Last updated: July 28, 2025

Introduction

Levonorgestrel, a synthetic progestogen widely used as an emergency contraceptive and in various hormonal contraceptive formulations, remains a pivotal player in the reproductive health market. Its long-standing efficacy, safety profile, and regulatory approval across global markets underpin its commercial stability. Analyzing the market dynamics and financial prospects requires understanding clinical advancements, regulatory trends, competitive landscape, and evolving consumer preferences.

Historical and Current Market Overview

Levonorgestrel's introduction in the 1980s revolutionized reproductive health, particularly with over-the-counter (OTC) availability for emergency contraception. According to IQVIA data, the global contraceptive market, valued approximately at USD 20 billion in 2022, includes a significant share attributed to levonorgestrel-based products. Its sales are driven by high consumer demand for reliable, accessible contraception options.

Market Drivers

Multiple factors fuel levonorgestrel's market trajectory:

-

Rising Awareness of Reproductive Rights: Increased education and advocacy have led to greater acceptance of hormonal contraception, boosting demand globally. Governments and NGOs actively promote contraceptive access, further expanding the market [1].

-

Regulatory Approvals and Market Expansion: Many countries have relaxed restrictions on OTC sales of levonorgestrel-based emergency contraceptives, notably in North America, Europe, and parts of Asia. This regulatory shift enhances sales volume and accessibility [2].

-

Product Diversification: Pharmaceutical companies are innovating formulations—combining levonorgestrel with other agents or developing new delivery systems such as intrauterine devices (IUDs)—which sustains growth prospects.

-

Demographic Trends: Population growth, especially among reproductive-age women in emerging markets like India and Nigeria, expands the consumer base, unlocking growth opportunities.

Market Challenges and Constraints

Despite its strengths, several challenges impede exponential growth:

-

Competitive Landscape: Introduction of newer emergency contraceptives such as ulipristal acetate and ellaOne provides alternatives, intensifying market competition [3].

-

Pricing and Reimbursement Policies: In many jurisdictions, pricing negotiations and insurance reimbursement policies influence patient access, potentially limiting market expansion.

-

Cultural and Legal Barriers: Variability in cultural acceptance and restrictive legal environments in certain countries hinder universal access.

-

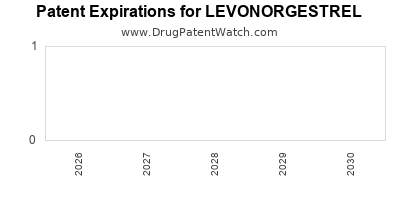

Patent and Intellectual Property Dynamics: Patent expirations can prompt generic entry, reducing prices but also impacting revenue streams for innovator companies.

Emerging Trends Influencing Market Trajectory

-

Shift Toward Long-Acting Reversible Contraceptives (LARCs): While LARCs dominate the contraceptive market with higher efficacy and compliance, levonorgestrel-based oral pills continue to be preferred for immediate, on-demand contraception.

-

Digital Health Integration: Mobile app-based reminders and telemedicine consultations are improving adherence and awareness, indirectly supporting levonorgestrel sales.

-

Growing Demand in Low- and Middle-Income Countries (LMICs): Efforts by NGOs and governments to improve contraceptive access are aligning with levonorgestrel's affordability and efficacy, driving sustained growth in these regions.

Financial Trajectory and Revenue Outlook

Forecasts indicate a steady growth trajectory for levonorgestrel-based products:

-

Market Size Projections: The global emergency contraceptive market alone is expected to reach approximately USD 2.2 billion by 2030, growing at a CAGR of 8–10% (2023–2030) [4]. Levonorgestrel remains a dominant active ingredient within this segment.

-

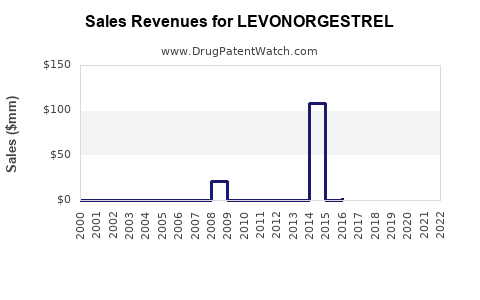

Revenue Streams: Established brands like Plan B One-Step and its generics contribute significantly to revenues, with strategic launches of new formulations further expanding income streams.

