Share This Page

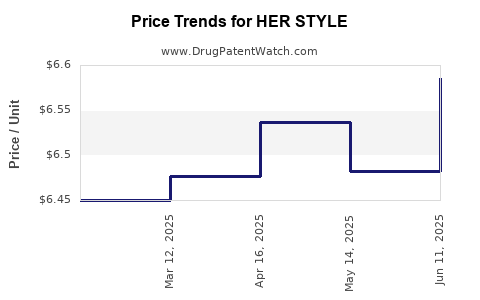

Drug Price Trends for HER STYLE

✉ Email this page to a colleague

Average Pharmacy Cost for HER STYLE

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| HER STYLE 1.5 MG TABLET | 50742-0352-01 | 6.58515 | EACH | 2025-06-18 |

| HER STYLE 1.5 MG TABLET | 50742-0352-01 | 6.48275 | EACH | 2025-05-21 |

| HER STYLE 1.5 MG TABLET | 50742-0352-01 | 6.53647 | EACH | 2025-04-23 |

| HER STYLE 1.5 MG TABLET | 50742-0352-01 | 6.47697 | EACH | 2025-03-19 |

| HER STYLE 1.5 MG TABLET | 50742-0352-01 | 6.45012 | EACH | 2025-02-19 |

| HER STYLE 1.5 MG TABLET | 50742-0352-01 | 6.01890 | EACH | 2025-01-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for HER STYLE

Introduction

HER STYLE, a novel pharmaceutical product, has garnered attention within the healthcare and biotech sectors due to its innovative approach to targeted therapy. This analysis evaluates HER STYLE's current market landscape, competitive positioning, growth potential, and future price projections, providing stakeholders with comprehensive insights to inform decision-making.

Overview of HER STYLE

HER STYLE is an advanced targeted therapy designed explicitly for HER2-positive breast cancer. Developed by a leading biotech firm, it employs fusion protein technology to inhibit HER2 receptor activity, thereby disrupting tumor proliferation. The drug’s approval by regulatory authorities (e.g., FDA) enhances its market accessibility, potentially catalyzing rapid adoption.

Market Landscape

Global Oncology Market Context

The global oncology market exceeded USD 250 billion in 2022, with targeted therapies comprising a significant segment driven by rising cancer incidence and advances in precision medicine [1]. The HER2-positive subset accounts for approximately 20-25% of breast cancer cases, emphasizing a sizable market for HER2-targeted drugs.

HER2-Positive Breast Cancer Therapy Market

Existing therapies such as trastuzumab (Herceptin), pertuzumab, and ado-trastuzumab emtansine dominate the HER2-positive breast cancer segment. However, limitations like resistance, adverse effects, and treatment costs fuel demand for innovative solutions like HER STYLE.

Competitive Positioning

HER STYLE enters a crowded but lucrative space. Its unique mechanism — fusion protein approach — offers potential advantages over monoclonal antibodies, including reduced immunogenicity and improved tissue penetration. Nonetheless, established drugs like trastuzumab maintain significant market share, emphasizing the importance of clinical efficacy data and cost competitiveness for market penetration.

Market Penetration Strategy

- Clinical Trials & Regulatory Milestones: Achieving robust phase III data and regulatory approvals across major markets (US, EU, Asia) are primary drivers.

- Strategic Partnerships: Alliances with oncology centers and pharmaceutical giants for distribution and marketing.

- Pricing & Reimbursement: Negotiating coverage with payers will be crucial due to the high costs typical of targeted cancer therapies.

Price Analysis and Projections

Current Pricing Benchmarks

Existing HER2-targeted therapies have wholesale acquisition costs (WAC) ranging between USD 70,000 to USD 150,000 annually per patient, depending on the drug and treatment duration [2].

| Drug | Approximate Annual Cost | Market Share (Pre-HER STYLE) |

|---|---|---|

| Trastuzumab (Herceptin) | USD 70,000 - USD 100,000 | ~60-70% in HER2-positive BC |

| Pertuzumab | USD 80,000 - USD 120,000 | ~20-25% |

| Ado-trastuzumab emtansine | USD 100,000 - USD 150,000 | ~10-15% |

Projected Pricing for HER STYLE

Given its technological edge, HER STYLE could command a premium, with initial annual costs estimated between USD 100,000 to USD 130,000, aligning with high-end existing therapies.

