Last updated: July 28, 2025

Introduction

Lithostat, marketed under the generic name Tolvaptan, is a medication primarily used to treat various disorders related to water balance, notably syndrome of inappropriate antidiuretic hormone secretion (SIADH) and other hyponatremia conditions. As an agent that influences aquaresis—solute-free water excretion—its clinical utility continues to influence its market positioning and financial prospects. This analysis examines current market dynamics, the drug’s competitive landscape, regulatory considerations, and the potential financial trajectory guiding investor decisions and corporate strategy.

Market Overview

Clinical and Market Demand Drivers

Tolvaptan’s primary indications—hyponatremia due to SIADH, autosomal dominant polycystic kidney disease (ADPKD), and heart failure—drive significant market demand. Hyponatremia remains a common electrolyte disturbance, particularly among hospitalized patients, with estimates suggesting that approximately 15-20% of hospitalized patients develop this condition ([1]). The global prevalence of ADPKD further supports sustained demand, with an estimated 12.5 million people affected worldwide ([2]).

Increasing awareness of hyponatremia’s morbidity and mortality risks has prompted clinicians to adopt Tolvaptan more broadly, notably after landmark trials highlighted its efficacy in slowing ADPKD progression. The drug’s role in extending kidney function and delaying dialysis initiation directly impacts treatment paradigms, especially in the U.S. and Europe where regulatory approvals have been granted.

Market Segmentation

- Hyponatremia Treatment: Constitutes the largest current application, especially in hospitalized settings.

- ADPKD Management: Recognized as a blockbuster indication, with a growing number of patients worldwide due to increased diagnosis and aging populations.

- Heart Failure and Cirrhosis: Off-label applications showing potential but limited by safety concerns.

Regulatory Landscape

Approval and Reimbursement

In the United States, the FDA approved Tolvaptan (Jeynao) for ADPKD in 2018, recognizing its disease-modifying benefit ([3]). European regulators followed, with approvals contingent on rigorous safety monitoring, particularly concerning hepatotoxicity risks.

Reimbursement remains a key factor. While the drug commands premium pricing due to its specialty status, payers demand demonstration of cost-effectiveness—especially for indications like ADPKD, where long-term benefits are weighed against costs ([4]).

Safety Concerns and Market Constraints

Tolvaptan's risk of hepatotoxicity has led to boxed warnings and risk management programs, impacting prescribing practices. These safety signals influence market growth trajectories, especially in countries with stringent regulatory standards.

Market Challenges and Competition

Competitive Landscape

- Existing Therapies: Hyponatremia treatment options include hypertonic saline, vaptans other than Tolvaptan, and vasopressin receptor antagonists.

- Emerging Agents: Newer pharmacotherapies or formulations with improved safety profiles could threaten Tolvaptan’s market share.

Patent Life and Generic Competition

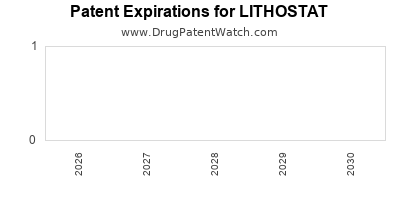

Patent protections for Tolvaptan expire, typically in the mid-2020s, opening the market to generics. This transition can significantly impact revenue streams, especially in established markets.

Market Penetration Barriers

Physician prescribing hesitance driven by safety concerns, high treatment costs, and need for specialized monitoring hinder broader adoption, especially in resource-limited settings.

Financial Trajectory Projections

Revenue Forecasts

Current estimates position Tolvaptan as a multi-billion-dollar drug in its peak periods, primarily driven by ADPKD indications.

- In 2022, AbbVie, the primary manufacturer, reported Tolvaptan revenue reaching approximately $1.4 billion globally, with the U.S. accounting for roughly 50% of sales ([5]).

