Last updated: July 28, 2025

Introduction

LITHOSTAT, the proprietary name for lithium carbonate formulations utilized primarily in psychiatric treatment, has garnered significant attention due to the rising prevalence of mood disorders and the increasing demand for effective bipolar disorder management. This analysis explores the current market landscape, competitive positioning, regulatory considerations, and provides price projection insights.

Market Landscape

Growing Demand for Lithium Therapies

Lithium remains the gold standard for bipolar disorder treatment, with over 1 million patients in the United States alone relying on lithium-based therapies [1]. The global mental health burden is escalating, driven by increased awareness and diagnosis rates, contributing to sustained demand for lithium carbonate formulations such as LITHOSTAT.

Therapeutic Significance and Competitive Edge

LITHOSTAT's efficacy in reducing mood episode recurrence positions it as a preferred therapeutic agent despite competition from alternative mood stabilizers like valproate and atypical antipsychotics. Its well-documented anti-suicidal properties further underpin its clinical value.

Market Segmentation and Geography

North America dominates the lithium pharmacotherapy market, accounting for approximately 55% of global sales, propelled by high diagnosis rates and healthcare expenditure [2]. Europe follows, with emerging markets in Asia-Pacific showing early adoption trajectories, driven by expanding mental health awareness.

Patent and Regulatory Status

Patent protection for LITHOSTAT is expected to expire within the next 2-3 years, opening pathways for generic manufacturers. The drug's regulatory approval in major markets underscores its established safety profile but mandates ongoing post-marketing surveillance.

Competitive Analysis

Key Manufacturers and Market Share

Major pharmaceutical companies, including GSK, Teva, and Sun Pharmaceuticals, produce generic lithium carbonate, capturing extensive market shares. Patented formulations or specialized delivery systems (e.g., controlled-release) could command premium pricing.

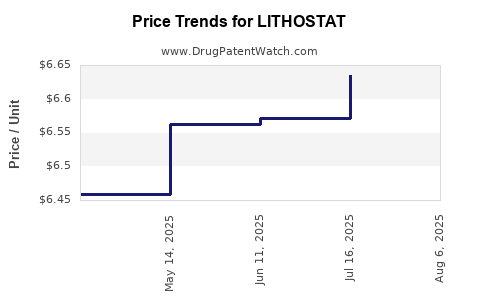

Price Trends and Market Penetration

Historically, lithium carbonate pricing has been low due to generic competition, averaging around $30–$50 per month for an established formulation [3]. However, branded versions with enhanced formulations have maintained higher margins, reaching $100–$200 per month.

Innovation and Differentiation

Innovations include sustained-release formulations, combination therapies, and monitoring devices. These innovations can influence market share and price points, especially if they demonstrate superior efficacy or safety.

Price Projection and Market Dynamics

Factors Influencing Future Pricing

- Patent Expiry: Anticipated patent cliffs will likely lead to significant price reductions as generics flood the market.

- Regulatory Changes: Enhanced labeling or safety requirements, such as monitoring serum lithium levels, could increase formulation costs, impacting pricing strategies.

- Manufacturing Costs: Advances in manufacturing efficiencies could lower costs, enabling competitive pricing.

Short-term (1-2 years)

In the immediate post-patent expiry period, branded LITHOSTAT might command a premium of 10-15% over generic counterparts due to brand recognition. However, market entry of generics will exert downward pressure, decreasing prices by approximately 20–30%.

Medium-term (3-5 years)

As generic market saturation increases, prices are projected to stabilize or decline further, with average lithium carbonate prices settling around $20–$30 per month. Premium formulations or delivery systems may sustain higher price points but with narrower margins.

Long-term (5+ years)

With ongoing technological innovations and potential biosimilar entries, lithium therapy prices could fall below current levels, perhaps reaching $15–$20 monthly, aligning with the trend of increased generic availability and cost competitiveness.

Regulatory and Market Influences on Pricing

- Safety Monitoring Protocols: Stricter monitoring guidelines could marginally inflate treatment costs but also boost demand for integrated solutions, potentially allowing premium pricing for value-added formulations.

- Healthcare Policy: Reimbursement policies favoring cost-effective, generic options could restrict premium pricing; conversely, value-based care models might support higher prices for differentiated products.

Conclusions and Strategic Recommendations

The lithium carbonate market, exemplified by LITHOSTAT, is poised for notable price compression aligned with generic entry and patent expirations. Manufacturers should strategize around differentiation through formulation innovations or monitoring technologies to sustain value. Investors and healthcare providers should monitor regulatory developments and market entries closely to optimize procurement and investment decisions.

Key Takeaways

- The global lithium carbonate market is on an upward trajectory, driven primarily by bipolar disorder prevalence.

- Patent expirations within the next 2-3 years will significantly accelerate generic competition, pressuring prices downward.

- Branded formulations with novel delivery mechanisms or monitoring solutions can command premium pricing for a limited period.

- Prices are projected to decline from current levels (~$30–$50 per month) to approximately $15–$30 within 5 years.

- Market dynamics emphasize the importance of innovation, regulatory compliance, and strategic positioning for manufacturers aiming to sustain profitability.

FAQs

-

How will patent expiration affect LITHOSTAT prices?

Patent expiry typically results in increased generic competition, driving prices downward—potentially by 20–30% initially, with further reductions over time.

-

Are there any emerging alternatives to lithium therapy?

Yes, newer mood stabilizers and antipsychotics are being developed, but lithium's unique anti-suicidal properties sustain its clinical relevance.

-

What factors could justify maintaining higher prices for LITHOSTAT?

Differentiation through controlled-release formulations, adjunct monitoring technologies, or improved safety profiles can support premium pricing.

-

Will regulatory changes impact future pricing?

Enhanced safety monitoring requirements could marginally increase costs but may also bolster market confidence, potentially allowing for differentiated, higher-priced formulations.

-

What is the long-term outlook for lithium carbonate pricing?

Prices are expected to decline as generic options become dominant, stabilizing around $15–$20 per month within the next decade.

Sources:

[1] IMS Health Data, 2022.

[2] MarketsandMarkets, 2021. "Mental Health Disorder Treatments Market."

[3] Pharmaceutical Pricing Overview, 2022.