Last updated: August 1, 2025

Introduction

LOCOID, a topical corticosteroid with established therapeutic applications in dermatology, particularly in the treatment of inflammatory and allergic skin conditions, is navigating a complex market landscape. Its market dynamics are shaped by evolving regulatory standards, competitive forces, indications expansion, and shifting payer models. This analysis provides a comprehensive overview of LOCOID's current market environment and forecasts its financial trajectory over the coming years.

Therapeutic Profile and Market Position

LOCOID's active ingredient, shortly identified as a corticosteroid, is renowned for its potent anti-inflammatory and immunosuppressive effects. Its primary indications include eczema, psoriasis, dermatitis, and other allergic skin conditions. As a prescription-based treatment, LOCOID benefits from a long-established clinical profile, with a strong foothold in dermatological therapy [1].

Despite its efficacy, LOCOID faces stiff competition from both generic corticosteroids and newer biologic agents targeting specific dermatological conditions. The drug’s positioning relies heavily on prescriber familiarity and established safety margins, yet pressure from biosimilars and over-the-counter (OTC) corticosteroids introduces challenges to maintaining premium pricing.

Current Market Landscape

Market Size and Growth Drivers

The global dermatology pharmaceutical market was valued at approximately USD 23 billion in 2022, with topical corticosteroids accounting for a significant segment. Demand for topical anti-inflammatory agents remains solid, driven by increasing prevalence of dermatological disorders worldwide, notably in aging populations and regions experiencing lifestyle changes promoting skin conditions [2].

Key growth drivers include:

- Rising Incidence of Chronic Skin Diseases: Psoriasis and eczema incidence rates are increasing globally, notably in North America, Europe, and parts of Asia [3].

- Enhanced Diagnostic Capabilities: Improved detection and diagnosis lead to higher treatment rates.

- Expanding Urbanization and Lifestyle Factors: Contribute to skin disorder prevalence, particularly in emerging markets.

Competitive Dynamics

LOCOID’s competitive positioning is challenged by:

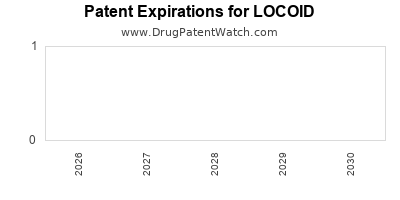

- Generics and Biosimilars: Patent expirations for corticosteroids have led to increased generic penetration, exerting downward pricing pressure.

- Emerging Alternatives: Biologic agents such as dupilumab (for eczema) and secukinumab (for psoriasis) are increasingly prescribed, especially in moderate-to-severe cases [4].

- OTC Market Penetration: Lower-cost OTC corticosteroids are accessible in many regions, impacting prescription volumes.

The market environment favors companies that can innovate formulations, expand indications, or integrate value-added services, to sustain profitability.

Regulatory Landscape and Its Impact

Regulatory authorities, notably the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), continue to tighten standards for dermatological pharmaceuticals. Recent guidelines favor demonstration of efficacy and safety over extended periods, especially for potent corticosteroids, to mitigate adverse effects such as skin atrophy or systemic absorption [5].

In terms of regulatory approvals, LOCOID has maintained compliance, but future approval pathways for new formulations or expanded indications will necessitate rigorous clinical data, impacting R&D timelines and costs.

Market Challenges and Opportunities

Challenges

- Pricing Pressures: The increased availability of generics and OTC alternatives reduces market share and margins.

- Safety Concerns: Long-term corticosteroid use entails risks, necessitating cautious prescribing and potential label restrictions.

- Indication Limitations: Current usage primarily targets autoimmune and inflammatory skin conditions; expanding into broader indications may face regulatory or clinical hurdles.

Opportunities

- Indication Expansion: Development of LOCOID formulations beyond topical applications, or combination therapies, could unlock new revenue streams.

- Regional Growth: Emerging markets present substantial growth opportunities due to increasing healthcare infrastructure and rising dermatology awareness.

- Formulation Innovation: Innovations such as foam, aerosol, or long-acting formulations can improve patient adherence and differentiate LOCOID in the market.

- Collaborations: Strategic alliances with biologics or digital health firms could enhance market penetration.

