IDHIFA Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Idhifa, and what generic alternatives are available?

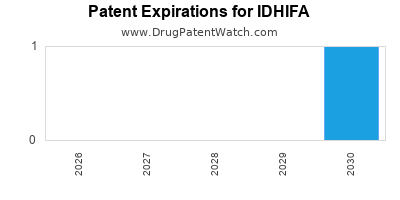

Idhifa is a drug marketed by Bristol Myers Squibb and is included in one NDA. There are six patents protecting this drug.

This drug has one hundred and fourteen patent family members in forty countries.

The generic ingredient in IDHIFA is enasidenib mesylate. One supplier is listed for this compound. Additional details are available on the enasidenib mesylate profile page.

DrugPatentWatch® Generic Entry Outlook for Idhifa

Idhifa was eligible for patent challenges on August 1, 2021.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be September 16, 2034. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for IDHIFA?

- What are the global sales for IDHIFA?

- What is Average Wholesale Price for IDHIFA?

Summary for IDHIFA

| International Patents: | 114 |

| US Patents: | 6 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 66 |

| Clinical Trials: | 12 |

| Patent Applications: | 860 |

| Drug Prices: | Drug price information for IDHIFA |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for IDHIFA |

| What excipients (inactive ingredients) are in IDHIFA? | IDHIFA excipients list |

| DailyMed Link: | IDHIFA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for IDHIFA

Generic Entry Date for IDHIFA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for IDHIFA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| University of Chicago | Phase 1 |

| AbbVie | Phase 1/Phase 2 |

| University Health Network, Toronto | Phase 1/Phase 2 |

Pharmacology for IDHIFA

| Drug Class | Isocitrate Dehydrogenase 2 Inhibitor |

| Mechanism of Action | Isocitrate Dehydrogenase 2 Inhibitors |

US Patents and Regulatory Information for IDHIFA

IDHIFA is protected by six US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of IDHIFA is ⤷ Get Started Free.

This potential generic entry date is based on patent ⤷ Get Started Free.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

International Patents for IDHIFA

When does loss-of-exclusivity occur for IDHIFA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 0411

Patent: COMPUESTOS TERAPEUTICAMENTE ACTIVOS Y SUS METODOS DE USO

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 13207289

Patent: Therapeutically active compounds and their methods of use

Estimated Expiration: ⤷ Get Started Free

Patent: 17265096

Patent: THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2014016805

Patent: compostos terapeuticamente ativos e seus métodos de uso

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 60623

Patent: COMPOSES THERAPEUTIQUEMENT ACTIFS ET LEURS PROCEDES D'UTILISATION (THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 14001793

Patent: Compuestos derivados de 1,3,5-triazinas sustituidas y sus sales, como inhibidores de la idh2 mutante; composicion farmaceutica que los comprende; y su uso para el tratamiento del cancer.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 4114543

Patent: Therapeutically active compounds and their methods of use

Estimated Expiration: ⤷ Get Started Free

Patent: 7417667

Patent: 治疗活性化合物及其使用方法 (Therapeutically active compounds and their methods of use)

Estimated Expiration: ⤷ Get Started Free

Patent: 8912066

Patent: 治疗活性化合物及其使用方法 (THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE)

Estimated Expiration: ⤷ Get Started Free

Patent: 4933585

Patent: 治疗活性化合物及其使用方法 (Therapeutically active compounds and methods of use thereof)

Estimated Expiration: ⤷ Get Started Free

Patent: 5521264

Patent: 治疗活性化合物及其使用方法 (Therapeutically active compounds and methods of use thereof)

Estimated Expiration: ⤷ Get Started Free

Patent: 5536635

Patent: 治疗活性化合物及其使用方法 (Therapeutically active compounds and methods of use thereof)

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 30962

Patent: Compuestos terapéuticamente activos y sus métodos de uso

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 140377

Patent: COMPUESTOS TERAPÉUTICAMENTE ACTIVOS Y SUS MÉTODOS DE USO

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0180844

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 20506

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 00743

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 14012726

Patent: COMPUESTOS TERAPÉUTICAMENTE ACTIVOS Y SUS MÉTODOS DE USO

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 0187

Patent: ТЕРАПЕВТИЧЕСКИ АКТИВНЫЕ СОЕДИНЕНИЯ И СПОСОБЫ ИХ ИСПОЛЬЗОВАНИЯ (THERAPEUTICALLY ACTIVE COMPOUNDS AND METHODS OF USE THEREOF)