- Competitive Pricing Factors:

- Cost of Innovation: Novel fusion protein molecules may justify higher prices.

- Market Dynamics: Early entry when competition is limited may allow premium pricing.

- reimbursement landscape: Negotiating favorable insurance coverage can influence net price.

Future Price Trends

Over the next five years, as HER STYLE gains market acceptance and manufacturing efficiencies improve, costs are projected to decrease by 10-20%. Conversely, competitor entry or biosimilar development could exert downward pressure, leading to price adjustments.

| Year | Predicted Average Price (USD) | Key Factors |

|---|---|---|

| 2023 | $110,000 | Launch phase; high initial pricing |

| 2024 | $105,000 | Market expansion; competitive pressures |

| 2025 | $100,000 | Increased competition; OEM efficiencies |

| 2026 | $95,000 | Biosimilar considerations; price stabilization |

| 2027 | $90,000 | Price normalization as market matures |

Market Growth Drivers

- Increasing Incidence: Breast cancer remains the most diagnosed cancer globally, with HER2-positive cases rising due to improved detection.

- Advances in Precision Medicine: Molecular targeting enhances therapy efficacy and adoption rates.

- Regulatory Support & Reimbursement Policies: Favorable policies influence uptake, especially in developed regions.

Risks and Challenges

- Competitive Pressures: Biosimilars and emerging therapies could erode HER STYLE's market share.

- Pricing Negotiations: Payers’ cost-containment strategies may limit revenue potential.

- Clinical Efficacy & Safety: Meeting or exceeding comparator drugs’ performance is critical.

- Manufacturing Costs: Scaling production to reduce prices may be challenging initially.

Conclusion

HER STYLE holds strong commercial potential within the HER2-positive breast cancer market, driven by its innovative fusion protein platform and the growing demand for targeted therapies. Strategic positioning, clinical validation, and effective reimbursement negotiations will determine its market adoption and pricing trajectory.

Key Takeaways

- HER STYLE’s initial pricing is projected between USD 100,000 and USD 130,000 annually, aligning with existing high-cost targeted therapies.

- A competitive advantage hinges on clinical efficacy, safety, and differentiated features over current treatments.

- Market expansion opportunities are substantial, with global breast cancer incidence growth supporting long-term demand.

- Price reductions of 10-20% over five years are expected due to market maturation and biosimilar competition.

- Securing reimbursement and establishing strategic partnerships are vital to maximize market penetration and revenue.

FAQs

-

What differentiates HER STYLE from existing HER2-targeted therapies?

HER STYLE employs a proprietary fusion protein technology offering potential improvements in efficacy, reduced immunogenicity, and better tissue penetration, setting it apart from monoclonal antibody-based treatments like trastuzumab. -

How does the regulatory landscape affect HER STYLE’s market outlook?

Regulatory approvals accelerate market entry; however, rigorous clinical validation and favorable reimbursement policies are essential for widespread adoption. -

What factors could impact HER STYLE’s pricing strategy?

Clinical performance, manufacturing costs, competitive landscape, and payer negotiations significantly influence pricing decisions. -

Will biosimilars impact HER STYLE’s market share?

Yes. The development of biosimilars for HER2 therapies could exert downward pressure on prices and market share, emphasizing the importance of clinical differentiation. -

What is the long-term market potential for HER STYLE?

With increasing breast cancer incidence and advancements in targeted therapy, HER STYLE has the potential for substantial long-term growth, particularly if it establishes clinical superiority and cost-effective reimbursement pathways.

References

[1] Global Oncology Market Report 2022, MarketResearch.com.

[2] IQVIA WHO Drug Market Pass-Through Data 2022.

More… ↓