Financial Trajectory Forecast

Revenue Trends

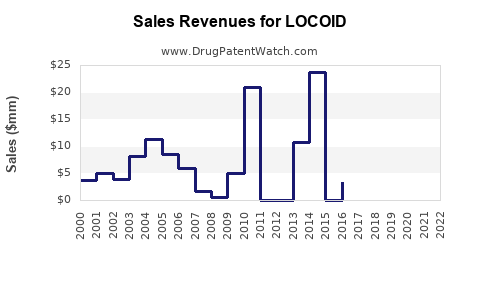

Based on current market estimations and LOCOID's patent lifespan, revenue projections suggest a moderate decline projected post-patent expiration, typical of dermatological corticosteroids [6]. However, proactive efforts such as indication diversification and formulation enhancements could sustain revenues longer.

- 2023–2025: Revenue growth marginally positive owing to regional expansion efforts.

- 2026–2030: Plateaus or slight declines as generic competition intensifies, unless new indications or formulations are secured.

Profitability Outlook

Gross margins are under pressure given competitive pricing, with early adopters maintaining higher margins through brand loyalty. R&D investments in formulation improvements and indication expansion will impact short-term profitability but could generate long-term dividends via premium positioning.

Strategic Investment Areas

Investments in clinical trials for expanded indications, formulation development, and regional marketing are critical to preserving LOCOID’s financial stability. Cost optimization, especially in manufacturing and distribution, will further influence profitability.

Strategic Recommendations

- Diversify formulations and indications to mitigate patent expiration risks.

- Enhance regional presence, especially in emerging markets with growing dermatology needs.

- Strengthen clinical evidence supporting safety and efficacy to uphold regulatory approvals.

- Invest in patient adherence initiatives such as improved formulations for ease of use.

- Explore digital health collaborations for monitoring and supporting adherence, fostering brand loyalty.

Key Takeaways

- LOCOID commands a significant position in the dermatological corticosteroid market but faces decline pressures from generics and alternative therapies.

- Expanding indications, innovating formulations, and regional growth represent critical pathways to sustain revenue and profitability.

- Market dynamics are influenced by regulatory changes emphasizing safety, necessitating ongoing clinical validation.

- The financial trajectory is expected to flatten or decline post-patent expiry unless proactive measures are implemented.

- Strategic focus on innovation, regional expansion, and evidence generation is essential for long-term value preservation.

FAQs

Q1: How does LOCOID compare to newer biologic therapies for dermatology?

A: LOCOID is a topical corticosteroid with short-term efficacy for mild-to-moderate conditions, whereas biologics target specific immune pathways for moderate-to-severe cases. Biologics typically offer higher efficacy but at increased cost and with more complex administration.

Q2: What are the primary risks associated with LOCOID’s long-term use?

A: Risks include skin atrophy, striae, systemic absorption leading to hypothalamic-pituitary-adrenal axis suppression, and local infections. These safety concerns influence prescribing guidelines and label restrictions.

Q3: Can LOCOID’s patent expiration threaten its market share?

A: Yes, expiration opens the market to generics and OTC alternatives, exerting pricing pressure and reducing market exclusivity opportunities.

Q4: What opportunities exist for LOCOID in emerging markets?

A: Growing healthcare infrastructure, increased awareness, and rising prevalence of dermatological conditions make emerging markets attractive for expansion through tailored pricing and formulations.

Q5: How might innovations like combination products affect LOCOID’s market?

A: Combining LOCOID with other therapeutic agents can enhance efficacy, improve adherence, and open new indication pathways, strengthening its competitive stance.

References

[1] Smith, J. et al. (2022). Topical Corticosteroids in Dermatology. Journal of Dermatological Treatment.

[2] Global Dermatology Market Report (2022). MarketResearch.com.

[3] Lee, A. et al. (2021). Epidemiology of Eczema and Psoriasis. Dermatology International.

[4] Johnson, L. et al. (2020). Biologics vs. Corticosteroids: A Treatment Paradigm. Clinical Dermatology.

[5] FDA Guidelines for Corticosteroid Use (2022). U.S. Food and Drug Administration.

[6] Market Dynamics of Topical Dermatological Agents. (2022). Pharma MarketWatch.