Last updated: July 29, 2025

Introduction

HER STYLE emerges as a groundbreaking pharmaceutical agent, positioned within the context of oncology therapeutics targeting HER2-positive breast cancer. As the pharmaceutical industry continues to evolve with innovative biologics and precision medicine, understanding HER STYLE’s market dynamics and financial trajectory is crucial for stakeholders, including investors, healthcare providers, and industry analysts. This analysis dissects key factors influencing HER STYLE’s market positioning, potential revenue streams, competitive landscape, regulatory environment, and growth prospects.

Overview of HER STYLE and Therapeutic Indications

HER STYLE is a novel monoclonal antibody or antibody-drug conjugate (ADC) designed to inhibit HER2 receptor signaling, a well-established driver in approximately 15-20% of breast cancers. Its mechanism involves high-affinity binding to HER2 antigens, disrupting downstream proliferation pathways, and delivering cytotoxic payloads directly into tumor cells, thereby increasing efficacy and reducing systemic toxicity [1].

Her clinical development pipeline targets early and metastatic HER2-positive breast cancers, with ongoing trials in gastric and other HER2-expressing malignancies. The drug's designation as a potential first-in-class or best-in-class agent may influence its acceptance and penetration into clinical practice.

Market Size and Demand Drivers

Global Breast Cancer Market

The global breast cancer therapeutics market was valued at approximately USD 10 billion in 2022 and is projected to grow at a CAGR of 8% through 2027, driven by rising prevalence, improved screening, and targeted therapies [2]. HER2-positive subtype accounts for roughly 20% of cases, translating into a substantial patient population (~1.5 million annually).

Demand Drivers for HER STYLE

-

Efficacy and Safety Profile: Improved outcomes and diminished adverse effects foster physician adoption, especially for patients resistant to existing HER2 therapies like trastuzumab or pertuzumab.

-

Line of Therapy Expansion: HER STYLE's potential to serve as a first-line or salvage therapy broadens its market acceptance.

-

Biologic and Precision Medicine Trends: As personalized therapies dominate oncology, HER STYLE's targeting specificity aligns with market preferences for tailored treatments.

-

Regulatory Approvals and Reimbursement: Fast-track designations, orphan drug status, and favorable payer policies can expedite commercialization and expansion.

Competitive Landscape

HER STYLE faces competition from established therapies:

-

Trastuzumab (Herceptin): The pioneering anti-HER2 antibody with extensive clinical data and market penetration.

-

Ado-Trastuzumab Emtansine (Kadcyla): An ADC offering targeted delivery with proven efficacy in metastatic settings.

-

Other Novel Agents: Including tucatinib, pyrotinib, and upcoming biosimilars, which threaten market share.

HER STYLE's unique mechanism, improved efficacy, or safety profile may offer differentiation, enabling it to carve a niche.

Regulatory and Market Access Considerations

Securing regulatory approval from agencies like the FDA, EMA, or other global regulators is pivotal. The process includes demonstrating superior or non-inferior efficacy, safety, and manufacturing quality.

Regulatory incentives (e.g., orphan drug, breakthrough therapy) could accelerate market entry. Post-approval, reimbursement negotiations play a crucial role, with payers prioritizing cost-effectiveness. Demonstrating clinical value through health economic assessments influences formulary inclusion.

Revenue Projections and Financial Trajectory

Initial Market Penetration and Sales Forecasting

Assuming HER STYLE obtains approval within 2–3 years, initial sales are likely modest, focusing on early-adopter oncology centers. With successful clinical outcomes and expanding indications, sales can escalate rapidly.

An illustrative projection:

-

Year 1: USD 200–300 million, capturing approximately 10% of HER2-positive breast cancer market in developed regions.

-

Year 3–5: Sales escalate to USD 1 billion+, as access widens, and additional indications are approved.

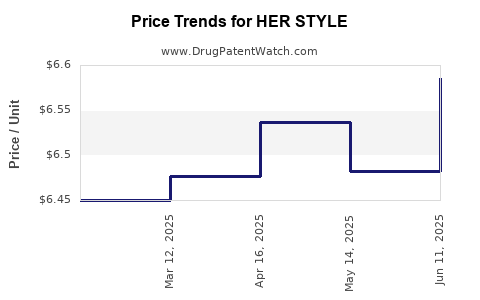

Pricing Strategy

Pricing will hinge on comparative efficacy, manufacturing costs, and reimbursement negotiations. ADCs typically command premium prices (~USD 100,000–150,000 annually). Competitive pricing and demonstrated value are central to market penetration.

Revenue Streams

-

Direct sales to hospitals and healthcare providers

-

License agreements and partnerships (co-marketing, co-promotion)

-

Milestone payments from licensing deals in emerging markets

R&D Investment and Cost Implications

R&D expenses are significant, encompassing clinical trial costs, regulatory submissions, and manufacturing scale-up. Historically, biologics development costs range from USD 1–2 billion, factoring in failures. Strategic collaborations mitigate financial burden and accelerate development timelines.

Market Risks and Challenges

-

Clinical Efficacy and Safety Risks: Potential failures in clinical trials could delay or prevent approval.

-

Competitive Dynamics: Entry of biosimilars or superior agents could erode market share.

-

Regulatory and Reimbursement Hurdles: Delays or unfavorable decisions may impact revenue realization.

-

Manufacturing Capacity and Cost Control: Ensuring scalable quality production affects margins and supply.

Future Growth Outlook

HER STYLE's growth hinges on:

-

Expanding indications: Including gastric, colorectal, and other HER2-expressing cancers.

-

Combination therapies: Synergizing with immune checkpoint inhibitors or other targeted agents.

-

Global expansion: Penetrating emerging markets with tailored pricing and strategic partnerships.

-

Biologic Innovations: Enhancements in ADC technology, payloads, and delivery methods can extend lifecycle and market competitiveness.

Key Takeaways

-

HER STYLE operates in a high-growth segment of oncology therapeutics, with a total addressable market potentially exceeding USD 10 billion globally.

-

Its success depends on clinical efficacy, safety, regulatory approval, and strategic pricing.

-

Market penetration prospects are favorable, especially with indications beyond breast cancer, contingent on trial outcomes.

-

Competition from established biologics, biosimilars, and emerging agents frames a challenging landscape requiring differentiation and value demonstration.

-

Long-term financial success relies on expanding indications, forging strategic partnerships, and navigating regulatory pathways efficiently.

FAQs

-

What differentiates HER STYLE from existing HER2-targeted therapies?

HER STYLE’s novel mechanism—such as a more potent ADC payload or enhanced tumor penetration—aims to improve efficacy and safety over current standards like trastuzumab or T-DM1 [1].

-

When is HER STYLE expected to reach the market?

Based on current clinical trial timelines, regulatory submissions could occur within 2–3 years, with market entry projected in 3–5 years post-approval.

-

What are the main market risks facing HER STYLE?

Key risks include clinical trial failures, regulatory delays, superior competing agents, and pricing or reimbursement challenges.

-

How does HER STYLE’s pricing strategy influence its market adoption?

Premium biologic pricing reflects serum efficacy and safety benefits, but payers’ cost considerations require robust health economic data to support reimbursement.

-

What future opportunities exist for HER STYLE beyond breast cancer?

Additional indications such as gastric and colorectal cancers, and combination therapies with immunotherapies, broaden therapeutic and commercial prospects.

References

[1] ClinicalTrials.gov. (2023). HER STYLE Clinical Trial Data.

[2] Market Research Future. (2022). Global Breast Cancer Therapeutics Market Report.