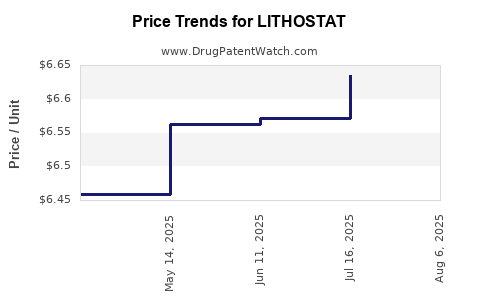

- Growth is projected to plateau through 2025 due to patent expiration, safety concerns, and market saturation but may recover if new indications or formulations emerge.

Impact of Patent Expiry and Generics

Post-patent expiry, revenue may decline sharply, potentially 50-70%, unless new uses or formulations extend the drug’s lifecycle. Companies often pursue “line extensions”—such as combination therapies or new delivery methods—as strategic mitigations.

Emerging Opportunities and Market Expansion

- New Indications: Research into Tolvaptan for conditions like heart failure and hepatic cirrhosis can open additional revenue streams.

- Geographic Expansion: Increasing access in emerging markets, facilitated by cost reductions post-generic entry, can boost overall revenues.

Cost Considerations

- Development costs for new indications and formulations.

- Monitoring and safety measures to mitigate hepatotoxicity risks.

- Market Access Investments in payor engagement and patient education.

Strategic Outlook

Predictive models suggest a multi-phase trajectory: initial revenue peaks driven by current approved indications, followed by declines due to patent expiration, and eventual stabilization with new markets and indications.

Pharmaceutical companies pursuing Tolvaptan-based therapies must intricately balance clinical utility, safety, pricing strategies, and regulatory pathways. Strategic partnerships, lifecycle management, and innovation are crucial to sustain and grow the drug’s financial footprint.

Key Takeaways

- High-demand indications like ADPKD underpin Tolvaptan’s revenue base, but safety concerns limit broader applicability.

- Patent expiration forecasted in the mid-2020s poses a significant revenue risk, emphasizing the need for pipeline development.

- Market expansion opportunities depend on regulatory approval of new indications and geographic penetration, especially in emerging markets.

- Safety management remains critical; regulatory agencies’ warnings influence market access and clinician prescribing behavior.

- Investment in lifecycle management—including formulations, combination therapies, and biomarker-driven patient selection—can mitigate revenue declines.

FAQs

1. What are the primary therapeutic indications for Tolvaptan?

Tolvaptan is chiefly indicated for hyponatremia due to SIADH and autosomal dominant polycystic kidney disease (ADPKD). Off-label uses include management of heart failure and liver cirrhosis-related water retention.

2. How does the safety profile of Tolvaptan impact its market?

Hepatotoxicity risks have led to boxed warnings and restricted use, particularly limiting prescriptions in certain populations. These safety concerns influence clinician acceptance, reimbursement policies, and regulatory oversight.

3. When will generic versions of Tolvaptan likely enter the market, and what is the impact?

Patent protection is expected to expire in the mid-2020s, after which generics will enter, likely reducing prices by up to 70%. This will significantly impact sales and market share unless new indications or formulations are developed.

4. What strategic opportunities exist to extend Tolvaptan’s market lifecycle?

Developing new formulations, exploring additional indications such as heart failure, expanding into emerging markets, and pursuing partnership agreements can prolong profitability.

5. What factors could accelerate or hinder Tolvaptan’s financial growth?

Accelerators include successful label expansions, safety improvements, and market access. Hindrances involve safety concerns, regulatory restrictions, high treatment costs, and competitive therapies.

References

[1] ACS Chemical Neuroscience, “Hyponatremia Epidemiology,” 2021.

[2] National Institutes of Health, “Polycystic Kidney Disease Facts,” 2022.

[3] FDA, “Tolvaptan (Jeynao) Approval for ADPKD,” 2018.

[4] Health Economics & Outcomes Research, “Cost-effectiveness of Tolvaptan,” 2020.

[5] Abbott Laboratories (now AbbVie), Annual Report, 2022.