LEFLUNOMIDE Drug Patent Profile

✉ Email this page to a colleague

When do Leflunomide patents expire, and what generic alternatives are available?

Leflunomide is a drug marketed by Abhai Llc, Aet Pharma, Alembic Pharms Ltd, Apotex, Aurobindo Pharma, Barr, Fosun Wanbang, Heritage, Lupin Ltd, Sandoz, Teva Pharms, and Zydus Lifesciences. and is included in twelve NDAs.

The generic ingredient in LEFLUNOMIDE is leflunomide. There are seven drug master file entries for this compound. Seventeen suppliers are listed for this compound. Additional details are available on the leflunomide profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Leflunomide

A generic version of LEFLUNOMIDE was approved as leflunomide by APOTEX on September 13th, 2005.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for LEFLUNOMIDE?

- What are the global sales for LEFLUNOMIDE?

- What is Average Wholesale Price for LEFLUNOMIDE?

Summary for LEFLUNOMIDE

| US Patents: | 0 |

| Applicants: | 12 |

| NDAs: | 12 |

| Finished Product Suppliers / Packagers: | 16 |

| Raw Ingredient (Bulk) Api Vendors: | 108 |

| Clinical Trials: | 108 |

| Patent Applications: | 1,729 |

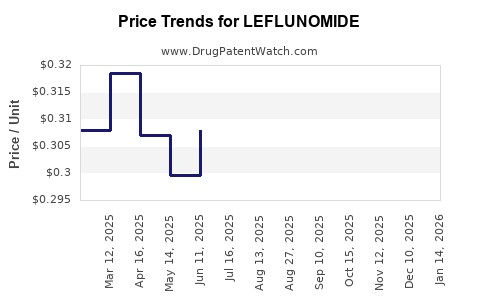

| Drug Prices: | Drug price information for LEFLUNOMIDE |

| What excipients (inactive ingredients) are in LEFLUNOMIDE? | LEFLUNOMIDE excipients list |

| DailyMed Link: | LEFLUNOMIDE at DailyMed |

See drug prices for LEFLUNOMIDE

Recent Clinical Trials for LEFLUNOMIDE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| NYU Langone Health | PHASE2 |

| West Virginia University | PHASE1 |

| City of Hope Medical Center | PHASE1 |

Pharmacology for LEFLUNOMIDE

| Drug Class | Antirheumatic Agent |

Anatomical Therapeutic Chemical (ATC) Classes for LEFLUNOMIDE

US Patents and Regulatory Information for LEFLUNOMIDE

EU/EMA Drug Approvals for LEFLUNOMIDE

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Zentiva k.s. | Leflunomide Zentiva (previously Leflunomide Winthrop) | leflunomide | EMEA/H/C/001129Leflunomide is indicated for the treatment of adult patients with:active rheumatoid arthritis as a 'disease-modifying antirheumatic drug' (DMARD);active psoriatic arthritis.Recent or concurrent treatment with hepatotoxic or haematotoxic DMARDs (e.g. methotrexate) may result in an increased risk of serious adverse reactions; therefore, the initiation of leflunomide treatment has to be carefully considered regarding these benefit / risk aspects.Moreover, switching from leflunomide to another DMARD without following the washout procedure may also increase the risk of serious adverse reactions even for a long time after the switching. | Authorised | no | no | no | 2010-01-08 | |

| Ratiopharm GmbH | Leflunomide ratiopharm | leflunomide | EMEA/H/C/002035Leflunomide is indicated for the treatment of adult patients with:active rheumatoid arthritis as a 'disease-modifying antirheumatic drug' (DMARD);active psoriatic arthritis.Recent or concurrent treatment with hepatotoxic or haematotoxic DMARDs (e.g. methotrexate) may result in an increased risk of serious adverse reactions; therefore, the initiation of leflunomide treatment has to be carefully considered regarding these benefit / risk aspects.Moreover, switching from leflunomide to another DMARD without following the washout procedure may also increase the risk of serious adverse reactions even for a long time after the switching. | Authorised | yes | no | no | 2010-11-28 | |

| medac Gesellschaft für klinische Spezialpräparate mbH | Leflunomide medac | leflunomide | EMEA/H/C/001227Leflunomide is indicated for the treatment of adult patients with:active rheumatoid arthritis as a 'disease-modifying antirheumatic drug' (DMARD).Recent or concurrent treatment with hepatotoxic or haematotoxic DMARDs (e.g. methotrexate) may result in an increased risk of serious adverse reactions, therefore, the initiation of leflunomide treatment has to be carefully considered regarding these benefit / risk aspects.Moreover, switching from leflunomide to another DMARD without following the washout procedure may also increase the risk of serious adverse reactions even for a long time after the switching. | Authorised | yes | no | no | 2010-07-27 | |

| Sanofi-aventis Deutschland GmbH | Arava | leflunomide | EMEA/H/C/000235Leflunomide is indicated for the treatment of adult patients with:active rheumatoid arthritis as a 'disease-modifying antirheumatic drug' (DMARD);active psoriatic arthritis.Recent or concurrent treatment with hepatotoxic or haematotoxic DMARDs (e.g. methotrexate) may result in an increased risk of serious adverse reactions; therefore, the initiation of leflunomide treatment has to be carefully considered regarding these benefit / risk aspects.Moreover, switching from leflunomide to another DMARD without following the washout procedure may also increase the risk of serious adverse reactions even for a long time after the switching. | Authorised | no | no | no | 1999-09-02 | |

| Teva B.V. | Repso | leflunomide | EMEA/H/C/001222Leflunomide is indicated for the treatment of adult patients with:active rheumatoid arthritis as a ‘disease-modifying antirheumatic drug’ (DMARD);active psoriatic arthritis.Recent or concurrent treatment with hepatotoxic or haematotoxic DMARDs (e.g. methotrexate) may result in an increased risk of serious adverse reactions; therefore, the initiation of leflunomide treatment has to be carefully considered regarding these benefit / risk aspects.Moreover, switching from leflunomide to another DMARD without following the washout procedure may also increase the risk of serious adverse reactions even for a long time after the switching. | Withdrawn | yes | no | no | 2011-03-14 | |

| Teva Pharma B.V. | Leflunomide Teva | leflunomide | EMEA/H/C/002356Leflunomide is indicated for the treatment of adult patients with active rheumatoid arthritis as a 'disease-modifying antirheumatic drug' (DMARD).Recent or concurrent treatment with hepatotoxic or haematotoxic DMARDs (e.g. methotrexate) may result in an increased risk of serious adverse reactions; therefore, the initiation of leflunomide treatment has to be carefully considered regarding these benefit / risk aspects.Moreover, switching from leflunomide to another DMARD without following the washout procedure may also increase the risk of serious adverse reactions even for a long time after the switching. | Withdrawn | yes | no | no | 2011-03-10 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

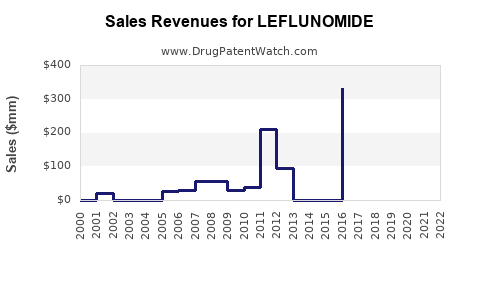

Market Dynamics and Financial Trajectory for Leflunomide

More… ↓