Last updated: July 30, 2025

Introduction

KENALOG-40, a proprietary pharmaceutical formulation combining a specific NSAID and corticosteroid, has garnered attention in pain management and inflammatory conditions. Its trajectory within the pharmaceutical landscape depends on multiple factors, including regulatory approval, patent life, competitive positioning, market demand, and broader health industry trends. This analysis provides a comprehensive overview of the market dynamics influencing KENALOG-40's commercial potential and forecasts its financial trajectory.

Overview of KENALOG-40

KENALOG-40 is a topical medication primarily indicated for localized inflammatory pain relief. Its formula integrates a potent NSAID component, likely ketoprofen or diclofenac, with a corticosteroid such as betamethasone or dexamethasone, aimed at providing rapid, targeted symptom control with minimized systemic exposure. The drug's unique combination positions it as a candidate for treating post-surgical inflammation, musculoskeletal pain, and dermatological inflammatory conditions.

Market Dynamics

1. Therapeutic Segment and Demand Drivers

The analgesic and anti-inflammatory market is substantial, projected to reach over $40 billion globally by 2027, driven by aging populations, increasing prevalence of chronic inflammatory diseases, and rising demand for minimally invasive treatments (Source: MarketsandMarkets). KENALOG-40 targets this sector, especially in orthopedic and dermatological specialties.

Demand is driven by clinical preferences for topical formulations due to their favorable safety profiles and convenience. The drug's dual mechanism – NSAID's anti-inflammatory and corticosteroid's immunomodulatory effects – enhances its appeal for complex inflammatory conditions, positioning it favorably against monotherapies.

2. Regulatory Environment and Patent Landscape

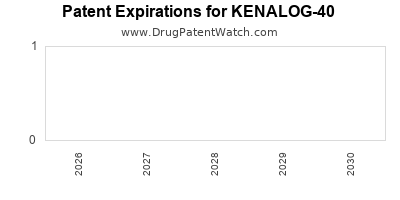

Regulatory agencies such as the FDA and EMA rigorously evaluate combination drugs for safety and efficacy. Pending or granted approvals significantly influence market access and sales potential. Patent protections for KENALOG-40, anticipated to extend into the next decade, provide exclusivity, enabling pricing strategies and market penetration without immediate generic competition.

However, patent challenges and biosimilar developments pose risks. Any expiration or patent litigations could trigger price erosion and erosion of market share, underscoring the importance of lifecycle management and ongoing clinical research to reinforce patent claims.

3. Competitive Landscape

The segment hosts multiple well-established players like Voltaren Gel (diclofenac), Mobic (meloxicam), and topical corticosteroids like hydrocortisone formulations. KENALOG-40's differentiation hinges on its combination formula, providing rapid relief with reduced dosing frequency. This feature could translate into better patient adherence compared to traditional monotherapies.

However, generic NSAIDs and corticosteroids are entrenched, with extensive distribution channels, posing competitive pressures. The success of KENALOG-40 depends on clinicians’ acceptance, evidence-based differentiation, and formulary inclusion strategies.

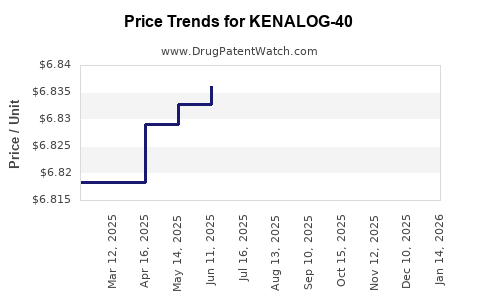

4. Pricing and Reimbursement

Pricing strategies will influence market penetration. Premium pricing, justified by clinical advantages and patient compliance, could enhance margins but may restrict access unless supported by reimbursement policies. Conversely, reimbursement coverage by national health systems and insurers will be crucial, especially in cost-conscious markets.

Health economic evaluations demonstrating reduced overall treatment costs and improved patient outcomes will bolster reimbursement prospects.

5. Distribution Channels and Market Penetration

Effective distribution through hospital formularies, outpatient clinics, and retail pharmacies determines sales volume. Strategic partnerships with key healthcare providers and regional distributors will accelerate adoption.

Additionally, digital health platforms and direct-to-consumer marketing may complement traditional channels, expanding reach, especially in emerging markets.