Estimated Expiration: ⤷ Get Started Free

Patent: 1491330

Patent: ТЕРАПЕВТИЧЕСКИ АКТИВНЫЕ СОЕДИНЕНИЯ И СПОСОБЫ ИХ ИСПОЛЬЗОВАНИЯ

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 00743

Patent: COMPOSÉS THÉRAPEUTIQUEMENT ACTIFS ET LEURS PROCÉDÉS D'UTILISATION (THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE)

Estimated Expiration: ⤷ Get Started Free

Patent: 06608

Patent: COMPOSÉS THÉRAPEUTIQUEMENT ACTIFS ET LEURS PROCÉDÉS D'UTILISATION (THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE)

Estimated Expiration: ⤷ Get Started Free

Patent: 84997

Patent: COMPOSÉS THÉRAPEUTIQUEMENT ACTIFS ET LEURS PROCÉDÉS D'UTILISATION (THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 03942

Patent: 治療活性化合物及其使用方法 (THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE)

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 38403

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 3503

Patent: מדכאי איזוציטראט דהידרוגנאז, תכשירים המכילים אותם ושימושים בהם (Isocitrate dehydrogenase inhibitors, compositions comprising same and uses thereof)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 09081

Estimated Expiration: ⤷ Get Started Free

Patent: 11895

Estimated Expiration: ⤷ Get Started Free

Patent: 15503571

Patent: 治療活性化合物およびその使用方法

Estimated Expiration: ⤷ Get Started Free

Patent: 17075193

Patent: 治療活性化合物およびその使用方法 (THERAPEUTICALLY ACTIVE COMPOSITIONS AND THEIR METHODS OF USE)

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 00743

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 5206

Patent: THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 8940

Patent: COMPUESTOS TERAPÉUTICAMENTE ACTIVOS Y SUS MÉTODOS DE USO. (THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE.)

Estimated Expiration: ⤷ Get Started Free

Patent: 14008350

Patent: COMPUESTOS TERAPEUTICAMENTE ACTIVOS Y SUS METODOS DE USO. (THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 7096

Patent: Triazinyl compounds and their methods of use

Estimated Expiration: ⤷ Get Started Free

Patent: 2582

Patent: Methods of preparing 2-methyl-1-[(4-[6-(trifluoromethyl)pyridin-2-yl]-6-{ [2-(trifluoromethyl)pyridin-4-yl]amino} -1,3,5-triazin-2-yl)amino]propan-2-ol

Estimated Expiration: ⤷ Get Started Free

Nicaragua

Patent: 1400073

Patent: COMPUESTOS TERAPÉUTICAMENTE ACTIVOS Y SUS MÉTODO

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 97546

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 142098

Patent: COMPUESTOS TERAPEUTICAMENTE ACTIVOS Y SUS METODOS DE USO

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 014501561

Patent: THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 00743

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 00743

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 401

Patent: TERAPEUTSKI AKTIVNA JEDINJENJA I POSTUPCI ZA NJIHOVU UPOTREBU (THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE)

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201602862R

Patent: Therapeutically Active Compounds And Their Methods Of Use

Estimated Expiration: ⤷ Get Started Free

Patent: 201403878Q

Patent: THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 00743

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1405163

Patent: THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1893112

Estimated Expiration: ⤷ Get Started Free

Patent: 140113712

Patent: THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 75760

Estimated Expiration: ⤷ Get Started Free

Patent: 01430

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 53228

Estimated Expiration: ⤷ Get Started Free

Patent: 1329054

Patent: Therapeutically active compounds and their methods of use

Estimated Expiration: ⤷ Get Started Free

Turkey

Patent: 1809228

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 7451

Patent: ТЕРАПЕВТИЧНО АКТИВНІ СПОЛУКИ І СПОСОБИ ЇХ ЗАСТОСУВАННЯ (THERAPEUTICALLY ACTIVE COMPOUNDS AND THEIR METHODS OF USE)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering IDHIFA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Denmark | 2800743 | ⤷ Get Started Free | |

| Japan | 6742905 | ⤷ Get Started Free | |

| Japan | 6409081 | ⤷ Get Started Free | |

| World Intellectual Property Organization (WIPO) | 2015018060 | ⤷ Get Started Free | |

| Poland | 2800743 | ⤷ Get Started Free | |

| Argentina | 090411 | COMPUESTOS TERAPEUTICAMENTE ACTIVOS Y SUS METODOS DE USO | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for IDHIFA (Enasidenib)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.