ILEVRO Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Ilevro, and what generic alternatives are available?

Ilevro is a drug marketed by Harrow Eye and is included in one NDA. There are two patents protecting this drug and one Paragraph IV challenge.

This drug has fifty-five patent family members in twenty-seven countries.

The generic ingredient in ILEVRO is nepafenac. There are eight drug master file entries for this compound. One supplier is listed for this compound. Additional details are available on the nepafenac profile page.

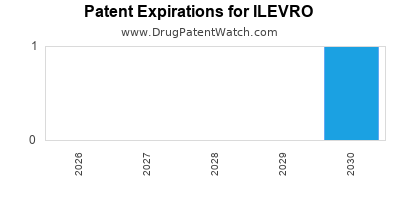

DrugPatentWatch® Generic Entry Outlook for Ilevro

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be December 1, 2030. This may change due to patent challenges or generic licensing.

There have been two patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ILEVRO?

- What are the global sales for ILEVRO?

- What is Average Wholesale Price for ILEVRO?

Summary for ILEVRO

| International Patents: | 55 |

| US Patents: | 2 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 93 |

| Clinical Trials: | 6 |

| Patent Applications: | 3,059 |

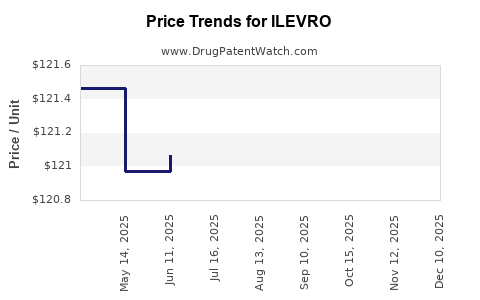

| Drug Prices: | Drug price information for ILEVRO |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for ILEVRO |

| What excipients (inactive ingredients) are in ILEVRO? | ILEVRO excipients list |

| DailyMed Link: | ILEVRO at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for ILEVRO

Generic Entry Date for ILEVRO*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

SUSPENSION/DROPS;OPHTHALMIC |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for ILEVRO

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Research Insight LLC | PHASE4 |

| Vance Thompson Vision - MT | Phase 4 |

| MDbackline, LLC | N/A |

Pharmacology for ILEVRO

| Drug Class | Nonsteroidal Anti-inflammatory Drug |

| Mechanism of Action | Cyclooxygenase Inhibitors |

US Patents and Regulatory Information for ILEVRO

ILEVRO is protected by two US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of ILEVRO is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Harrow Eye | ILEVRO | nepafenac | SUSPENSION/DROPS;OPHTHALMIC | 203491-001 | Oct 16, 2012 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Harrow Eye | ILEVRO | nepafenac | SUSPENSION/DROPS;OPHTHALMIC | 203491-001 | Oct 16, 2012 | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for ILEVRO

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Harrow Eye | ILEVRO | nepafenac | SUSPENSION/DROPS;OPHTHALMIC | 203491-001 | Oct 16, 2012 | ⤷ Get Started Free | ⤷ Get Started Free |

| Harrow Eye | ILEVRO | nepafenac | SUSPENSION/DROPS;OPHTHALMIC | 203491-001 | Oct 16, 2012 | ⤷ Get Started Free | ⤷ Get Started Free |

| Harrow Eye | ILEVRO | nepafenac | SUSPENSION/DROPS;OPHTHALMIC | 203491-001 | Oct 16, 2012 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for ILEVRO

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Novartis Europharm Limited | Nevanac | nepafenac | EMEA/H/C/000818Nevanac is indicated for:, , , prevention and treatment of postoperative pain and inflammation associated with cataract surgery;, reduction in the risk of postoperative macular oedema associated with cataract surgery in diabetic patients., , | Authorised | no | no | no | 2007-12-11 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for ILEVRO

When does loss-of-exclusivity occur for ILEVRO?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 0572

Patent: SUSPENSIONES DE NANOPARTICULAS QUE CONTIENEN POLIMERO DE CARBOXIVINILO

Estimated Expiration: ⤷ Get Started Free

Patent: 2463

Patent: SUSPENSIONES DE NANOPARTÍCULAS QUE CONTIENEN POLÍMERO DE CARBOXIVINILO

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 10326099

Patent: Carboxyvinyl polymer-containing nanoparticle suspension

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2012013503

Patent: suspensões de nanopartícula contendo polímero de carboxivinila

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 81254

Patent: SUSPENSION DE NANOPARTICULES CONTENANT UN POLYMERE DE TYPE CARBOXYVINYLE (CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSION)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 12001402

Patent: Composicion farmaceutica en suspension oftalmica acuosa de administracion topica que comprende polimero de carboxivinilo, galactomanana, borato, compuesto en nanoparticulas escasamente soluble, agentes para ajustar ph y tonicidad, conservante y quelante; metodo para tratar trastornos oftalmicos, metodo para mantener viscosidad.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 2724965

Patent: Carboxyvinyl polymer-containing nanoparticle suspensions

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0140016

Estimated Expiration: ⤷ Get Started Free

Patent: 0181337

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 14871

Estimated Expiration: ⤷ Get Started Free

Patent: 20585

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 06831

Estimated Expiration: ⤷ Get Started Free

Patent: 86426

Estimated Expiration: ⤷ Get Started Free

Patent: 65749

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 06831

Patent: SUSPENSION DE NANOPARTICULES CONTENANT UN POLYMÈRE DE TYPE CARBOXYVINYLE (CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSIONS)

Estimated Expiration: ⤷ Get Started Free

Patent: 86426

Patent: Suspension de nanoparticules contenant un polymère de type carboxyvinyle (Carboxyvinyl polymer-containing nanoparticle suspensions)