-

Impact of Patent Expirations: The patent expirations of some formulations in the late 2010s partially opened the floodgates for generic competition, intensifying price pressure but also broadening market penetration.

-

Emerging Markets: Rapid population growth and rising healthcare infrastructure investments in LMICs are expected to amplify revenues over the next decade.

Competitive Landscape

Major pharmaceutical players like Teva, Pfizer, and Noor Abu Dhabi Pharma dominate the landscape, leveraging their extensive distribution networks. The entrance of biosimilar and generic manufacturers in emerging markets enhances affordability and access, albeit compressing margins for established brands.

Regulatory and Policy Influences

Government policies significantly influence market trajectories:

-

OTC Accessibility: Countries like the U.S., UK, and Canada have expanded OTC access, directly boosting sales.

-

Reimbursement Models: Variations across countries can either limit or promote product utilization—public health initiatives often subsidize costs in LMICs, promoting broader usage.

-

Legal Restrictions: Legislation surrounding contraception rights, especially in conservative regions, creates regional disparities in market potential.

Future Outlook

Long-term prospects for levonorgestrel are robust, driven by demographic trends, policy shifts favoring access, and product innovation. However, success hinges on navigating regulatory landscapes, maintaining product differentiation, and aligning with evolving consumer preferences.

Key Market Segments and Revenue Drivers

-

Emergency Contraception: The largest segment, forecasted to grow at a CAGR of 8–10%, driven by OTC accessibility and consumer awareness.

-

Oral Contraceptives: Adjunct use of levonorgestrel in daily pills continues, with innovations targeting improved compliance.

-

Intrauterine Devices (IUDs): Levonorgestrel-releasing IUDs constitute a growing subset, offering long-term solutions with high efficacy, expanding the product portfolio.

Implications for Stakeholders

-

Pharmaceutical Companies: Continued investment in formulation improvements, market expansion strategies, and real-world evidence collection can sustain growth.

-

Regulatory Agencies: Streamlining approval processes and expanding OTC access will influence market dynamics favorably.

-

Investors: Focusing on company pipelines, especially in emerging markets and generic manufacturing, offers lucrative opportunities given the stable, yet growing, revenue landscape.

Key Takeaways

-

Levonorgestrel's extensive clinical history and regulatory acceptance underpin its continued dominance in reproductive health.

-

Market expansion hinges on improved access, particularly through OTC availability and in LMICs.

-

Competition from newer contraceptive agents and generics exerts pricing pressure but also broadens consumer options.

-

Innovations such as long-acting delivery systems and digital health integration will shape future growth.

-

Strategic positioning by pharmaceutical firms around emerging markets and regulatory trends can enhance long-term revenue prospects.

FAQs

1. How does patent expiration impact levonorgestrel market revenues?

Patent expirations of branded levonorgestrel formulations open markets to generic manufacturers, significantly reducing product prices and eroding revenue margins for originators. However, increased competition can boost overall market volume and accessibility, especially in regions with price-sensitive consumers.

2. What are the main regulatory hurdles for levonorgestrel in expanding markets?

Regulatory challenges include approval delays, restrictions on OTC sales, and legal restrictions related to reproductive rights. Variations in regulatory frameworks across countries require tailored compliance strategies for market entry.

3. How is technological innovation influencing levonorgestrel formulations?

Innovations include the development of long-acting intrauterine devices! and novel delivery systems that improve efficacy, compliance, and user convenience, thereby expanding market segments and enhancing revenue potential.

4. What role do demographic trends play in levonorgestrel’s market outlook?

Demographic factors such as increasing reproductive-age populations, especially in LMICs, drive demand. Population growth coupled with rising awareness and improved healthcare infrastructure sustains long-term growth prospects.

5. How do competitive dynamics shape future revenue streams?

The rise of generic manufacturers and alternative contraceptive methods intensifies price competition, potentially compressing margins but also expanding market access and consumer choice, ultimately fostering a resilient revenue environment for leading players aligned with market needs.

References

[1] IQVIA. Global contraceptive market report, 2022.

[2] U.S. Food and Drug Administration. Emergency contraceptives regulations overview, 2023.

[3] European Medicines Agency. Approvals and updates on emergency contraception, 2022.

[4] Grand View Research. Emergency Contraceptive Market Size, Share & Trends, 2023-2030.