INREBIC Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Inrebic, and what generic alternatives are available?

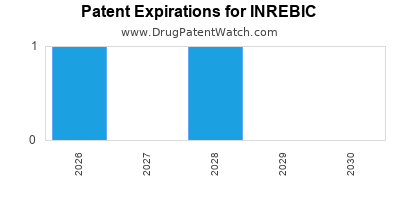

Inrebic is a drug marketed by Bristol-myers and is included in one NDA. There are five patents protecting this drug and one Paragraph IV challenge.

This drug has one hundred and nineteen patent family members in forty-two countries.

The generic ingredient in INREBIC is fedratinib hydrochloride. One supplier is listed for this compound. Additional details are available on the fedratinib hydrochloride profile page.

DrugPatentWatch® Generic Entry Outlook for Inrebic

Inrebic was eligible for patent challenges on August 16, 2023.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be June 4, 2032. This may change due to patent challenges or generic licensing.

There has been one patent litigation case involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for INREBIC?

- What are the global sales for INREBIC?

- What is Average Wholesale Price for INREBIC?

Summary for INREBIC

| International Patents: | 119 |

| US Patents: | 5 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 134 |

| Clinical Trials: | 4 |

| Patent Applications: | 117 |

| Drug Prices: | Drug price information for INREBIC |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for INREBIC |

| What excipients (inactive ingredients) are in INREBIC? | INREBIC excipients list |

| DailyMed Link: | INREBIC at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for INREBIC

Generic Entry Date for INREBIC*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

CAPSULE;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for INREBIC

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Joseph Jurcic | Phase 1 |

| Bristol-Myers Squibb | Phase 1 |

| H. Lee Moffitt Cancer Center and Research Institute | Phase 2 |

Paragraph IV (Patent) Challenges for INREBIC

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| INREBIC | Capsules | fedratinib hydrochloride | 100 mg | 212327 | 1 | 2023-08-16 |

US Patents and Regulatory Information for INREBIC

INREBIC is protected by five US patents and one FDA Regulatory Exclusivity.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of INREBIC is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

International Patents for INREBIC

When does loss-of-exclusivity occur for INREBIC?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Australia

Patent: 10363329

Patent: Compositions and methods for treating myelofibrosis

Estimated Expiration: ⤷ Get Started Free

Patent: 11323108

Patent: Compositions and methods for treating myelofibrosis

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2013011184

Patent: composições e métodos para tratamento de mielofibrose

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 16710

Patent: COMPOSITIONS ET METHODES DE TRAITEMENT DE LA MYELOFIBROSE (COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS)

Estimated Expiration: ⤷ Get Started Free

Patent: 16957

Patent: COMPOSITIONS ET PROCEDES DE TRAITEMENT DE LA MYELOFIBROSE (COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 13001252

Patent: Capsula para administracion oral que comprende n-terc-butil-3-[(5-metil-2-{[4-(2-pirrolidin-1-iletoxi)fenil]amino}pirimidin-4-il)amino]bencenosulfonamida, una celulosa microcristalina y estearil fumarato de sodio; forma de dosificacion unitaria; metodo para tratar mielofibrosis; metodo de preparacion; y articulo de preparacion.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 3282036

Patent: Compositions and methods for treating myelofibrosis

Estimated Expiration: ⤷ Get Started Free

Patent: 8125923

Patent: 用于治疗骨髓纤维化的组合物和方法 (Compositions and methods for treating myelofibrosis)

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 01724

Patent: Composiciones y métodos para el tratamiento de la mielofibrosis

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0221269

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 35282

Estimated Expiration: ⤷ Get Started Free

Dominican Republic

Patent: 013000097

Patent: COMPOSICIONES Y MÉTODOS PARA EL TRATAMIENTO DE LA MIELOFIBROSIS

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 13012658

Patent: COMPOSICIONES Y MÉTODOS PARA EL TRATAMIENTO DE LA MIELOFIBROSIS

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 35282

Patent: COMPOSITIONS ET MÉTHODES DE TRAITEMENT DE LA MYÉLOFIBROSE (COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS)

