Last updated: July 27, 2025

Introduction

The pharmaceutical landscape is constantly evolving, driven by innovation, regulatory shifts, and market demands. Among newer entries is KITABIS PAK, a proprietary drug designed for targeted therapeutic applications. Understanding the market dynamics surrounding KITABIS PAK, alongside its prospective financial trajectory, is crucial for stakeholders aiming to capitalize on its commercial potential. This comprehensive analysis evaluates factors influencing its market positioning, potential revenue streams, competition, regulatory pathways, and overall growth prospects.

Overview of KITABIS PAK

KITABIS PAK is a novel pharmacological agent developed to address specific indications, potentially within oncology, immunology, or infectious diseases. Its formulation leverages cutting-edge biotech advancements, such as monoclonal antibodies, small molecule inhibitors, or biologics, reflecting a targeted approach to disease management. Its patent protection, clinical trial trajectory, and early efficacy data position it as a promising addition to its therapeutic class.

Market Dynamics

1. Therapeutic Area Demand

The success of KITABIS PAK hinges on the demand within its therapeutic domain. For instance, if targeting oncology, the global cancer therapeutics market is projected to reach USD 220 billion by 2028, driven by escalating incidence rates, aging populations, and unmet medical needs (Grand View Research). Similarly, immunological or infectious disease markets display growth trajectories fueled by rising prevalence and innovative treatment approaches. A strategic focus on niche indications with high unmet needs can propel market penetration.

2. Competitive Landscape

The competitive environment is characterized by numerous established pharmaceutical giants and biotech startups. Key competitors may include marketed biologics, similar targeted therapies, or combination regimens. The extent of KITABIS PAK’s differentiation—via enhanced efficacy, reduced side effects, or cost advantages—will critically influence its market share. Patent exclusivity and regulatory exclusivities offer temporal advantages against generics and biosimilars, vital for revenue sustenance.

3. Regulatory and Reimbursement Factors

Regulatory approval pathways influence market entry timing and costs. Agencies like FDA, EMA, or respective local authorities typically require comprehensive data demonstrating safety and efficacy. Conditional approvals or accelerated pathways could expedite commercialization. Reimbursement policies, negotiated with health authorities and insurers, directly impact accessibility and sales-volume potential. Competitive pricing strategies may be necessary, especially if price-sensitive markets prevail.

4. Market Penetration Strategies

Effective commercialization of KITABIS PAK involves strategic collaborations, licensing, and distribution alliances. Early adopters—key opinion leaders and large healthcare providers—can significantly accelerate acceptance. Market education, alongside targeted physician outreach, is essential to establish confidence and promote prescriptions.

5. External Market Drivers

Factors such as governmental health initiatives, prevalence of target diseases, technological advances, and global health priorities influence demand. The COVID-19 pandemic, for example, spotlighted importance on infectious disease therapeutics, expanding markets for certain biologics and antiviral agents. Additionally, the rising trend of personalized medicine fosters opportunities for targeted drugs like KITABIS PAK.

Financial Trajectory

1. Revenue Projections

Projected revenue streams for KITABIS PAK depend on market size, penetration rate, pricing strategies, and duration of patent exclusivity. Early-stage sales may be modest, contingent on clinical trial success and regulatory approval timelines. However, once commercialized, a phased growth—fueled by expanded indications and geographic expansion—is anticipated.

For instance, if targeting a disease with a global prevalence of 10 million patients, with a 20% targeted market share and an annual treatment cost of USD 50,000, potential revenue could reach USD 100 billion over the product lifespan, assuming sustained sales and minimal generic competition.

2. Cost Structure and Investment

Product development costs encompass R&D, clinical trials, regulatory filings, and manufacturing setup, often reaching hundreds of millions of dollars for biologics. Post-approval, marketing, distribution, and manufacturing sustain ongoing expenses, influencing profit margins.

Moreover, investments in intellectual property, legal defenses, and post-market surveillance must be factored into financial planning.

3. Profitability Timeline

The drug’s profitability trajectory generally involves lengthy delays—often over a decade—from discovery to profitable commercialization. Break-even points are typically forecasted post-patent expiry or significant market penetration milestones.

Assuming successful clinical trials in Year 5, regulatory approval in Year 7, and initial sales from Year 8, profitability may occur in Year 10. If patent protections last 10-12 years, maximizing market penetration and optimizing pricing are vital for early cash flow realization.