Estimated Expiration: ⤷ Get Started Free

Patent: 65749

Patent: SUSPENSIONS DE NANOPARTICULES CONTENANT UN POLYMÈRE CARBOXYVINYLIQUE (CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSIONS)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 70164

Patent: CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSIONS

Estimated Expiration: ⤷ Get Started Free

Patent: 78802

Patent: 含毫微顆粒懸浮體的羧基乙烯聚合物 (CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSIONS)

Estimated Expiration: ⤷ Get Started Free

Patent: 17091

Patent: 含羧乙烯基聚合物的納米顆粒混懸液 (CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSIONS)

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 25838

Estimated Expiration: ⤷ Get Started Free

Patent: 38821

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 64433

Estimated Expiration: ⤷ Get Started Free

Patent: 55849

Estimated Expiration: ⤷ Get Started Free

Patent: 13512912

Estimated Expiration: ⤷ Get Started Free

Patent: 15061886

Patent: カルボキシビニルポリマー含有ナノ粒子懸濁物 (CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSION)

Estimated Expiration: ⤷ Get Started Free

Patent: 16106155

Patent: カルボキシビニルポリマー含有ナノ粒子懸濁物 (CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSIONS)

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 65749

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 12006231

Patent: SUSPENSION DE NANOPARTICULAS QUE CONTIENEN POLIMERO DE CARBOXIVINILO. (CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSION.)

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 06831

Estimated Expiration: ⤷ Get Started Free

Patent: 86426

Estimated Expiration: ⤷ Get Started Free

Patent: 65749

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 06831

Estimated Expiration: ⤷ Get Started Free

Patent: 86426

Estimated Expiration: ⤷ Get Started Free

Patent: 65749

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 71078

Patent: СУСПЕНЗИИ НАНОЧАСТИЦ, СОДЕРЖАЩИЕ КАРБОКСИВИНИЛОВЫЙ ПОЛИМЕР (SUSPENSIONS OF NANOPARTICLES, CONTAINING CARBOXYVINYL POLYMER)

Estimated Expiration: ⤷ Get Started Free

Patent: 12127675

Patent: СУСПЕНЗИИ НАНОЧАСТИЦ, СОДЕРЖАЩИЕ КАРБОКСИВИНИЛОВЫЙ ПОЛИМЕР

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 085

Patent: SUSPENZIJE NANOČESTICA KOJE SADRŽE KARBOKSIVINILNI POLIMER (CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSION)

Estimated Expiration: ⤷ Get Started Free

Patent: 465

Patent: NANOČESTIČNE SUSPENZIJE KOJE SADRŽE KARBOKSIVINIL POLIMER (CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSIONS)

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 06831

Estimated Expiration: ⤷ Get Started Free

Patent: 86426

Estimated Expiration: ⤷ Get Started Free

Patent: 65749

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1203770

Patent: CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSIONS

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1543613

Estimated Expiration: ⤷ Get Started Free

Patent: 1809484

Estimated Expiration: ⤷ Get Started Free

Patent: 120099269

Patent: CARBOXYVINYL POLYMER- CONTAINING NANOPARTICLE SUSPENSION

Estimated Expiration: ⤷ Get Started Free

Patent: 150063587

Patent: 카복시비닐 폴리머를 포함하는 나노입자 현탁액 (CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSIONS)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 41420

Estimated Expiration: ⤷ Get Started Free

Patent: 50942

Estimated Expiration: ⤷ Get Started Free

Patent: 84752

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 86178

Estimated Expiration: ⤷ Get Started Free

Patent: 1129395

Patent: Carboxyvinyl polymer-containing nanoparticle suspensions

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 081

Patent: SUSPENSIONES DE NANOPARTÍCULAS QUE CONTIENEN POLÍMEROS DE CARBOXIVINILO

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering ILEVRO around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Mexico | 2012006231 | SUSPENSION DE NANOPARTICULAS QUE CONTIENEN POLIMERO DE CARBOXIVINILO. (CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSION.) | ⤷ Get Started Free |

| Argentina | 013272 | COMPOSICIONES OFTALMICAS TOPICAS EN LA FORMA DE UN LíQUIDO QUE CONTIENEN POLíMEROS DE GUAR Y BORATO Y USO DE DICHAS COMPOSICIONES PARA PREPARAR UN MEDICAMENTO | ⤷ Get Started Free |

| Serbia | 57465 | NANOČESTIČNE SUSPENZIJE KOJE SADRŽE KARBOKSIVINIL POLIMER (CARBOXYVINYL POLYMER-CONTAINING NANOPARTICLE SUSPENSIONS) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for ILEVRO

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 0716600 | C00716600/01 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: NEPAFENAC; REGISTRATION NUMBER/DATE: SWISSMEDIC 58745 24.09.2008 |

| 0999825 | C300622 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: NEPAFENAC; REGISTRATION NO/DATE: EU/1/07/433/002 20130503 |

| 0999825 | 122013000085 | Germany | ⤷ Get Started Free | PRODUCT NAME: NEPAFENAC (OPHTHALMISCHE SUSPENSION); REGISTRATION NO/DATE: EU 1/07/433/002 20130503 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

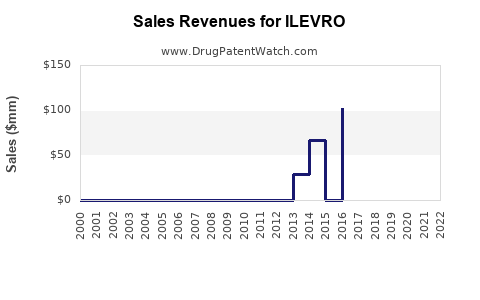

Market Dynamics and Financial Trajectory for ILEVRO (Nepafenac)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.