Estimated Expiration: ⤷ Get Started Free

Patent: 59216

Patent: COMPOSITIONS DE TRAITEMENT DE LA MYÉLOFIBROSE (COMPOSITIONS FOR TREATING MYELOFIBROSIS)

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 60254

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 6101

Patent: פורמולציות קפסולה של n-טרט-בוטיל-3-[(5 -מתיל-2-{[4-(2 -פירולידין-1-אילאתוקסי(פניל[אמינו{פירימידין-4-איל)אמינו]בנזינסולפונאמיד ושימוש בהן להכנת תרופות לטיפול במיאלופיברוזיס (Capsule formulations of n-tert-butyl-3-[(5-methyl-2-{[4-(2-pyrrolidin-1-ylethoxy)phenyl]amino}pyrimidin-4-yl)amino]benzenesulfonamide and use thereof in the preparation of medicaments for treating myelofibrosis)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 33211

Estimated Expiration: ⤷ Get Started Free

Patent: 13541595

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 35282

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 1164

Patent: COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 0246

Patent: COMPOSICIONES Y METODOS PARA EL TRATAMIENTO DE LA MIELOFIBROSIS. (COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS.)

Estimated Expiration: ⤷ Get Started Free

Patent: 1913

Patent: COMPOSICIONES Y METODOS PARA EL TRATAMIENTO DE LA MIELOFIBROSIS. (COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS)

Estimated Expiration: ⤷ Get Started Free

Patent: 13005020

Patent: COMPOSICIONES Y METODOS PARA EL TRATAMIENTO DE LA MIELOFIBROSIS. (COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS.)

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 723

Patent: COMPOSITIONS ET MÉTHODES DE TRAITEMENT DE LA MYÉLOFIBROSE

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 1363

Patent: Compositions and methods for treating myelofibrosis

Estimated Expiration: ⤷ Get Started Free

Nicaragua

Patent: 1300038

Patent: COMPOSICIONES Y MÉTODOS PARA EL TRATAMIENTO DE LA MIELOFIBROSIS

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 140389

Patent: COMPOSICIONES Y METODOS PARA EL TRATAMIENTO DE LA MIELOFIBROSIS

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 013500924

Patent: COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 35282

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 35282

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 16262

Patent: КОМПОЗИЦИИ И СПОСОБЫ ЛЕЧЕНИЯ МИЕЛОФИБРОЗА (COMPOSITIONS AND METHODS FOR MYELOFIBROSIS TREATMENT)

Estimated Expiration: ⤷ Get Started Free

Patent: 13126121

Patent: КОМПОЗИЦИИ И СПОСОБЫ ЛЕЧЕНИЯ МИЕЛОФИБРОЗА

Estimated Expiration: ⤷ Get Started Free

San Marino

Patent: 02200453

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 996

Patent: KOMPOZICIJE ZA LEČENJE MIJELOFIBROZE (COMPOSITIONS FOR TREATING MYELOFIBROSIS)

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 0134

Patent: COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 35282

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1303423

Patent: COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1940979

Estimated Expiration: ⤷ Get Started Free

Patent: 2131241

Estimated Expiration: ⤷ Get Started Free

Patent: 130137647

Patent: COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS

Estimated Expiration: ⤷ Get Started Free

Patent: 180122029

Patent: 골수 섬유증을 치료하기 위한 조성물 및 방법 (COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS)

Estimated Expiration: ⤷ Get Started Free

Patent: 200083676

Patent: 골수 섬유증을 치료하기 위한 조성물 및 방법 (COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS)

Estimated Expiration: ⤷ Get Started Free

Patent: 240029118

Patent: 골수 섬유증을 치료하기 위한 조성물 및 방법 (COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 30650

