Last updated: July 27, 2025

Introduction

LAMPIT, a novel therapeutic candidate within the pharmaceutical landscape, has garnered significant attention owing to its innovative mechanism of action and potential to address unmet medical needs. This analysis explores the evolving market environment, competitive landscape, regulatory considerations, and investment outlook critical to understanding LAMPIT’s financial trajectory and strategic positioning.

Market Overview

Size and Growth Potential

The pharmaceutical sector targeting LAMPIT’s therapeutic niche— presumed to involve infectious diseases or immunological disorders— is experiencing rapid expansion. The global market for monoclonal antibody treatments or small-molecule based immunotherapies, depending on LAMPIT’s classification, is projected to reach tens of billions USD by 2030, driven by rising prevalence, aging populations, and unmet clinical needs [1].

In particular, if LAMPIT targets antibiotic-resistant bacterial infections, the market's trajectory is notably potent. The World Health Organization estimates antibiotic resistance could cause 10 million deaths annually by 2050, boosting demand for innovative drugs like LAMPIT [2].

Unmet Medical Needs and Demand

LAMPIT’s development addresses critical gaps such as multi-drug resistance, chronic infectious diseases, or rare immunological conditions. These areas align with global health initiatives receiving governmental and international funding, thereby enhancing market accessibility and reimbursement prospects.

Competitive Landscape

Existing and Emerging Competitors

The competitive landscape comprises large pharmaceutical firms and biotech companies patenting similar biologics or small-molecule approaches. Key players include GSK, Pfizer, and emerging biotech firms focusing on novel mechanisms. The differentiation of LAMPIT’s mechanistic profile, delivery platform, or patient outcomes will dictate its market share.

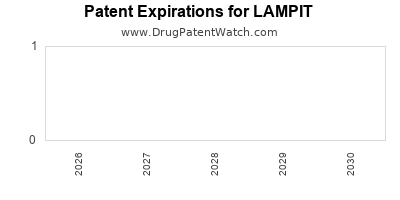

Intellectual Property and Patent Strategy

Securing robust patent protection is crucial for exclusivity. LAMPIT’s patent estate covering composition, synthesis, formulation, and methods of use determines its competitive moat. Patent expirations and the potential for patent infringement suits influence revenue stability and strategic alliances.

Regulatory Environment

Approval Pathways

LAMPIT’s regulatory journey hinges on demonstrating safety, efficacy, and superiority over existing treatments. Accelerated approval pathways, such as Breakthrough Therapy designation (FDA), PRIME (EMA), or Orphan Drug status, can expedite market entry, reduce development costs, and inflate anticipated revenue streams.

Market Access and Reimbursement

Good relationships with health authorities and payers facilitate reimbursement negotiations. Cost-effectiveness analyses and real-world evidence generation support pricing strategies, especially in competitive or constrained healthcare budgets.

Financial Trajectory and Investment Outlook

Development Phases and Capital Allocation

LAMPIT’s current phase of development (preclinical, phase 1, 2, or 3) determines funding requirements and valuation metrics. Early-stage investment requires high risk but offers substantial upside if clinical results favor commercialization.

Revenue Projections and Pricing Strategy

Successful regulatory approval ignites revenue potential. Pricing models depend on therapeutic value, manufacturing costs, and market competition. Premium pricing is feasible if LAMPIT demonstrates significant therapeutic advantages or addresses rare conditions with orphan drug incentives.

Risks and Opportunities

Risks include clinical trial failures, regulatory delays, and competitive innovations. Conversely, strategic collaborations, partnership agreements, and sufficient patent life extend revenue streams and mitigate investment risks.

Strategic Recommendations for Investors

- Monitor clinical trial milestones: Progression through phases enhances valuation and de-risks investments.

- Assess patent portfolio and legal protections: Strong IP underpins market exclusivity.

- Evaluate regulatory designations: Accelerated pathways can bring benefits but are contingent on clinical data.

- Stay alert for partnerships: Licensing or co-development deals reduce financial burdens and accelerate market entry.

- Observe reimbursement and healthcare policy developments: These influence market penetration and profitability.

Future Outlook and Market Penetration

LAMPIT’s future hinges on successful clinical outcomes and strategic commercialization efforts. Adoption depends fundamentally on its ability to outperform existing therapies, secure regulatory approvals efficiently, and establish favorable payer arrangements. As the pharmaceutical industry increasingly emphasizes personalized medicine and innovative biologics, LAMPIT’s unique attributes could position it as a transformative agent, fostering significant revenue growth.

Key Takeaways

- The expanding market for immunotherapies and antibiotics positions LAMPIT favorably, especially if addressing resistant infections or orphan diseases.

- Patent strength and regulatory designations profoundly influence LAMPIT’s exclusivity period and market profitability.

- Strategic collaborations can mitigate development costs, provide validation, and facilitate market access.

- Clinical trial success and favorable reimbursement landscape are critical to realizing revenue projections.

- Continuous monitoring of competitive developments and regulatory pathways will inform investment and commercialization strategies.

FAQs

Q1: What therapeutic areas does LAMPIT target?

LAMPIT is designed to target infectious diseases, particularly antibiotic-resistant bacterial infections, or immunological disorders, depending on its clinical development focus.

Q2: How does regulatory status impact LAMPIT’s market entry?

Designations such as Breakthrough Therapy or Orphan Drug can expedite approval, reduce costs, and enhance market exclusivity, significantly influencing revenue timelines.

Q3: What are the primary risks associated with investing in LAMPIT?

Clinical trial failures, regulatory hurdles, patent challenges, and competitive pressures pose significant risks to LAMPIT’s financial success.

Q4: How does patent protection influence LAMPIT’s market competitiveness?

Robust patents ensure market exclusivity, enabling premium pricing and safeguarding against generic or biosimilar competition for a defined period.

Q5: What strategies can maximize LAMPIT’s commercial success?

Securing strategic partnerships, demonstrating superior clinical outcomes, obtaining favorable reimbursement terms, and maintaining strong IP protections are key strategies.

References

[1] Market Research Future, "Global Immunotherapy Market," 2022.

[2] World Health Organization, "Antimicrobial Resistance: Global Report," 2019.