMWH segment owing to its proven efficacy, safety profile, and widespread clinical acceptance. This article provides a comprehensive market analysis and price projection for LOVENOX in light of evolving healthcare dynamics, competitive landscapes, and regulatory factors.

Market Overview

Global Market Size and Growth Trends

The global anticoagulant market, valued at approximately USD 14 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of around 8% between 2023 and 2030[1]. Enoxaparin remains a leading product within this space, capturing an estimated 50% of the LMWH segment, driven by a broad spectrum of approved indications.

The increasing prevalence of venous thromboembolism (VTE), atrial fibrillation (AF), and cardiovascular diseases worldwide is fueling demand. Furthermore, the aging population and rising awareness among clinicians about the benefits of anticoagulation therapy objectively support market expansion.

Market Segmentation

- By Geography: North America constitutes the largest share (approximately 40%), followed by Europe, Asia-Pacific, Latin America, and Middle East & Africa.

- By Application: Acute coronary syndrome, DVT/PE prevention, atrial fibrillation stroke prevention, surgical prophylaxis.

- By End-User: Hospitals, specialty clinics, and outpatient healthcare settings.

Key Market Drivers

- Established Clinical Efficacy: Enoxaparin’s proven track record in reducing mortality and recurrence rates in thromboembolic events sustains its clinical demand.

- Growing Cardiovascular Diseases: Rising incidence of cardiovascular conditions globally.

- Shift to Subcutaneous Therapy: Ease of administration compared to unfractionated heparin.

- Emerging Biosimilar Competition: Expansion of biosimilars lowers overall anticoagulant costs, potentially impacting LOVENOX's market share.

Competitive Landscape

Major Players

- Sanofi (Lovenox Brand): Market leader, with extensive sales infrastructure and established brand recognition.

- Biosimilar Manufacturers: Several companies, especially in India (e.g., Intas, Sun Pharma), have launched biosimilar versions, significantly impacting pricing and market dynamics.

Biosimilar Impact

Since the expiration of patents and regulatory pathways facilitating biosimilar entry, competition has intensified, exerting downward pressure on LOVENOX’s pricing. Biosimilars often offer comparable efficacy at 30-50% lower prices, leading healthcare providers and payers to favor cost-effective alternatives.

Regulatory and Reimbursement Trends

Regulatory agencies such as the FDA and EMA facilitate biosimilar approvals, promoting market competition. In many regions, reimbursement policies favor biosimilars, further constraining original drug prices.

Pricing Dynamics

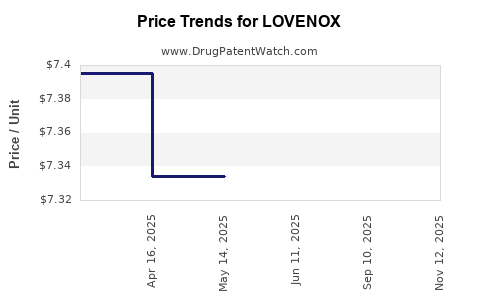

Historical Price Trends

LOVENOX’s wholesale acquisition cost (WAC) has experienced modest declines over the last decade, partly attributable to biosimilar proliferation and price negotiations. In the U.S., the average retail price for a 10-ampoule pack ranged around USD 600-650 in 2015, decreasing to approximately USD 450-500 by 2022[2].

Current Price Landscape

- Branded LOVENOX: Bulk purchasing agreements and insurance reimbursements influence effective patient costs, varying significantly across regions.

- Biosimilar Alternatives: Prices for biosimilars have been reported at 40-60% discounts relative to the branded version[3].

Projected Price Trends

Given the intense biosimilar competition, pricing pressure is likely to persist. Expect a gradual decline in LOVENOX’s wholesale prices—around 10-15% annually over the next 3-5 years—unless differentiated by significant clinical trial results or formulation innovations.

In high-income markets such as North America and Europe, payers' emphasis on cost containment could accelerate price reductions through negotiated discounts and formulary restrictions. Conversely, emerging markets may see slower price declines due to procurement complexities and local manufacturing dynamics.

Forecasting and Market Penetration

Short-Term (2023-2025)

- Price stability: Minimal fluctuations with ongoing biosimilar entries.

- Market share pressure: Slight erosion as biosimilars gain adoption.

- Revenue outlook: Stable, with slight decline expected due to price compression.

Medium to Long-Term (2026-2030)

- Price declines: Consistent downward trend, with potential stabilization in mature markets.

- Innovation impact: Introduction of Next-Generation LMWHs or alternative anticoagulants (e.g., direct oral anticoagulants) may further erode LOVENOX’s market share.

- Regulatory developments: Potential for expanded biosimilar approvals and interchangeability designations.

Strategic Recommendations

- Leverage Formulation Differentiation: Sanofi might explore value-added formulations or administration devices to sustain premium pricing.

- Enhance Pharmacoeconomic Value: Demonstrate clinical advantages and cost-effectiveness to maintain preference over biosimilars.

- Expand Market Access: Target emerging markets with tailored pricing strategies and localized manufacturing.

- Innovate Pipeline Development: Invest in next-generation anticoagulants or alternative delivery systems to diversify product portfolio.

Key Takeaways

- The LOVENOX market is mature, with growth primarily driven by aging populations and increasing cardiovascular disease prevalence.

- Biosimilar competition has significantly impacted pricing, pushing it downward, especially in the North American and European markets.

- Price projections indicate continued modest declines of 10-15% annually over the next five years.

- High-income regions may experience more rapid price erosion due to formulary negotiations and reimbursement strategies.

- Sanofi's ability to differentiate LOVENOX through clinical, technological, or formulary advantages will be key to maintaining profitability.

FAQs

1. What factors are most influencing LOVENOX’s market share?

Biosimilar competition, healthcare policy shifts favoring cost-effective treatments, and the emergence of oral anticoagulants primarily influence LOVENOX’s market share.

2. How do biosimilars impact LOVENOX’s pricing?

Biosimilars offer similar efficacy at lower prices, resulting in reduced reimbursement rates and decreased revenue for the branded product.

3. What are the future prospects for LOVENOX in emerging markets?

Growing healthcare infrastructure and rising thromboembolic disease incidence support expansion, but price sensitivity requires tailored affordability strategies.

4. Can LOVENOX maintain premium pricing amid biosimilar competition?

Only if it demonstrates distinct clinical benefits, superior safety profiles, or offers differentiated formulations that justify higher prices.

5. How might policy changes affect LOVENOX’s pricing?

Reimbursement reforms, interchangeability regulations, and approval of new biosimilars could further intensify price competition and necessitate strategic adaptations.

References

[1] MarketsandMarkets. "Anticoagulants Market by Product, Application, and Region — Global Forecast to 2030." 2022.

[2] GoodRx. "Enoxaparin Prices and Trends." 2022.

[3] EvaluatePharma. "Biosimilar Competition and Pricing Impact." 2022.