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 31389

Estimated Expiration: ⤷ Get Started Free

Patent: 1306882

Patent: Compositions and methods for treating myelofibrosis

Estimated Expiration: ⤷ Get Started Free

Tunisia

Patent: 13000195

Patent: COMPOSITIONS AND METHODS FOR TREATING MYELOFIBROSIS

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 4076

Patent: КОМПОЗИЦІЯ І СПОСІБ ЛІКУВАННЯ МІЄЛОФІБРОЗУ

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering INREBIC around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Hungary | E060254 | ⤷ Get Started Free | |

| Croatia | P20221269 | ⤷ Get Started Free | |

| Russian Federation | 2013126121 | КОМПОЗИЦИИ И СПОСОБЫ ЛЕЧЕНИЯ МИЕЛОФИБРОЗА | ⤷ Get Started Free |

| European Patent Office | 1951684 | ⤷ Get Started Free | |

| Spain | 2930650 | ⤷ Get Started Free | |

| Russian Federation | 2012103851 | ⤷ Get Started Free | |

| Peru | 20140389 | COMPOSICIONES Y METODOS PARA EL TRATAMIENTO DE LA MIELOFIBROSIS | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for INREBIC

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 1951684 | 767 | Finland | ⤷ Get Started Free | |

| 1951684 | CR 2021 00011 | Denmark | ⤷ Get Started Free | PRODUCT NAME: FEDRATINIB ELLER ET FARMACEUTISK ACCEPTABELT SALT DERAF ELLER ET FARMACEUTISK ACCEPTABELT HYDRAT DERAF, ISAER FEDRATINIB-DIHYDROCHLORIDMONOHYDRAT; REG. NO/DATE: EU/1/20/1514 20210209 |

| 1951684 | C202130029 | Spain | ⤷ Get Started Free | PRODUCT NAME: FEDRATINIB, O UNA SAL FARMACEUTICAMENTE ACEPTABLE DEL MISMO, O UN HIDRATO FARMACEUTICAMENTE ACEPTABLE DEL MISMO, EN PARTICULAR MONOHIDRATO DE DIHIDROCLORURO DE FEDRATINIB; NATIONAL AUTHORISATION NUMBER: EU/1/20/1514; DATE OF AUTHORISATION: 20210208; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/20/1514; DATE OF FIRST AUTHORISATION IN EEA: 20210208 |

| 1951684 | PA2021509 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: FEDRATINIBAS ARBA FARMACINIU POZIURIU PRIIMTINA JO DRUSKA, ARBA FARMACINIU POZIURIU PRIIMTINAS JO HIDRATAS, YPAC FEDRATINIBO DIHIDROCHLORIDO MONOHIDRATAS; REGISTRATION NO/DATE: EU/1/20/1514 20210208 |

| 1951684 | 132021000000053 | Italy | ⤷ Get Started Free | PRODUCT NAME: FEDRATINIB, O UN SUO SALE FARMACEUTICAMENTE ACCETTABILE, O UN SUO IDRATO FARMACEUTICAMENTE ACCETTABILE, IN PARTICOLARE FEDRATINIB DICLORIDRATO MONOIDRATO(INREBIC); AUTHORISATION NUMBER(S) AND DATE(S): EU/1/20/1514, 20210209 |

| 1951684 | 301104 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: FEDRATINIB, OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN, OF EEN FARMACEUTISCH AANVAARDBAAR HYDRAAT DAARVAN, IN HET BIJZONDER FEDRATINIBDIHYDROCHLORIDEMONOHYDRAAT; REGISTRATION NO/DATE: EU/1/20/1514 20210209 |

| 1951684 | PA2021509,C1951684 | Lithuania | ⤷ Get Started Free | PRODUCT NAME: FEDRATINIBAS ARBA FARMACINIU POZIURIU PRIIMTINA JO DRUSKA, ARBA FARMACINIU POZIURIU PRIIMTINAS JO HIDRATAS, YPAC FEDRATINIBO DIHIDROCHLORIDO MONOHIDRATAS; REGISTRATION NO/DATE: EU/1/20/1514 20210208 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for Inrebic (Fedratinib)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.