KOVANAZE Drug Patent Profile

✉ Email this page to a colleague

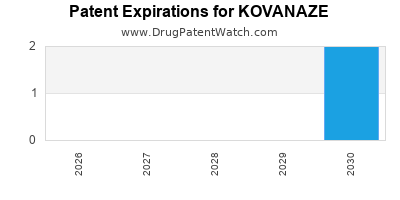

When do Kovanaze patents expire, and what generic alternatives are available?

Kovanaze is a drug marketed by St Renatus and is included in one NDA. There are two patents protecting this drug.

This drug has twenty-six patent family members in sixteen countries.

The generic ingredient in KOVANAZE is oxymetazoline hydrochloride; tetracaine hydrochloride. There are three drug master file entries for this compound. Additional details are available on the oxymetazoline hydrochloride; tetracaine hydrochloride profile page.

DrugPatentWatch® Generic Entry Outlook for Kovanaze

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be April 2, 2030. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for KOVANAZE?

- What are the global sales for KOVANAZE?

- What is Average Wholesale Price for KOVANAZE?

Summary for KOVANAZE

| International Patents: | 26 |

| US Patents: | 2 |

| Applicants: | 1 |

| NDAs: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Clinical Trials: | 5 |

| Drug Prices: | Drug price information for KOVANAZE |

| What excipients (inactive ingredients) are in KOVANAZE? | KOVANAZE excipients list |

| DailyMed Link: | KOVANAZE at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for KOVANAZE

Generic Entry Date for KOVANAZE*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

SPRAY, METERED;NASAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for KOVANAZE

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Virginia Commonwealth University | Phase 2 |

| University of North Carolina, Chapel Hill | Phase 4 |

| Louisiana State University Health Sciences Center in New Orleans | Phase 4 |

US Patents and Regulatory Information for KOVANAZE

KOVANAZE is protected by two US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of KOVANAZE is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| St Renatus | KOVANAZE | oxymetazoline hydrochloride; tetracaine hydrochloride | SPRAY, METERED;NASAL | 208032-001 | Jun 29, 2016 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| St Renatus | KOVANAZE | oxymetazoline hydrochloride; tetracaine hydrochloride | SPRAY, METERED;NASAL | 208032-001 | Jun 29, 2016 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for KOVANAZE

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| St Renatus | KOVANAZE | oxymetazoline hydrochloride; tetracaine hydrochloride | SPRAY, METERED;NASAL | 208032-001 | Jun 29, 2016 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for KOVANAZE

When does loss-of-exclusivity occur for KOVANAZE?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 10232995

Estimated Expiration: ⤷ Get Started Free

Patent: 15242984

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 1010303

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 57032

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2421416

Estimated Expiration: ⤷ Get Started Free

Patent: 3932973

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 13899

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 4184

Patent: СТОМАТОЛОГИЧЕСКОЕ АНЕСТЕЗИРУЮЩЕЕ СРЕДСТВО ДЛЯ ИНТРАНАЗАЛЬНОГО ВВЕДЕНИЯ, СОДЕРЖАЩЕЕ ТЕТРАКАИН И ВАЗОКОНСТРИКТОР (DENTAL ANESTHETIC COMPRISING TETRACAINE AND A VASOCONSTRICTOR FOR INTRANASAL ADMINISTRATION)

Estimated Expiration: ⤷ Get Started Free

Patent: 1171215

Patent: СТОМАТОЛОГИЧЕСКОЕ АНЕСТЕЗИРУЮЩЕЕ СРЕДСТВО ДЛЯ ИНТРАНАЗАЛЬНОГО ВВЕДЕНИЯ, СОДЕРЖАЩЕЕ ТЕТРАКАИН И ВАЗОКОНСТРИКТОР

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 13899

Patent: ANESTHÉSIQUE DENTAIRE COMPRENANT DE LA TÉTRACAÏNE ET UN VASOCONSTRICTEUR POUR ADMINISTRATION INTRANASALE (DENTAL ANESTHETIC COMPRISING TETRACAINE AND A VASOCONSTRICTOR FOR INTRANASAL ADMINISTRATION)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 88864

Estimated Expiration: ⤷ Get Started Free

Patent: 12522783

Estimated Expiration: ⤷ Get Started Free

Patent: 15034167

Patent: 鼻腔内投与用のテトラカインおよび血管収縮薬を含む歯科用麻酔剤 (DENTAL ANESTHETIC COMPRISING TETRACAINE AND VASOCONSTRICTOR FOR INTRANASAL ADMINISTRATION)

Estimated Expiration: ⤷ Get Started Free

Patent: 17031226

Patent: 鼻腔内投与用のテトラカインおよび血管収縮薬を含む歯科用麻酔剤 (DENTAL ANESTHETIC COMPRISING TETRACAINE AND VASOCONSTRICTOR FOR INTRANASAL ADMINISTRATION)

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 11010445

Patent: ANESTESICO DENTAL QUE COMPRENDE TETRACAINA Y UN VASOCONSTRICTOR PARA ADMINISTRACION INTRANASAL. (DENTAL ANESTHETIC COMPRISING TETRACAINE AND A VASOCONSTRICTOR FOR INTRANASAL ADMINISTRATION.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 5376

Patent: DENTAL ANESTHETIC COMPRISING TETRACAINE AND A VASOCONSTRICTOR FOR INTRANASAL ADMINISTRATION

Estimated Expiration: ⤷ Get Started Free

Patent: 2063

Patent: Dental anesthetic comprising tetracaine and a vasoconstrictor for intranasal administration

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 13899

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 13899

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1107011

Patent: DENTAL ANESTHETIC COMPRISING TETRACAINE AND A VASOCONSTRICTOR FOR INTRANASAL ADMINISTRATION

Estimated Expiration: ⤷ Get Started Free

Patent: 1309321

Patent: DENTAL ANESTHETIC COMPRISING TETRACAINE AND A VASOCONSTRICTOR FPR INTRANASAL ADMINISTRATION

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1747979

Estimated Expiration: ⤷ Get Started Free

Patent: 120042729

Patent: DENTAL ANESTHETIC COMPRISING TETRACAINE AND A VASOCONSTRICTOR FOR INTRANASAL ADMINISTRATION

Estimated Expiration: ⤷ Get Started Free

Patent: 170026639

Patent: 비강 투여를 위한 테트라카인 및 혈관수축제를 포함하는 치과용 마취제 (DENTAL ANESTHETIC COMPRISING TETRACAINE AND A VASOCONSTRICTOR FOR INTRANASAL ADMINISTRATION)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 61064

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering KOVANAZE around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| South Africa | 201107011 | DENTAL ANESTHETIC COMPRISING TETRACAINE AND A VASOCONSTRICTOR FOR INTRANASAL ADMINISTRATION | ⤷ Get Started Free |

| New Zealand | 595376 | DENTAL ANESTHETIC COMPRISING TETRACAINE AND A VASOCONSTRICTOR FOR INTRANASAL ADMINISTRATION | ⤷ Get Started Free |

| New Zealand | 612063 | Dental anesthetic comprising tetracaine and a vasoconstrictor for intranasal administration | ⤷ Get Started Free |

| South Africa | 201309321 | DENTAL ANESTHETIC COMPRISING TETRACAINE AND A VASOCONSTRICTOR FPR INTRANASAL ADMINISTRATION | ⤷ Get Started Free |

| Poland | 2413899 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for the Pharmaceutical Drug: KOVANAZE

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.