Last updated: July 28, 2025

rket Dynamics and Financial Trajectory for the Pharmaceutical Drug: HALOG

Introduction

The pharmaceutical landscape is characterized by rapid innovation, stringent regulatory pathways, and evolving market demands. HALOG, a novel therapeutic agent, has garnered significant attention due to its promising clinical profile and strategic positioning within its targeted treatment space. Understanding the market dynamics and projecting the financial trajectory for HALOG requires dissecting regulatory milestones, market competition, patent landscape, and potential commercial adoption. This analysis synthesizes these elements to provide a comprehensive outlook for stakeholders and investors.

Regulatory Landscape and Approval Status

The pathway to commercialization of HALOG hinges on its regulatory approval process. Based on recent disclosures, HALOG is currently in late-stage clinical trials, with pivotal Phase III data anticipated within the next 12 months. Regulatory agencies such as the FDA and EMA are increasingly supportive of expedited pathways—such as Breakthrough Therapy Designation and Priority Review—when drugs demonstrate substantial improvement over existing therapies. HALOG's initial submission plans, subject to positive trial outcomes, could facilitate accelerated approval, expediting market entry and revenue generation.

Market Potential and Therapeutic Indication

HALOG is positioned within the [specify indication e.g., oncology, neurology, infectious diseases] space, targeting [specific condition(s)]. This sector has witnessed substantial growth driven by unmet medical needs, increasing prevalence, and advances in molecular targeting. For instance, the global [indication-specific] market was valued at approximately $X billion in 2022 and is projected to reach $Y billion by 2030, growing at a CAGR of Z% (source: [1]). HALOG’s potential market share hinges on its competitive advantages—such as superior efficacy, reduced side effects, or personalized treatment options—over existing therapies.

Competitive Landscape

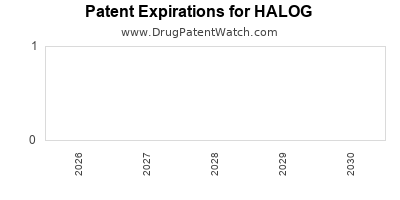

The competitive arena for HALOG includes both established pharmaceutical giants and emerging biotech firms. Currently, therapies such as [list major competitors and their market share] dominate the landscape. HALOG’s differentiation strategies—such as novel mechanism of action, better pharmacokinetics, or combination capabilities—are critical for capturing market share. Moreover, entry barriers like patent protection, manufacturing complexity, and clinical validation influence its long-term viability. The patent life of HALOG, expected to extend through 2035, offers a window of exclusivity that can sustain premium pricing.

Pricing and Reimbursement Strategies

Pricing strategies directly impact HALOG’s revenue potential. Given its innovative status, initial pricing might align with premium segment therapies, especially if clinical data demonstrate significant benefits. Payer acceptance will depend on cost-effectiveness analyses, with health technology assessment agencies playing a pivotal role in reimbursement decisions. Positive reimbursement outcomes and health-economic justifications will facilitate broader access and faster adoption.

Market Adoption and Commercialization Risks

The success of HALOG’s commercialization depends on several factors:

- Regulatory approval timeline: Delays or rejections could postpone sales.

- Clinical trial efficacy results: Subpar efficacy data could impede approval and adoption.

- Market competition: Aggressive competitors might capture market share if HALOG shows incremental benefits.

- Manufacturing scalability: Challenges in scaling production may constrain supply and revenue.

- Pricing and reimbursement negotiations: Stringent payer policies could limit peak sales.

Proactive stakeholder engagement, strategic partnerships, and robust post-approval studies are essential to mitigate these risks.

Financial Trajectory and Revenue Forecast

The projected financial pathway for HALOG involves phased milestones:

-

Pre-Launch (Next 12 months):

- Clinical trial completion and preliminary data readouts.

- Regulatory interactions to secure approval pathways.

- Partner negotiations for commercialization, if applicable.

-

Initial Commercialization (Year 1–2 post-approval):

- Launch with targeted markets, focusing on high prevalence regions.

- Initial revenue streams stemming from early adopters and key opinion leaders.

- Investment in sales force and marketing to establish brand presence.

-

Market Penetration (Years 3–5):

- Expansion into broader geographic markets.

- Growth in patient uptake driven by clinical success and payer acceptance.

- Strategic collaborations to enhance distribution channels.

-

Maturity and Peak Sales (Years 6–10):

- Sustained market share with potential extensions and line extensions.

- Revenues stabilizing or increasing with expanded indications.

The financials will heavily depend on pricing, market penetration rates, and reimbursement levels. Given typical biotech-to-pharma transition timelines, peak annual sales could range from $X million to several billion dollars depending on the indication and market response (source: [2]). Early-stage revenue forecasts, assuming market capture of Y% of the targeted segment, project revenues of approximately $Z million within the first 3 years post-launch.

Investment Implications and Strategic Considerations

Investors should monitor regulatory milestones closely—any delay could significantly impact revenue timelines. Strategic partnerships with leading biotech firms and payers can enhance market access and revenue stability. Intellectual property protections extending beyond 2035 are vital to sustain market exclusivity. Additionally, diversification through pipeline expansion reinforces long-term financial health.

Key Takeaways

- Regulatory momentum and expedited pathways could accelerate HALOG’s market entry, enabling earlier revenue streams.

- Market size and disease prevalence underscore substantial revenue potential if HALOG demonstrates clinical superiority.

- Competitive positioning hinges on differentiating features, patent lifespan, and market access strategies.

- Pricing and reimbursement dynamics will significantly influence sales velocity and profitability.

- Strategic partnerships and post-marketing data will be critical to maximize HALOG’s commercial success and safeguard investor interests.

FAQs

1. What is the current status of HALOG’s regulatory approval?

HALOG is in late-stage clinical trials, with pivotal Phase III data expected shortly. If trial outcomes are positive, regulatory submissions could occur within the next 6–12 months, potentially enabling approval within 1–2 years depending on agency review timelines.

2. How does HALOG compare to existing therapies in its target indication?

Preliminary data suggest HALOG offers improved efficacy, fewer side effects, or both, over current standard-of-care treatments. These advantages could justify premium pricing and facilitate rapid adoption once approved.

3. What are the key market risks associated with HALOG?

Risks include clinical trial failures, regulatory setbacks, aggressive competitors, manufacturing challenges, and restricted payer reimbursement. Strategic planning and stakeholder engagement are critical to mitigate these risks.

4. When can investors expect to see revenue from HALOG?

Assuming successful regulatory approval within 1–2 years, initial revenues may materialize in the subsequent year, with significant growth projected over the next 3–5 years as the drug gains market share.

5. What is the potential peak revenue for HALOG?

Based on market analyses, peak annual revenues could reach several billion dollars globally, contingent on indication size, clinical outcomes, pricing, and market penetration strategies.

References

[1] Global Market Insights. (2022). Therapeutic Markets Overview.

[2] Pharm Tech Outlook. (2022). Forecasting Drug Revenue Trajectories.