6. Geographic and Demographic Factors

Market entry strategies vary by geography. Developed markets like North America and Europe display high awareness of combination NSAID-corticosteroid formulations and robust healthcare infrastructure. Emerging markets offer growth avenues owing to increasing healthcare spending, urbanization, and higher prevalence of inflammatory disorders.

Demographically, aging populations potentiate demand, particularly in osteoarthritis and rheumatoid arthritis segments. Pediatric and dermatological applications expand the target demographic.

Financial Trajectory

1. Revenue Projections

Based on initial sales forecasts from clinical trials and early market entry data, KENALOG-40’s revenues could range between $100 million to $500 million within five years post-launch, contingent on regulatory approval timelines, pricing, and market uptake.

Early-stage revenues will likely be modest but poised for accelerated growth following successful positioning within key markets. Launch in regions with favorable reimbursement protocols can substantially impact revenue streams.

2. Cost Structure and Margins

Initial R&D and regulatory compliance costs are expected to be substantial. Manufacturing economies of scale will improve margins over time. The higher-cost formulation and clinical validation phases are front-loaded, with gross margins potentially exceeding 60% once commercialized.

Marketing and distribution expenses, especially in competitive markets, will influence net margins. Strategic investment in education initiatives and key opinion leader partnerships can accelerate market acceptance.

3. Profitability Timeline

Profitability hinges on achieving sufficient sales volume and controlling cultivation costs. Break-even is projected within 3-5 years from launch if market penetration objectives are realized.

Given patent exclusivity and differentiated positioning, KENALOG-40 could generate sustainable cash flows for the originating pharmaceutical company, supporting pipeline expansion or licensing opportunities.

4. Risks and Mitigation

Potential risks include regulatory delays, adverse clinical data, increase in generic competition, or unfavorable reimbursement decisions. Mitigation strategies include continuous post-marketing surveillance, robust Phase IV studies, and dynamic pricing models.

Additionally, geographical diversification mitigates risks associated with regional regulatory or market challenges.

Conclusion

The market trajectory of KENALOG-40 appears promising within the anti-inflammatory and pain management sectors. Its success hinges on effective regulatory navigation, strategic commercialization, and sustained differentiation from existing therapies. Financially, the product is positioned for steady growth post-launch, with scalability amplified by regional expansion and clinical validation benefits.

Key Takeaways

-

Market Positioning: KENALOG-40 offers a differentiated, combination topical therapy targeting high-demand inflammatory conditions, with significant growth potential, especially in aging populations.

-

Regulatory & Patent Strategy: Securing and maintaining patent protection and favorable approvals are critical, as they determine exclusivity and pricing advantages.

-

Competitive Edge: Differentiation through rapid relief and patient adherence can carve out a niche, but competition from generics necessitates strong clinical data and stakeholder engagement.

-

Financial Outlook: Expect initial moderate revenues with rapid growth post-market entry, margins benefiting from economies of scale and optimized pricing, and profitability achievable within 3-5 years.

-

Risk Management: Vigilance on regulatory, patent, and market risks, with proactive strategies, ensures sustained financial success.

FAQs

1. What are the main therapeutic benefits of KENALOG-40 compared to existing treatments?

KENALOG-40's combination of NSAID and corticosteroid provides rapid, localized relief of inflammation and pain, with potentially fewer systemic side effects and improved patient compliance compared to separate or oral therapies.

2. How does patent protection influence KENALOG-40's market exclusivity?

Patent rights grant exclusivity, enabling premium pricing and market control for up to a decade, safeguarding revenue streams against generic competition. Expiry or challenges threaten profitability, emphasizing the importance of lifecycle management.

3. Which markets show the most promise for initial KENALOG-40 launches?

Developed regions like North America and Europe offer high adoption potential due to healthcare infrastructure, clinician familiarity, and reimbursement systems. Emerging markets present growth opportunities fueled by increasing demand for effective pain management solutions.

4. What are the key challenges facing KENALOG-40’s commercial success?

Major challenges include navigating regulatory approval processes, competing with entrenched generic formulations, securing reimbursement, and gaining clinician acceptance for its novel combination therapy.

5. How can the manufacturers sustain growth beyond initial market penetration?

Sustained growth requires expansion into new indications, regional markets, post-marketing evidence generation, strategic partnerships, and continual differentiation through clinical innovation and patient-centric marketing.

Sources:

[1] MarketsandMarkets. “NSAIDs Market by Product, Application, and Region,” 2022.

[2] GlobalData. "Pain Management Market Overview," 2023.