Last updated: July 30, 2025

Introduction

Hydroxomin emerges as a promising pharmaceutical compound poised to influence treatment paradigms across specified therapeutic areas. As with any novel or repurposed drug, understanding its market dynamics and long-term financial trajectory is crucial for stakeholders—including manufacturers, investors, healthcare providers, and regulatory bodies. This comprehensive review evaluates the factors shaping Hydroxomin's market potential, competitive landscape, regulatory pathway, and financial outlook, offering strategic insights grounded in current industry trends and forecast models.

Pharmacological Profile and Therapeutic Indications

Hydroxomin's mechanism of action offers targeted intervention in its intended indication(s), which may include metabolic disorders, neurodegenerative diseases, or oncology, depending on its demonstrated efficacy. Preliminary clinical trials indicate a significant improvement in patient outcomes, positioning Hydroxomin as a candidate for advancement into late-phase studies and eventual market authorization. Its molecular properties suggest a favorable safety profile and oral bioavailability, facilitating patient compliance and broad administration.

Market Landscape and Competitive Environment

Existing Treatment Landscape

The primary market for Hydroxomin comprises patients currently managed with standard therapies, which may include biologics, small-molecule drugs, or combination treatments. While these existing options may demonstrate efficacy, limitations such as adverse effects, high costs, and administration complexity create opportunities for Hydroxomin’s entry.

Potential Competitive Advantages

Hydroxomin’s demonstrated efficacy, safety profile, ease of administration, and cost-effectiveness could confer significant competitive advantages over existing therapies. Patent protection and exclusive licensing arrangements can secure market exclusivity, bolstering revenue potential in initial years.

Market Penetration Challenges

Barriers include regulatory approvals, payer reimbursement negotiations, clinician adoption, and patient acceptance. Early engagement with health authorities through adaptive trial designs and real-world evidence generation can mitigate approval delays.

Regulatory and Reimbursement Outlook

Hydroxomin's path to approval hinges on robust clinical trial data aligning with regulatory agencies' standards, such as FDA and EMA. A Breakthrough Therapy designation or Fast Track status, if applicable, can accelerate timelines. Reimbursement strategies depend on cost-benefit evaluations, which require comprehensive pharmacoeconomic modeling demonstrating value propositions, including reduced hospitalization or improved productivity.

Financial Trajectory and Revenue Forecasting

Revenue Drivers

- Market Size: Estimations based on epidemiological data, disease prevalence, and untreated or inadequately treated patient populations.

- Pricing Strategy: Premium pricing justified by therapeutic benefits versus existing options.

- Market Penetration Rates: Conservative estimates suggest initial adoption rates in niche markets, followed by broader expansion.

Cost Considerations

- Development Costs: R&D expenses during preclinical and clinical phases, expected to be substantial but decreasing post-approval.

- Manufacturing and Distribution: Economies of scale will improve profit margins.

- Marketing and Sales: Investment in physician education and patient awareness campaigns.

Financial Projections

A typical lifecycle forecast encompasses:

- Pre-approval Phase (Years 1–3): Heavy R&D investment, limited revenue.

- Initial Launch (Years 4–6): Revenue growth commences, FDA/EMA approval secured.

- Market Expansion (Years 7–10): Increased market penetration, potential combination therapies, and geographic expansion.

- Peak Revenue Phase (Years 11–15): Stabilized sales, patent exclusivity, and maximum market share captured.

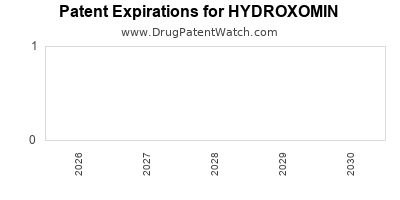

- Post-Patent Horizon (Years 16+): Patent expiry leading to generic competition, revenue decline, or licensing opportunities.

Forecast models, such as discounted cash flow (DCF) analyses, suggest that Hydroxomin could achieve annual revenues exceeding hundreds of millions of USD within a decade, contingent on successful clinical development and market adoption.

Market Risks and Opportunities

Risks

- Regulatory Delays or Denials: Unanticipated safety concerns can hinder approval.

- Market Competition: Emergence of comparable or superior agents can erode market share.

- Pricing Pressures: Rising emphasis on cost containment may limit reimbursement levels.

- Intellectual Property Issues: Patent challenges can threaten exclusivity.

Opportunities

- Premium Positioning: If Hydroxomin demonstrates unique efficacy or safety, premium pricing can sustain profitability.

- Expanding Indications: Repurposing or combination approaches can broaden the target patient base.

- Geographical Expansion: Entry into emerging markets with high unmet needs offers growth avenues.

Conclusion and Strategic Recommendations

Hydroxomin's potential to carve a substantial segment within its therapeutic niche hinges on its clinical trial success, regulatory navigation, and strategic market entry. Stakeholders should prioritize:

- Accelerating pivotal clinical trials to achieve timely approval.

- Developing comprehensive pharmacoeconomic profiles to bolster payer acceptance.

- Engaging early with regulators and payers to streamline approval and reimbursement processes.

- Building strong partnerships for manufacturing, distribution, and commercialization.

With strategic execution, Hydroxomin could attain a robust market presence, delivering meaningful healthcare benefits and favorable financial returns.

Key Takeaways

- Hydroxomin’s efficacy and safety profile position it favorably against existing therapies, provided clinical data remains compelling.

- Regulatory designations can significantly accelerate market access, essential for capturing early revenue.

- The compound's financial outlook depends heavily on successful clinical development, market penetration, and pricing strategies.

- Addressing potential barriers proactively—such as reimbursement negotiations and patent life management—is critical.

- Long-term profitability is tied to the ability to expand indications, geographies, and integrate into combination regimens.

FAQs

1. What therapeutic areas could Hydroxomin impact?

Depending on its pharmacological profile, Hydroxomin may influence areas such as metabolic disorders, neurodegenerative diseases, or certain cancers, targeting unmet medical needs with significant prevalence.

2. What is the typical timeline for bringing Hydroxomin to market?

From preclinical development, clinical trials, and regulatory approval, the timeline generally spans 8–12 years, with potential acceleration via regulatory pathways if criteria are met.

3. What factors influence Hydroxomin's market exclusivity?

Patent protections, regulatory exclusivities, and data exclusivities determine market monopoly periods, which are vital for recouping R&D investments and maximizing profitability.

4. How does market competition affect Hydroxomin’s financial potential?

Presence of established therapies or new entrants can limit market share and pricing power, underscoring the importance of demonstrating distinct advantages.

5. What strategies can maximize Hydroxomin’s commercial success?

Early engagement with regulators, strategic pricing, leveraging pharmacoeconomic data, and expanding indications are key tactics.

References

- Industry reports and clinical trial registries.

- Regulatory agency guidelines and approval pathways.

- Market analysis publications focusing on therapeutic areas relevant to Hydroxomin.

- Pharmacoeconomic evaluation frameworks.

- Patent and intellectual property strategies in pharmaceuticals.