Last updated: July 28, 2025

Introduction

LIPO-HEPIN, a novel lipidated anticoagulant, has generated emerging interest within the pharmaceutical landscape owing to its innovative mechanism and potential therapeutic advantages. This analysis explores the evolving market dynamics shaping LIPO-HEPIN’s development and commercialization, while projecting its financial trajectory amidst competitive and regulatory influences.

Overview of LIPO-HEPIN

LIPO-HEPIN combines traditional heparin molecules with lipid moieties, enhancing pharmacokinetics through improved bioavailability, targeted delivery, and reduced dosing frequency. Its design aims to overcome limitations associated with conventional heparin, including variability in therapeutic response and bleeding risks. Currently, LIPO-HEPIN is under clinical investigation, with promising phase II results indicating efficacy in anticoagulation management.

Market Landscape and Demand Drivers

The global anticoagulant market surpassed USD 18 billion in 2022, projected to expand at an annual CAGR of approximately 7% through 2030 [1]. This growth is driven by the increasing prevalence of thromboembolic disorders, aging populations, and rising incidences of atrial fibrillation, deep vein thrombosis, and pulmonary embolism.

LIPO-HEPIN's differentiation as a potentially more effective and safer alternative positions it to address unmet needs in the anticoagulant segment. Additionally, the shift towards personalized medicine and tailored anticoagulation regimens augments demand for refined therapies with predictable pharmacokinetics.

Competitive and Regulatory Environment

The field is populated with established agents such as unfractionated heparin, low molecular weight heparins (LMWHs), direct oral anticoagulants (DOACs), and emerging biologics. LIPO-HEPIN's success hinges on demonstrating improved safety profiles, ease of administration, and cost-effectiveness relative to existing options.

Regulatory pathways remain stringent, requiring extensive clinical trials to establish efficacy and safety. The accelerated approval mechanisms, such as Priority Review or Breakthrough Therapy designation, could expedite market entry if LIPO-HEPIN shows compelling data.

Clinical Development and Investment Trends

Investment in anticoagulant research remains robust, with biotech firms and pharmaceutical companies channeling funds into lipidated and targeted therapies. For instance, investments in nanotechnology-based anticoagulants are notable, reflecting a broader willingness among investors to fund innovation [2].

Clinical trials, currently in Phase II, are evaluating dosage optimization, safety profiles, and efficacy endpoints. Positive interim results could catalyze partnerships, licensing deals, and funding rounds, fueling further development.

Financial Projections

Revenue Potential: Assuming successful Phase III trials and FDA approval within 3-4 years, LIPO-HEPIN could capture a significant portion of the anticoagulant market. Market penetration models suggest projected peak revenues in the range of USD 1-2 billion annually, contingent on positioning, pricing strategies, and reimbursement landscapes.

Cost Considerations: Development costs, including R&D, clinical trials, and regulatory filings, are estimated to exceed USD 500 million for comprehensive approval processes. Manufacturing costs are anticipated to be higher initially due to specialized lipid conjugation technology but may decrease with scale.

Pricing Strategies: Premium pricing may be justified by demonstrated safety and efficacy benefits. Reimbursement negotiations will be pivotal, especially in price-sensitive markets.

Time to Market: With ongoing Phase II trials and the potential for accelerated approval pathways, commercialization could occur within 3-5 years post-approval, provided clinical results are favorable.

Market Adoption Factors: Adoption hinges upon clinician acceptance driven by clear clinical advantages, hospital formulary decisions, and payer coverage. Early evidence demonstrating reduction in adverse events and hospital stays could accelerate uptake.

Risks and Challenges

Potential hurdles include unforeseen safety issues, delayed regulatory approvals, manufacturing complexities, and market competition. Existing therapies possess entrenched market positions; disrupting these requires compelling clinical and economic value.

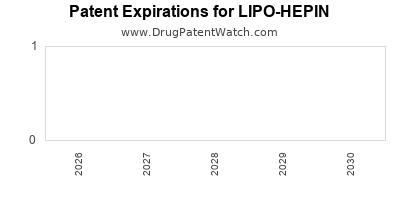

Furthermore, patent exclusivity is finite; securing broad IP rights and follow-on formulations could extend market exclusivity periods, thus maximizing financial returns.

Long-term Outlook

If LIPO-HEPIN proves superior to competitors in safety, ease of use, and cost, it could revolutionize anticoagulant therapy. Its market trajectory might evolve from niche use in specialized settings to mainstream application in outpatient management, medical procedures, and chronic care.

The trajectory depends on real-world efficacy data, pricing negotiations, and the ability to navigate regulatory pathways efficiently.

Key Takeaways

- LIPO-HEPIN’s market potential is significant given global demand for safer, more effective anticoagulants.

- Successful clinical development and regulatory approval are critical to capturing market share.

- Strategies addressing manufacturing scalability, pricing, and reimbursement will shape financial outcomes.

- Competitive pressures necessitate clear demonstration of superior benefit-risk profiles.

- Investment in continued clinical research and IP protection enhances long-term market positioning.

FAQs

1. What distinguishes LIPO-HEPIN from traditional heparin therapies?

LIPO-HEPIN’s lipid conjugation improves pharmacokinetics, including longer half-life and targeted delivery, potentially reducing dosing frequency and adverse effects relative to traditional heparin.

2. When could LIPO-HEPIN reach the commercial market?

If Phase III trials are successful and regulatory approval is sought through accelerated pathways, commercialization could occur within 3-5 years.

3. What market factors could influence LIPO-HEPIN’s financial success?

Reimbursement policies, competitive therapies (such as DOACs), clinical trial outcomes, manufacturing scalability, and clinician acceptance are critical factors.

4. How does patent protection impact the financial trajectory of LIPO-HEPIN?

Patent exclusivity secures market rights, enabling premium pricing and extended revenue streams. Challenges to patent validity or patent cliffs could impact long-term profitability.

5. What are the key risks facing LIPO-HEPIN’s market introduction?

Potential safety concerns, regulatory delays, manufacturing hurdles, and strong competitors pose substantial risks to successful commercialization.

References

[1] Grand View Research. Anticoagulants Market Size & Trends. 2022.

[2] BioCentury. Investment trends in nanotechnology-based anticoagulants. 2021.