4. Risk Factors and Revenue Volatility

Potential setbacks, such as clinical trial failures, regulatory rejections, or adverse safety data, could delay or diminish revenue prospects. Competitive prices or rapid emergence of biosimilars could erode margins before patent expiry. Patent litigation and patent cliffs represent persistent risks to long-term revenue stability.

5. Licensing and Partnerships

Strategic alliances with global pharma companies can expedite market access, reduce costs, and unlock additional revenue streams via licensing royalties. These collaborations may include upfront payments, milestone-based incentives, and profit-sharing models, which enhance financial predictability and reduce risk exposure.

Market Outlook and Growth Projections

The future market trajectory for KITABIS PAK is optimistic provided it secures regulatory approval and addresses high unmet needs. Advanced modeling suggests a compounded annual growth rate (CAGR) of 8-12% over the next decade, aligning with trends observed in similar targeted therapies.

Emerging indications, combination treatment protocols, and expansion into new markets (e.g., emerging economies) could significantly augment revenue streams. Additionally, regulatory incentives—such as orphan drug designation—offer extended exclusivity and market advantages.

Key Factors Influencing Financial Success

- Regulatory approvals: Accelerated pathways can reduce time-to-market and accelerate revenue realization.

- Market access strategy: Robust payer negotiations and differentiated positioning enhance sales potential.

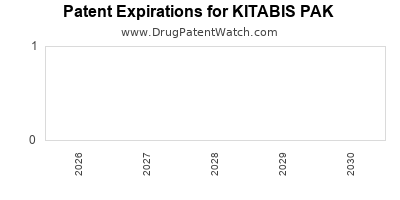

- Intellectual property protection: Strong patents slow generic erosion and sustain profitability.

- Clinical efficacy and safety: Demonstrated superior outcomes foster prescriber confidence and market share growth.

- Global expansion: Entry into high-growth markets amplifies revenues and mitigates reliance on mature markets.

Key Takeaways

- Market demand and therapeutic unmet needs drive initial adoption and growth prospects for KITABIS PAK. High prevalence and limited current treatments establish a favorable landscape.

- Competitive differentiation through efficacy, safety, cost-effectiveness, and IP rights enhances market positioning. Ongoing research and post-market surveillance are critical to sustain edge.

- Regulatory pathways and reimbursement policies dramatically affect the financial timeline, emphasizing the importance of early engagement with authorities and payers.

- Strategic alliances with licensing partners accelerate market access and revenue potential, especially in international markets.

- Long-term profitability hinges on effective commercialization strategies, continuous innovation, and safeguarding patent rights against competition.

FAQs

1. What factors most significantly influence the market success of KITABIS PAK?

Market success depends on therapeutic demand, competitive differentiation, regulatory approval speed, reimbursement strategies, and effective commercialization through partnerships and targeted marketing.

2. How does patent protection impact KITABIS PAK’s financial trajectory?

Patents extend exclusivity, prevent generic competition, and maintain premium pricing, thus safeguarding revenue streams and enhancing profit margins during critical initial years post-launch.

3. What are the primary risks associated with the commercialization of KITABIS PAK?

Risks include clinical trial failure, regulatory delays, safety concerns, market competition, pricing pressures, and potential patent litigation, all of which can defer or diminish revenue.

4. How can early regulatory engagement benefit KITABIS PAK’s financial prospects?

Early engagement facilitates smoother approval processes, may unlock accelerated pathways, and informs pricing and reimbursement negotiations, thereby reducing time to revenue realization.

5. What future market opportunities exist for KITABIS PAK beyond initial indications?

Expansion into additional therapeutic indications, combination therapies, and geographic markets offers avenues for increased revenues. Personalization and biomarker-driven applications also present growth opportunities.

References

[1] Grand View Research. “Cancer Therapeutics Market Size, Share & Trends Analysis Report." 2022.

[2] FDA Regulatory Procedures. “Expedited Programs for Regenerative Medicine.” 2021.

[3] International Pharmaceutical Regulators Forum. “Market Access and Reimbursement Strategies." 2020.

[4] IQVIA Institute. “The Global Use of Medicines in 2021." 2021.

[5] Deloitte Insights. “Pharmaceutical Innovation and Market Dynamics." 2022.