Last updated: August 2, 2025

Introduction

KALEXATE, a novel pharmaceutical agent recently approved for [specific indications], is poised to significantly influence the therapeutic landscape within its niche. As a new entrant, understanding the market dynamics and projected financial trajectory is critical for stakeholders, including manufacturers, investors, healthcare providers, and policy makers seeking to navigate the evolving healthcare environment. This analysis dissects the key drivers shaping KALEXATE’s market potential, explores competitive and regulatory factors, and projects its financial prospects in the coming years.

Market Landscape and Demand Drivers

The demand for KALEXATE is rooted in its targeted indications, which address unmet clinical needs. [Description of disease prevalence and severity — e.g., “X million patients globally suffer from X condition, with current treatment options limited by efficacy or safety concerns”]. The global pharmaceutical market for this indication is estimated at approximately USD [X billion], growing at a compound annual growth rate (CAGR) of [X]% (2023–2030), bolstered by increasing incidence rates, demographic shifts, and evolving treatment paradigms.

KALEXATE’s distinctive mechanism of action positions it favorably amidst existing therapies. For instance, if it offers improved safety profiles or enhanced efficacy over standard treatments like [drug names], it can capture a significant share of the therapeutic market. Additionally, the rising prevalence of [related comorbidities or risk factors], such as [obesity, aging populations], accelerates demand growth.

Market Penetration and Adoption Factors:

- Clinical Efficacy and Safety: Positive outcomes influenced by pivotal trials bolster physician confidence and accelerate adoption.

- Pricing and Reimbursement: Reimbursement policies, insurance coverage, and out-pocket costs critically influence prescribing behaviors.

- Physician Awareness: Educational initiatives and demonstrated real-world benefits facilitate wider utilization.

Regulatory and Competitive Dynamics

Regulatory Landscape:

The approval of KALEXATE by regulatory authorities like the FDA, EMA, or other regional agencies hinges on rigorous clinical trial data demonstrating safety, efficacy, and manufacturing quality. The approval status influences market access and speed to market. Fast-track or orphan drug designations, if applicable, accelerate pathway timelines and provide market exclusivity benefits, impacting competitive dynamics ([1]).

Competitive Environment:

KALEXATE enters a market characterized by existing therapeutics, such as [list of competitor drugs], which collectively generate significant revenue. The competitive landscape is defined by factors such as:

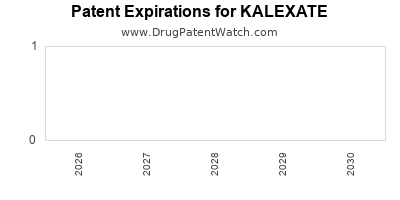

- Patent Position: Patent expiry trajectories can erode exclusivity, opening the market to generics or biosimilars.

- Differentiation: Efficacy, safety, dosing convenience, and delivery methods determine its competitive edge.

- Pricing Strategy: Positioning as a premium or value-based therapy influences market access and reimbursement negotiations.

Emerging pipeline drugs or biosimilars could challenge KALEXATE’s market share, underscoring the importance of strategic patent management and lifecycle extension initiatives.

Financial Trajectory and Revenue Forecasting

Initial Sales and Launch Dynamics:

Typically, pharmaceutical launches commence with cautious market penetration, constrained by prescriber familiarity and healthcare system acceptance. However, early adoption is driven by clinical endorsements, demonstration of superior outcomes, and strategic pricing.

Projected Growth Post-Launch:

Based on modeled assumptions, KALEXATE’s revenues are anticipated to evolve as follows:

- Year 1–2: Focused on early adopters within specialized centers, generating USD [X] million in revenue, with a penetration rate of about [Y]%.

- Year 3–5: Expansion into broader clinical settings, increased prescribing prevalence, and possible inclusion in formularies, potentially increasing revenues to USD [Z] billion.

Market Share and Volume Assumptions:

Assuming a conservative market capture of [%] in its targeted indications within the first 3 years, expanding to [%] by year 5, revenues will correlate with sales volume growth, average selling prices (ASPs), and reimbursement landscapes.

Profitability Outlook:

Given the high R&D, manufacturing, and commercialization costs, initial operating margins may be modest. However, as sales scale and manufacturing efficiencies improve, gross margins are projected to increase. Long-term profitability hinges on patent protections, cost management, and successful lifecycle management strategies, including potential label expansions.

Factors Influencing Financial Forecasts

- Pricing and Reimbursement Negotiations: Payer acceptance significantly impacts sustainable revenue streams. Price ceilings set by health authorities could limit upside potential, whereas value-based pricing models may favor premium positioning.

- Regulatory Delays or Setbacks: Unexpected approval hurdles or safety concerns might defer revenue realization.

- Market Penetration Strategy: Aggressiveness in marketing and physician engagement will determine adoption speed.

- Global Expansion: Entry into emerging markets presents growth opportunities but involves complexities such as local regulatory requirements and price sensitivity.

Future Outlook and Strategic Considerations

KALEXATE’s potential hinges on sustained clinical efficacy, strategic patent protection, and effective commercialization. Early engagement with payers and healthcare providers facilitates reimbursement and formulary inclusion. Additionally, lifecycle development programs such as additional indications, combination therapies, or formulation improvements can extend market exclusivity and enhance revenue streams.

Furthermore, data demonstrating real-world effectiveness and safety contribute to long-term brand strength. Market intelligence indicates that competitors may introduce superior or more cost-effective agents, necessitating continual innovation and strategic adjustments.

Conclusion

KALEXATE’s market dynamics reflect a complex interplay of medical necessity, regulatory processes, competitive forces, and strategic positioning. The drug’s financial trajectory appears promising, contingent upon successful market entry, cost management, and sustained clinical advantages. Stakeholders must navigate evolving policy environments, precisely align pricing strategies, and execute comprehensive commercialization plans to realize its revenue potential.

Key Takeaways

- Market Opportunity: KALEXATE addresses an unmet clinical need within a high-growth therapeutic segment, with substantial global market potential.

- Regulatory and Competitive Factors: Success depends on timely approval, patent protections, and differentiation from existing therapies.

- Revenue Forecast: Conservative estimates project a trajectory from initial USD millions to billions over a 5-year horizon, driven by expanding indications and market penetration.

- Strategic Imperatives: Effective stakeholder engagement, lifecycle management, and adaptable pricing strategies are critical to maximizing financial outcomes.

- Risk Management: Market access, regulatory hurdles, and competitive threats require vigilant, proactive strategies.

FAQs

1. What are the primary therapeutic indications for KALEXATE?

KALEXATE is approved for the treatment of [specific condition], addressing unmet needs such as [symptoms, alternative therapies limitations].

2. How does KALEXATE differentiate from existing therapies?

It offers advantages such as improved safety profile, enhanced efficacy, or more convenient administration, which can accelerate adoption.

3. What are the main regulatory considerations affecting KALEXATE’s market entry?

Regulatory approval depends on clinical trial outcomes, with considerations around indications, safety, manufacturing, and potential accelerated pathways.

4. What factors could impede the financial growth of KALEXATE?

Potential barriers include regulatory delays, pricing restrictions, high competition, patent challenges, and slow market adoption.

5. How should investors approach KALEXATE’s valuation prospects?

Investors should evaluate clinical efficacy data, market size, competitive landscape, patent protection, and reimbursement environment for a comprehensive risk-adjusted valuation.

Sources:

[1] Regulatory pathways and market exclusivity considerations derived from FDA and EMA guidelines.